How to withdraw money on Deriv – Withdrawal tutorial

Table of Contents

Online trading can help investors earn a considerably high amount of profits. All investors trade with the dream of making high profits to build their wealth. However, if you cannot withdraw these profits when you want to, all the hard work goes to vain. Some online trading platforms make it very hard for their clients to withdraw their funds from their accounts. It is a problem that no investor wants to face.

When you trade with Deriv, you can be rest assured that you will not encounter any problems while withdrawing your funds. It is not a back-breaking task to open your Deriv account. On the contrary, opening your Deriv account is a very straightforward process.

You can sign up for your trading account on the Deriv website untroubled. Adding funds to your trading account after signing up is even easier. You can select a payment method and deposit funds into your Deriv account just like you shop online for your favorite products.

Similarly, Deriv withdrawal is an effortless process that you can undertake at your will. You can withdraw any amount from your trading account once you select a payment method.

So, let us discuss everything about Deriv withdrawal. But first, let us know a few things about the Deriv trading platform.

About Deriv

Deriv is an online brokerage firm situated in Malta. It began its operations in 2000, and it has over 20 years of experience as a broker company. At Deriv, an investor has numerous features in investment and options to trade in various securities. It is a safe and trusted online trading platform.

Earlier, Deriv traded under the name of Binary.com, having millions of investors across the world as its clients.

Various technological innovations at Deriv offer the users benefits of trading in multiple securities. Deriv has a client base in Australia, Thailand, the United Kingdom, South Africa, India, Germany, Norway, Sweden, Italy, Denmark, and many other countries.

Deriv.com has the option of using a demo account for the traders who want to learn binary trading. After spending some time on the demo account, you can gain experience buying and selling securities. It will help you to step easily into the real trading market.

An investor can deposit any amount of funds in his Deriv trading account. Also, he can withdraw the funds as and when he wants to. If you wish to make your Deriv withdrawal today, let us see the available withdrawal methods you can use.

Payment methods

At Deriv, you can use the payment option of your choice for both depositing funds and making withdrawals.

- Online Banking

- Credit/Debit cards

- E-wallets

- Cryptocurrencies

- Deriv P2P

Like any other online trading platform, Deriv offers you multiple payment options to keep any inconvenience at bay. You can use any payment method to get your Deriv withdrawal.

Let us look at these withdrawal methods one by one.

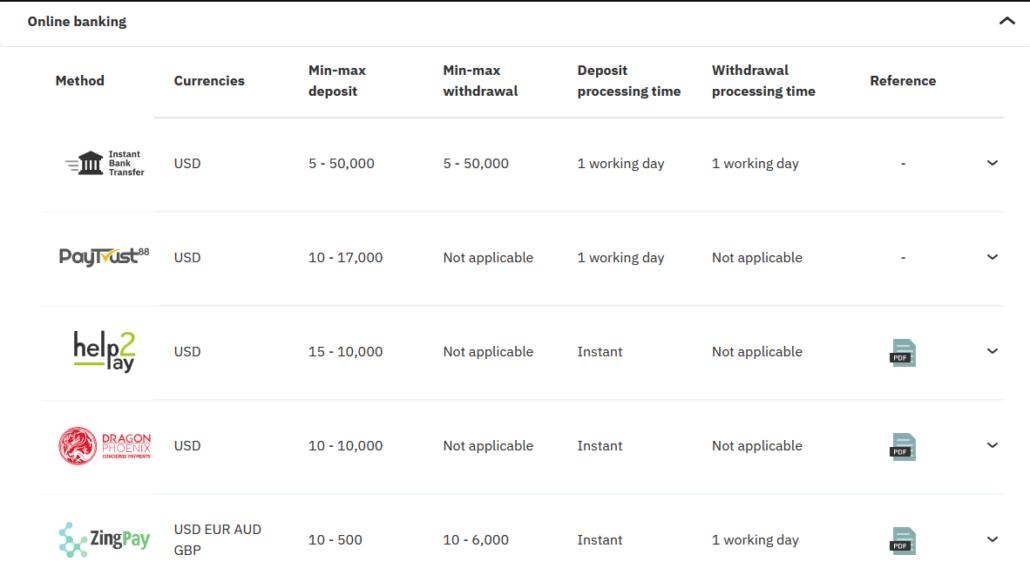

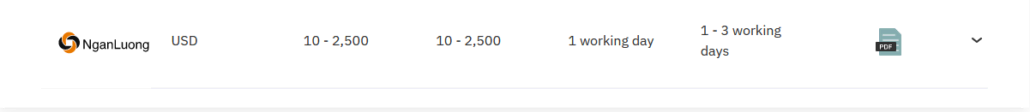

1. Online banking

Online banking or bank transfer is a widely used option for withdrawing funds from trading accounts. So, you can withdraw funds from your Deriv account also through a bank transfer. All you need to do is enter the details of your bank account. You can upload a bank statement for verification purposes. After verification, Deriv will initiate a fund transfer into your bank account.

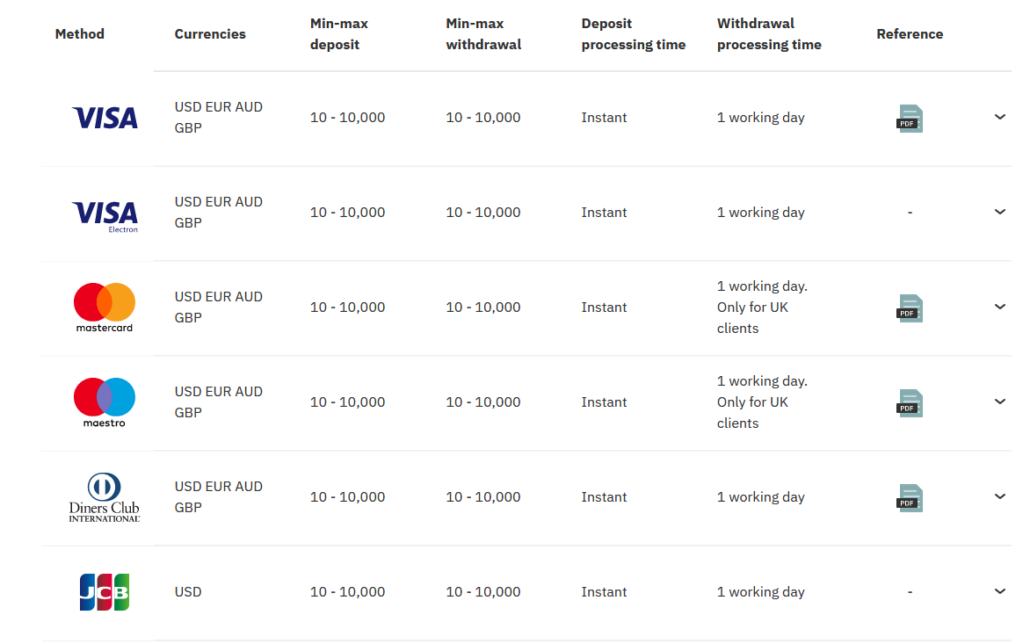

2. Credit or debit cards

Deriv supports both credit and debit card withdrawals. You can withdraw your funds in significant currencies like USD, AUD, EUR, and GBP. Deriv supports transactions through your VISA, VISA electron, MasterCard, Maestro, Diners Club International, and JCB. So, no matter which debit/credit card you own, you can get your Deriv Withdrawal into it.

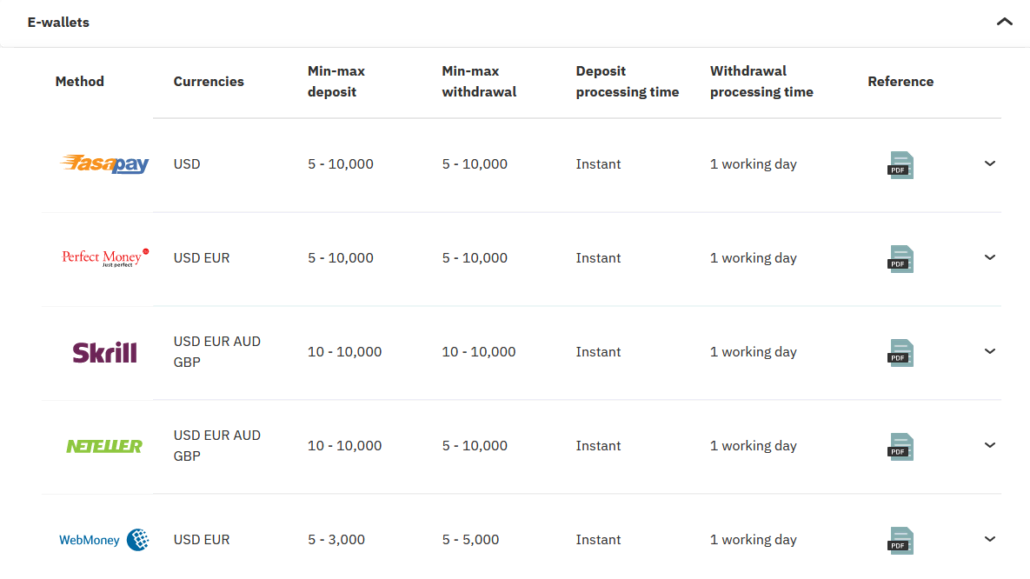

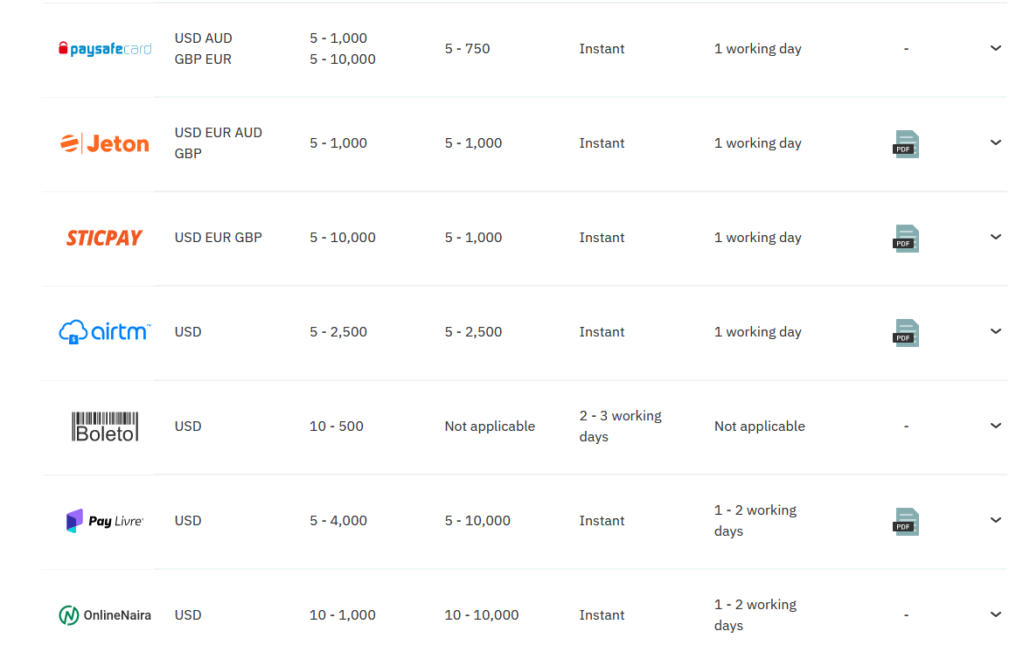

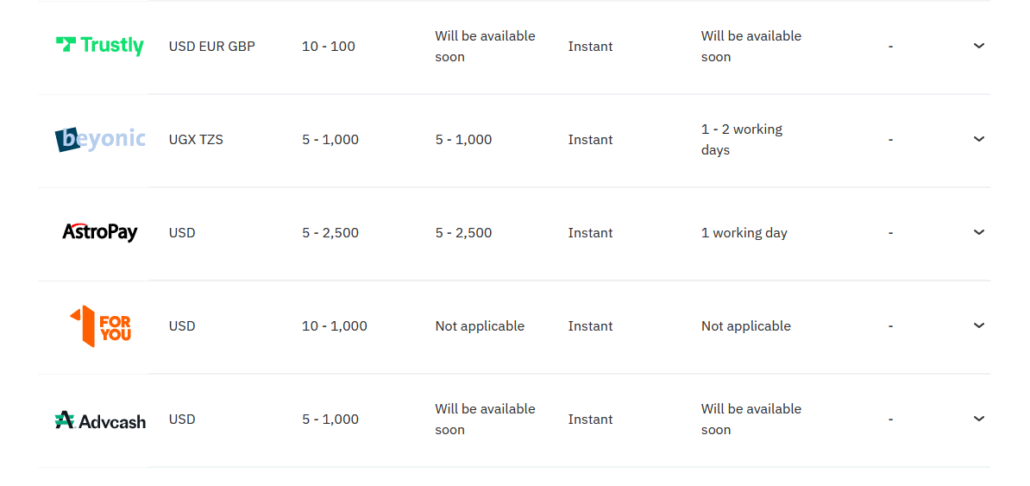

3. E-wallets

An electronic wallet or e-wallet is another option to get your Deriv withdrawal. If you seek a quick deposit and withdrawal method, an e-wallet is an apt choice for you. You can get funds deposited into your account instantly through your e-wallet. Likewise, the process of withdrawing funds is also instant when one uses an electronic wallet.

4. Cryptocurrencies

Cryptocurrencies are the new and widely used payment option supported by many online trading platforms. Deriv also supports withdrawals through cryptocurrencies like Bitcoin, Ethereum, Litecoin, USD coin, and Tether. These withdrawals, however, are subject to internal checks.

5. Deriv P2P

You can get your Deriv withdrawal in your country’s currency through this payment method. The processing time for this withdrawal method is a maximum of two hours. However, a daily withdrawal limit of 500 USD applies to this payment method.

How to withdraw money?

After discussing all the payment methods that we can use, let us look at the process of Deriv withdrawal. The process of withdrawing funds is more or less similar to these steps. You can follow these steps to use the funds lying in your Deriv account however you want to.

Step 1: Logging in to your Deriv Account

When you want to withdraw funds from your Deriv account, logging in to your account is the first step. Open the Deriv website and enter your login credentials like username and password to access your trading account.

Step 2: Go to your account and click on ‘withdraw funds’

After logging in, click on the ‘Withdraw funds’ option. Various payment options to make Deriv withdrawal will appear on your screen when you click on the fund withdrawal option.

Step 3: Enter the withdrawal amount

You can enter any amount higher than 5 USD/EUR/AUD/GBP for initiating a withdrawal request. For card withdrawals, the minimum amount that you can request to withdraw is 10 USD/EUR/AUD/GBP. The minimum withdrawal amount varies for different payment options. We shall look at these minimum withdrawal amounts in the subsequent sections.

Step 4: Select a payment method

You can choose any payment method you used previously to make your Deriv deposit. The broker offers a variety of payment options, and you can select any one of your choices. If you are more comfortable with a credit card withdrawal or a bank transfer, you can choose this as your desired option.

Step 5: Confirm the withdrawal request

The final step to making Deriv withdrawal is to confirm the withdrawal request. On clicking the confirm or submit button, Deriv will process your fund withdrawal at the earliest. It will send you a notification confirming your request, and in due course of time, you will receive the funds you withdrew.

How long does it take to withdraw money from Deriv?

When you submit a withdrawal request to Deriv, it processes your request within 2-3 hours. For online bank transfers, Deriv may take one working day. It is the maximum it takes to initiate your fund withdrawal. However, the time involved in receiving funds depends upon the payment method you choose. You can have an idea about the time involved in withdrawing money from Deriv with the help of this table.

Payment Method | Withdrawal processing time | The time involved in receiving funds |

Online bank transfers | 1 working day | 3-4 working days |

Credit or Debit cards | 1 working day | Up to 24 hours |

E-wallets | 1 working day | Instantly after the request gets processed |

Cryptocurrencies | Subject to internal check | Instantly after the request gets processed |

Deriv P2P | A maximum of 2 hours | 2 hours |

Now that you know how long it will take you to receive funds, you can submit your request timely. It will avoid any last-minute hassle if you need funds urgently. You can select the payment method for Deriv withdrawal that you used to deposit funds earlier.

Minimum withdrawal amount

There is a variable minimum withdrawal amount depending on payment methods. The minimum Withdrawal amount for some options starts with only 5 USD/AUD/GBP/EUR. However, some withdrawals need a minimum amount of 10 USD/AUD/GBP/EUR. There is a maximum withdrawal amount for your Deriv account as well.

This table will give you an idea about the minimum and maximum amount for Deriv withdrawal through different payment methods.

Payment Method | Minimum Withdrawal Amount (USD/GBP/AUD/EUR) | Maximum Withdrawal Amount (USD/GBP/AUD/EUR) |

Online bank transfers | 5 | 50,000 |

Debit/credit cards | 10 | 10,000 |

E-wallets | 5 | 10,000 |

Cryptocurrency | 0.0022 | NA |

Derive P2P | NA | 500 USD ( Daily limit) |

You can make Deriv withdrawal as per your need through the given payment options. You must keep in mind the minimum and maximum amount you can withdraw from your trading account. You must be careful about not taking out all the funds from your account. It is crucial to have some balance in your account to cover the margin requirements.

Let us see if Deriv charges any withdrawal fee from its clients.

Fees that can occur

Deriv does not charge any withdrawal fees from its users. Deposits and withdrawals at Deriv are free of any charge. It means that you can use your earned profits without sharing any part of it with the broker. It makes the users confident to trade with Deriv.

Though Deriv does not charge any withdrawal fees from its clients, you might have to pay a convenience fee to the bank for bank transfers. Likewise, some credit cards also might charge a fund transfer fee. So, you must check all the details prior to making a withdrawal request. It will eliminate the possibility of any conflict owing to the withdrawal fee.

Problems/Issues with Deriv withdrawal

Deriv withdrawal is a simple process, but sometimes you might confront various problems. These issues can make it difficult for you to make Deriv withdraw. Here, we will discuss these issues and find an appropriate solution.

1. Expiry of the withdrawal link

Sometimes, a user requests Deriv withdrawal, but his withdrawal link expires before he proceeds with the process. It makes it a challenge to withdraw money from your trading account. The withdrawal link expires possibly because a user clicks on the ‘withdraw’ option too many times. To solve this issue, you can click on the withdraw option again and wait for the latest withdrawal link on your e-mail. Click on this link, and complete your Deriv withdrawal. However, you should use this withdrawal link within one hour when it generates.

2. Lifting your withdrawal limits

Have you earned high profits on your binary trading with Deriv? Do you want to withdraw a part of this profit to enjoy or use it for some other purpose? If yes, you might want to raise your Deriv withdrawal limit. It is a straightforward process to lift the amount you can withdraw from your trading account. You only need to verify your identity and address for this purpose.

If you want to check your current withdrawal limit, you can go to your Deriv account’s settings. Then, you can click on the ‘safety and security button, and finally, on account limits. You will see your current withdrawal limit, and if you want to lift it, you can verify your identity and address.

3. Unable to withdraw in your MasterCard/Maestro cards

If you are not an investor from the United Kingdom, you will not be able to make a Deriv withdrawal in your MasterCard of Maestro. It is because Maestro and MasterCard Withdrawals are available only to UK clients. So, if you encounter this problem, you can use another payment option from amongst bank transfer, e-wallet, cryptocurrencies, etc.

4. Not being able to withdraw less than 5 AUD/GBP/USD/EUR

If you want to withdraw funds less than 5 AUD/GBP/USD/EUR, it might be a problem. Deriv has a minimum withdrawal limit of 5 AUD/USD/GBP/EUR. So, if you want to withdraw funds from your Deriv account, it should be equal to or more than 5 AUD/USD/GBP/EUR. However, some withdrawal options have a minimum withdrawal amount of 10 AUD/USD/GBP/EUR. You can cross-check the minimum withdrawal amount for different payment options on the Deriv website.

Deriv reviews

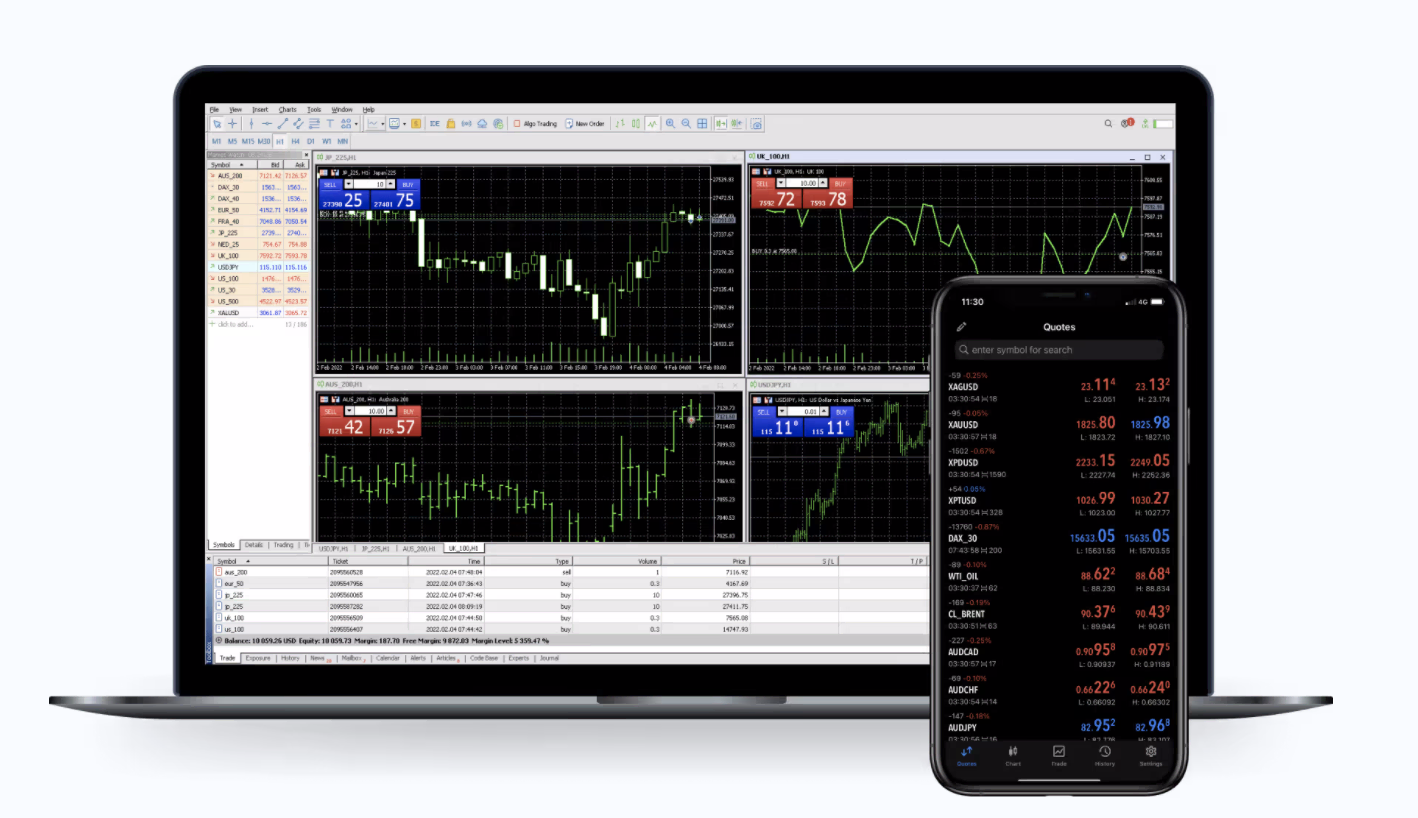

Deriv is a user-friendly and top-rated online trading platform. It offers multiple trading platforms like DTrader, Deriv GO, DMT5, Deriv X, Smart Trader, and an investor can choose any trading platform according to his choice. The method of depositing and withdrawing funds from the Deriv account is easy and does not require specialization.

Deriv has a trading platform for all kinds of investors to suit their needs. Not many online brokers encourage their clients to start investing with such low deposits. However, Deriv is an exception because it motivates its clients to start trading with a low financial requirement. Considering everything, Deriv is the most favorable trading platform for beginners and experienced traders.

Conclusion

If you are skeptical about starting online trading with Deriv, you are mistaken. Once you start trading with Deriv, there is no turning back. Deriv offers its users the technology and opportunities to invest to their maximum potential. Not all trading platforms offer their users the artificial intelligence-enabled online platform. However, Deriv provides its clients with a trading platform with top-class facilities.

Deposits and withdrawals are a speedy process at Deriv. You don’t have to wait for days for Deriv to process your withdrawal request. At the most, Deriv will take one working day to process your request, which is less than most brokers across the Internet. So, ideally, Deriv is the perfect platform to begin your online trading journey.

FAQ – The most asked questions about withdraw money on Deriv :

Is it easy to submit a withdrawal request with Deriv?

It is straightforward to make a Deriv withdrawal from your trading account. You can follow the instructions that appear on your screen to withdraw funds from your Deriv account. You only have to click on the ‘Withdrawal’ or the ‘withdraw funds’ option. Then, you can enter the amount you want to withdraw from your account and select a payment method.

What payment mode can I use to make a Deriv withdrawal?

You can use the same payment method as you used to make the deposit. There are multiple payment options to make your Deriv withdrawal. These include online bank transfers, credit and debit cards, e-wallets, cryptocurrencies, and Deriv P2P. Electronic wallets such as Fasapay, Skrill, Perfect Money, Neteller, WebMoney, etc., are supported by Deriv.

What is the minimum Deriv withdrawal that I can make?

You can withdraw a minimum of 5 USD/AUD/GBP/EUR from your Deriv account. Some withdrawal methods have a minimum withdrawal amount of 10 USD/AUD/GBP/EUR. You can find the list of minimum and maximum withdrawal limits on the website of Deriv.

Will Deriv charge withdrawal fees from me?

Deriv does not charge any withdrawal fees from its clients, and you can withdraw funds without paying anything to Deriv. But, you might have to pay an amount called a convenience fee or handle charges to your bank or the credit card company for their services. Other than this, your deposits and Deriv withdrawals are free of any charge.

How long will my withdrawal be pending on Deriv?

Deriv does not take a long time to process the withdrawal request of its clients. At most, it takes one working day to process the request and initiate a transfer of funds. After the withdrawal process, it might take some time for the amount to get credited into your account. The time involved in this depends upon the payment method you choose. Online bank transfers can take a long time compared to other payment options. E-wallets help you in receiving your funds instantly. So, you can select any payment method of your accord.

What is the procedure for a Deriv withdrawal?

Follow these instructions to make a Deriv withdrawal:

First, log in to your Deriv account.

Then, click on the cashier option.

After that, go to the withdrawal section.

Then, fill in your Perfect Money USD account number.

A verification mail indicating receipt of the withdrawal order will be sent to you.

Can I make a Deriv withdrawal without verification?

No, you do not need to validate your Deriv account until requested. In case of verification, you have to undergo a process. Anyways you don’t need to get much stressed about it. The company will contact you through email. They will convey all about the procedure. Also, you will know the process for submitting your documents.

What payment methods are available for Deriv withdrawal?

There are a lot of withdrawal methods that you can make use of. You can use debit cards at your convenience. In addition, there are e-wallets and cryptocurrency wallets. When you sign in to your Deriv account, the Cashier section will display the payment options that are accepted in your nation. Once you’ve used these financing options, you can withdraw from Deriv.

See more articles about forex trading here:

Last Updated on September 3, 2023 by Res Marty