How to check for a forex broker license – 3 necessary steps

Table of Contents

One of the first things you look for when choosing a broker is their license and regulation. Some traders do this at the right time, which is at the beginning of their search for information before they go into forex trading. Others forget to carry out this research until they run into problems with the broker.

Whichever category you fall under, you can check your broker’s license to confirm if the broker is legit or a scam.

There are many brokers in the forex market that operate without regulations. Some crooked ones use a false license to deceive people into signing up with them.

Below, we will explain how to check your broker’s license before you commit to trading with them. If you’re already working with the broker, it is safe to still confirm that you’re with a genuine one who’s authorized by a reputable financial body.

3-steps to check your forex broker’s license:

1. Visit the broker’s official website.

The broker’s license should be displayed on their website. Most times, they place the regulators’ names and logos at the bottom of their landing page for all to see. Once you scroll down, you should find this information there. You may also find it in the disclaimer section of the page. The information should include the company’s name, location, license and registration number, and the regulator’s name or logo.

If you do not find the regulator’s information on the company website, that should give you pause. You would need to proceed cautiously with this broker.

2. Visit the regulators official website.

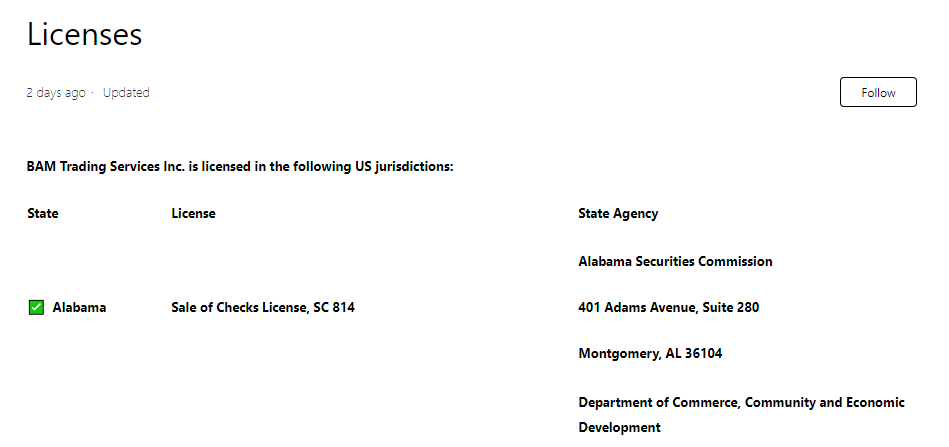

The next step is to copy the broker’s company name and the license number. Bear in mind that some brokers have a separate company name, different from the brand name of the brokerage service they provide. In this case, sometimes, the license may carry the name of the company. Some brokerages are a subsidiary of a bigger financial institution too, and the license may be in the name of the parent company. So ensure you have the right company name of the broker.

Then visit the regulator’s official webpage. Look for the search bar and paste the information you copied. Your search results should not show NOT FOUND if the broker is truly authorized by that regulator. It should show you full details of the license.

Trade forex with the best conditions and a regulated broker:

Broker: | Review: | Advantages: | Free account: |

|---|---|---|---|

1. Capital.com  | # Spreads from 0.0 pips # No commissions # Best platform for beginners # No hidden fees # More than 3,000+ markets | Live account from $ 20: (Risk warning: 78.1% of retail CFD accounts lose money) | |

2. RoboForex  | # High leverage up to 1:2000 # Free bonus # ECN accounts # MT4/MT5 # Crypto deposit/withdrawal | Live account from $ 10 (Risk warning: Your capital can be at risk) | |

3. Vantage Markets  | # High leverage up to 1:500 # High liquidity # No requotes # MT4/MT5 # Spreads from 0.0 pips | Live account from $ 200 (Risk warning: Your capital can be at risk) |

3. Confirm the broker’s license status.

To be certain about your search, you can check the regulator’s brokers’ blacklist. This list contains the brokers whose licenses were revoked by that regulator. It is safe to look through the list and make sure your broker’s company name does not appear here.

You can also contact the regulator through their contact details on the website if you have questions.

Once you conclude these three (3) steps, you will know if your broker’s license is genuine or not.

Most brokers have multiple licenses from different regions. The more license they have, the more trustworthy the broker is.

You should check on all of them.

Here’s a list of famous brokers from different regions:

1. Financial Conduct Authority FCA. Year established: 2013. Country: United Kingdom.

2. Cyprus Securities and Exchange Commission CySEC. Year established: 2001. Country: Cyprus.

3. Financial Sector Conduct Authority FSCA. Year established: 2018. Country: South Africa.

4. National Futures Association NFA. Year established: 1981. Country: United States of America.

5. Australia Securities and Investment Commission ASIC. Year established: 1991. Country: Australia.

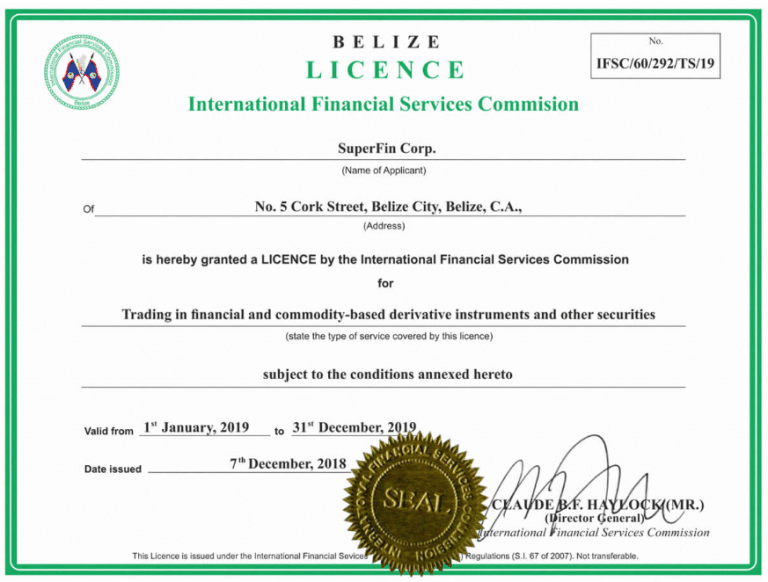

6. International Financial Service Commission IFSC. Year founded: 1999. Country: Belize.

7. Commissione Nazionnale per le Societa e la Borsa, CONSOB. Year founded: 1974. Country: Italy

8. Cayman Island Monetary Authority, CIMA. Year founded: 1997. Country: Cayman Islands.

9. Financial Market Supervisory Authority, FINMA. Year founded: 2009. Country: Swiss.

10. Financial Service Authority FSA. Year founded: 2013. Country: Seychelles.

11. Financial Service Commission FSC. Year founded: 2001. Country: Mauritius.

12. Bundesanstalt für Finanzdienstleistungsaufsicht BaFIN. Year founded: 2002. Country: Germany.

Note:

Apart from these listed here, most countries have special financial bodies that regulate the activities of their exchange market. And in some cases, these bodies have to officially authorize your broker to trade with its citizens. Therefore, you should also check on this before you register with the broker.

Trade from 0.0 pips over 3,000 markets without commissions and professional platforms:

(Risk warning: 78.1% of retail CFD accounts lose money)

Reasons and importance of a regulatory license for forex traders.

The forex market itself is not regulated by a single world body. We all know that where there are no rules, chaos reigns. This is why each region or jurisdiction has to set up a body that oversees brokers’ operations in their market.

It is easy for bad actors to run rampant without these organizations, defrauding innocent investors of their hard-earned funds. Regulators exist, especially, to protect retail traders like you and me from scammers and brokers’ malpractice. This is why it is safer to trade with a broker who has a license to prove they’re regulated.

Here’s how regulatory organizations protect forex traders:

1. They ensure that the licensed broker separates your funds from their company’s account. So that it is not affected in any way in case of any eventuality with the company.

2. Regulators demand periodic reports from licensed brokers and audit their accounts to make sure that they are dealing fairly with clients’ funds.

3. Regulators have laid down rules and policies that protect traders. Their license increases the broker’s credibility in the industry and gives them access to larger markets. Hence, brokers adhere strictly to all these policies to continue to operate under these organizations.

4. Licensed brokers are required to provide some safety measures to traders’ funds, such as negative balance protection, website encryption to protect your details and compensation schemes.

All these are among the reasons you should seek out licensed brokers for your trading. They are safer to deal with and come with many benefits that you may have access to with an unregulated broker. Remember that shady brokers with no license may display false registration numbers on their websites to get customers. You can verify your broker’s license through the steps outlined above.

Trade from 0.0 pips over 3,000 markets without commissions and professional platforms:

(Risk warning: 78.1% of retail CFD accounts lose money)

FAQ – The most asked questions about check for a forex broker license :

Is there a way to check the forex broker license while sitting at home?

The license for the broker should be visible on their website. The names and logos of the regulators are typically displayed for everyone to see at the bottom of their landing page. You should be able to find this information by scrolling down. The disclaimer section of the page might potentially contain it. The details should contain the name of the business, its address, its license and registration numbers, and the name or logo of the regulatory body.

Does checking the number of licenses or regulations a good way to check a forex broker license?

Most brokers hold several licenses from several jurisdictions. The broker is more reliable if they have more licenses. Every one of them needs your attention. You can check the regulator’s brokers’ blacklist to confirm your search. The brokers whose licenses were suspended by that regulator are listed on the blacklist. It is a good idea to scan the list to ensure your broker is not included.

My forex broker doesn’t have a license certificate on their website. How to check a forex broker license in such a case?

In such a case, check the regulator’s website. A license may be issued in the parent company’s name if the brokerage is a subsidiary of a larger financial institution. So, make sure the broker’s company name is in the correct format. Then go to the regulator’s main website. Locate the search field and paste the data you copied. If the broker is permitted by that regulator, “NOT FOUND” should not appear in your search results. You should be able to see the license’s complete details.

See more articles about forex trading:

Last Updated on January 27, 2023 by Arkady Müller

(5 / 5)

(5 / 5)