Can a broker steal your money? A guide to avoiding broker fraud

Table of Contents

Investments are always associated with risk. However, when the definition of risk expands to your broker’s wrongdoings leading to money loss, it constitutes stockbroker’s fraud. So, even if your broker doesn’t steal your money from your trading account, their violation of rules and unethical activities performed by them can count as broker fraud.

Financial crimes like a broker’s fraud can take years to unravel, after which they significantly impact the market. Investors bear the brunt of the financial losses arising from such scams. That is why realizing the red flags to avoid such losses becomes crucial for investors. Let’s jump into this guide and uncover how brokers can steal your money and ways to avoid it.

Can a broker steal your money? Can you get scammed by a broker?

Since legal rules leave some room for brokers to conduct illegal activities, they might indulge in evil acts to gain personal advantage. It is challenging for the brokers to withdraw your money and run away, although it does sometimes happen. Usually, brokers would misappropriate your money, stating that they have done this on your behalf.

A few ways brokers might scam you or rob your money are as follows. Please note that the intention behind a broker’s actions matters while determining fraud:

- Conversion of funds or direct theft

- Not recommending suitable investments

- Failure to diversify the portfolio

- Violations during breakpoint sale

- Trading without authorization

- Managing the portfolio negligently

- Churning or trading in excess

- Not disclosing a personal conflict of interest

- Misrepresenting or omitting material facts

- Front running of block transactions

- Breaching promises

- Abusing margin accounts

- Inadequate licenses and registrations

In most cases, brokers will try to persuade you to buy something that will benefit them financially, even if it isn’t something they would invest in themselves. They are taking a risk with your money. For this reason, it is crucial to review your statements and check for discrepancies frequently. Being vigilant and showing utmost diligence while dealing with a broker is crucial in any circumstances.

Trade more than 3,000+ markets from 0.0 pips spread without commissions and professional platforms:

(Risk warning: 78.1% of retail CFD accounts lose money)

Broker fraud examples

Several famous cases of broker fraud and scams that have occurred over the years have contributed to shaking entire nations. Here are a few such instances explained briefly:

- Affinity fraud

- Promoting stocks fraudulently

- Binary Options fraud

1. Affinity fraud

Under this brokerage fraud, the broker earns the trust of a community and leads them to invest in misleading financial schemes. These scams target particular, recognizable groups like senior citizens.

Real-life scam

Philip Elvin Riehl claimed to invest money on behalf of 400 Mennonite and Amish families. He promised high returns but lost nearly $59 million. It was revealed that he was running an elaborate Ponzi scheme.

2. Promoting stocks fraudulently

In these cases, fraudsters create a buying frenzy using newsletters and social media to promote the financial securities in their possession. It enables them to sell the stock at artificially high prices induced by them. Once the price falls, the unsuspecting and unwitting investors lose considerable money.

Real-life scam

Steven Gallagher set up a social media account on Twitter where he’d promote Over-the-Counter (OTC) penny stocks. New investors would be lured through the incorrect information so that they’d buy the risky assets. Gallagher artificially inflated the stock prices and sold his holdings to earn a net $1 million profit.

3. Binary Options fraud

Fraudsters undertake binary frauds by drafting incorrect or rigged contracts. They can steal your money and your information.

Real-life scam

Ronald Montanato would take investments from people for an alleged automated trading system. He claimed to enable people to profit from binary options through such a mechanism. In September 2021, a Florida judge ordered him to pay around $2.5 million for the scam.

These are a few real examples of scams conducted by brokers. Many might go unnoticed or unreported because of the tactics employed by a broker.

Can you trust brokers?

Due to the complexities involved, many investors hire brokers to handle their portfolios on their behalf. Seeing such scams in the market can make you cautious about investing. Brokers primarily play on the faith and trust you place in them as intermediaries to the transactions. However, as is evident, no trade is 100% risk-free, including your contracts with brokers.

Therefore, you need to be as cautious as possible when it comes to trusting them. Answering ‘can you trust brokers’ is dicey with no definitive answer. The basket of brokers includes good and rotten apples. So even though the appearance is shiny, you need to consider several factors. Even then, you cannot rely on them 100%.

Continuous reviewing and monitoring of their actions would be necessary to safeguard your interests.

The best brokers for traders in our comparisons – get professional trading conditions with a regulated broker:

Broker: | Review: | Advantages: | Free account: |

|---|---|---|---|

1. Capital.com  | # Spreads from 0.0 pips # No commissions # Best platform for beginners # No hidden fees # More than 3,000+ markets | Live account from $ 20: (Risk warning: 78.1% of retail CFD accounts lose money) | |

2. RoboForex  | # High leverage up to 1:2000 # Free bonus # ECN accounts # MT4/MT5 # Crypto deposit/withdrawal | Live account from $ 10 (Risk warning: Your capital can be at risk) | |

3. Vantage Markets  | # High leverage up to 1:500 # High liquidity # No requotes # MT4/MT5 # Spreads from 0.0 pips | Live account from $ 200 (Risk warning: Your capital can be at risk) |

How to check if a broker is legit?

Based on the above discussions, it’s clear that you would need help discovering the legitimacy of a broker. Here we present ten crucial questions you must ask before hopping onto a platform to ensure the broker is reliable.

- Is the stockbroker regulated?

- What are the standard payment methods accepted by the broker?

- Is the broker involved in cold calling?

- Is the broker/broker company facing penalties from the financial regulators?

- Does the broker platform possess an SSL certificate?

- Does your broker promise high returns?

- Has your broker offered no-risk investments?

- Is the broker listed on the warning list issued by regulators?

- Have you considered reviews and feedback from authentic sources?

- How good is the customer service with the broker?

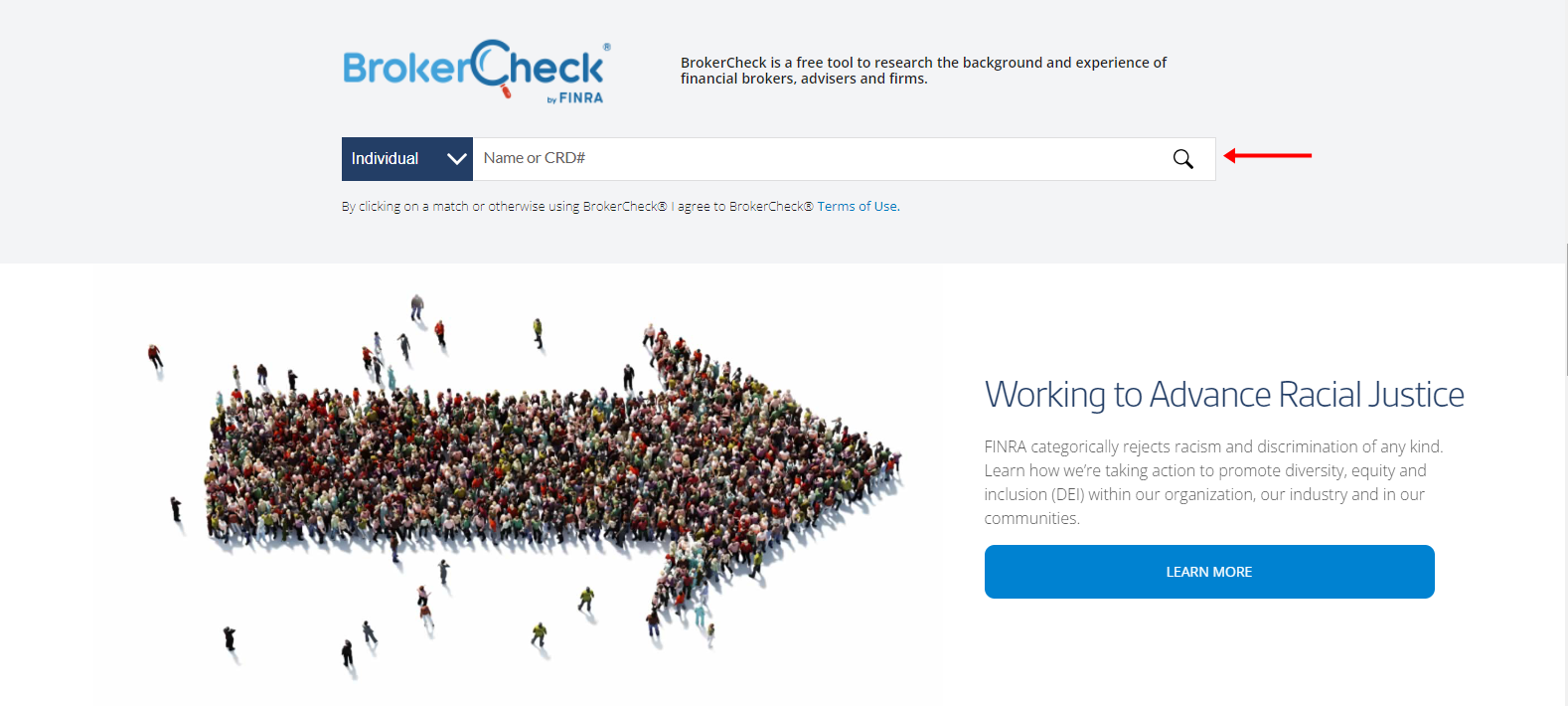

1. Is the stockbroker regulated?

Before going for any stock broker platform or a broker, check the regulations they follow and their registration status with the regulator. Financial professionals and firms must register with federal and state regulators.

Even if the agency comes under overlapping enforcement jurisdictions, verify them all for complete knowledge:

- The state regulators will possess information regarding licensing, registration, and disciplinary actions, if any, taken against the broker

- Check the BrokerCheck website by FINRA for additional details about the broker and brokerage firms

- The SEC’s Investment Advisor Public Disclosure website also offers information about registered financial advisors

Brokers in the foreign exchange (FX) and contract for difference (CFD) markets are subject to oversight from governing bodies such as the Financial Conduct Authority (FCA) in the United Kingdom, the Australian Securities and Investments Commission (ASIC), and the Cyprus Securities and Exchange Commission (CySEC).

Thus, check all the sources to gain the individual’s regulation, registration, and licensing details.

2. What are the standard payment methods accepted by the broker?

Any reputable broker worth their salt will accept the usual suspects regarding payment: credit cards, debit cards, bank transfers, & electronic wallets. Commonly utilized and overseen by banking regulators, these payment options add another layer of safety to your transactions.

Thus, looking into the payment methods that a broker accepts is of particular importance. It will help you outline the various options and ensure everything happens legally. For instance, it may be suspicious if the broker asks for a portion of money through a card and the rest in cash. Delve into such details for better security and protection.

3. Is the broker involved in cold calling?

Unsolicited sales calls, or “cold calls” are made by persons trying to sell you something over the phone. Any unsolicited contact from a business or a broker you have never dealt with is cold calling. It can include brokers in the foreign exchange (FX) and contract for difference (CFD) markets who recommend a specific deal or account opening.

Cold calling is a big no-no and a primary red flag you may see in brokers. Traders might receive an email, phone call, or even a letter, which should all be ignored. Avoid getting sucked by invitations to investment seminars where they promise free lunches or incentives to gain your trust. They will attempt to convince you to invest with them blindly.

A suspicion should also arise when brokers employ high-pressure sales tactics, lack written information, and once-in-a-lifetime opportunities.

Trade more than 3,000+ markets from 0.0 pips spread without commissions and professional platforms:

(Risk warning: 78.1% of retail CFD accounts lose money)

4. Is the broker/broker company facing penalties from the financial regulators?

Fraud can be anything from improperly utilizing client money to making up claims or engaging in insider trading. Financial authorities keep a close eye on the foreign exchange (FX) and contract for difference (CFD) markets to safeguard investors from scams. If a broker has violated regulations, the regulators will fine them.

Expand your research base and look into information regarding the existing penalties imposed by the regulators. You can find this information on the official website, where registration details are available.

Knowing about the pending penalties will inform you about the broker’s violations and misconduct. Thus, you can practice diligence in your choice.

5. Does the broker platform possess an SSL certificate?

SSL is the abbreviation of Secure Sockets Layer and is crucial for any website or platform online, for those dealing with money in particular. It is necessary to keep the internet connection secure and maintain the privacy of all transactions. The SSL certificate is a must-have for online broker platforms to safeguard sensitive data sent and received, including financial transactions.

Examining the URL or the lock icon in your browser’s address bar can tell whether a broker uses SSL encryption. The URL should use ” https” instead of “http”. Clicking the padlock icon and then looking up the certificate issuer is another way to ensure the SSL certificate is legitimate.

If your broker doesn’t have this proof, you might jump straight into a pothole. So, beware of the brokers without the necessary protection and security standards implemented.

6. Does your broker promise high returns?

The stock market is pretty volatile, and making fake promises like guarantees of high returns by brokers is probably a scam. Even if a broker is good at predicting market trends due to their experience and skills, they won’t promise or guarantee any rewards.

The market can turn upside-down at any point in time. So, there’s always a risk associated with every transaction. The fraud brokers might initially offer a reward one or two times, but then, they’ll turn to their greedy tactics.

7. Has your broker offered no-risk investments?

The first rule of investing is you’ll have to bear risk. The proportion can be low or high depending on the nature of the investment, but it will never be zero. Even the most experienced traders can lose money trading foreign exchange (FX) and contracts for difference (CFDs). So, when a broker or brokerage platform offers you no-risk high-return investment opportunities, steer clear and take a U-turn from them.

Such schemes and offers are bogus and offered by fraudsters. A seasoned broker might help you minimize risk by diversifying your portfolio, but they’ll never promise risk-free returns.

8. Is the broker listed on the warning list issued by regulators?

Always check the warning lists issued by regulators to ensure your preferred broker or brokerage platform is not mentioned there. The Financial Conduct Authority (FCA), the Australian Securities and Investments Commission (ASIC), and the National Futures Association (NFA) are just a few of the organizations that regularly publish such blacklists.

Appearing in these lists signifies that the broker is not authorized to deal in securities. If an investor trades through these platforms, they do so at their own peril and will be responsible for any losses. Therefore, investors must practice caution in engaging with such fraudulent platforms.

Protecting your investment requires checking regulators’ warning lists. If you check these lists and don’t find the name of your broker there, you can rest certain that they are not engaging in any illegal activity and your money is safe with them.

9. Have you considered reviews and feedback from authentic sources?

Insight into a broker’s business practices, client service, and general reputation can be gained from reviews and evaluations from reliable third parties. You can use their expertise to spot warning signs and make calculated financial moves.

Suppose a broker has a record of unsatisfactory performance in key areas like customer service or withdrawal processing. In that case, this could indicate they are not who they claim to be.

Web communities, review websites, & social media are all common places to find relevant information. There are several online communities and discussion boards where users can share their experiences with various brokers and read other users’ opinions.

Check out what other traders have said on specialized review sites, discussion forums, & social media groups that are all about foreign exchange (FX) and contract for difference (CFD) trading.

Several-year-old comments and testimonials might not be the most up-to-date sources. Read comments and testimonials from the past year to acquire the most current knowledge.

Verify that the reviews and ratings all agree with one another. Consistently low ratings or complaints may indicate that a broker needs to be more reputable. Beware of the fabricated lies that may be put through fake sources. Genuine reviews and feedback will provide an overall impression of the broker’s functioning and involvement in illegal activities.

10. How good is the customer service with the broker?

You’ll require adequate customer service to help you in the situation when you get stuck with your trades, withdrawal, or other processes on the brokerage platform. Scam brokers’ primary concern is making as much money as they can off of as many victims as quickly as possible, so their customer care is likely to be poor. Therefore, you may verify the broker’s trustworthiness by examining their support.

So, check the quality of such services offered by the broker for a comprehensive review. It’s easy to gauge interest and response by asking a few questions before you sign up. Consider switching brokers if communication with them is slow or ineffective.

You can rate the brokers based on these parameters. The grading scale can go from 1- 10. 10 means the broker checks all the boxes, while lower grades indicate more research requirements.

Trade more than 3,000+ markets from 0.0 pips spread without commissions and professional platforms:

(Risk warning: 78.1% of retail CFD accounts lose money)

5 trusted brokers

Our picks for the top five reliable brokers you can consider for securities and forex trading are as follows:

1. RoboForex

RoboForex is a reliable online broker offering live accounts in three tiers (Pro-Cent, Pro-Standard, and RAMM) with access to various trading assets. RoboForex supports multiple trading platforms, such as MetaTrader 4 and MetaTrader 5.

The Financial Services Commission of Belize governs the International Financial Services Market in which RoboForex operates. RoboForex also provides industry-leading insurance and protection against negative balances.

As a whole, RoboForex can be summed up as a reliable broker with low-priced spreads on CFDs. It has a trust score of 94/100 and provides access to more than 12000 trading instruments. The Financial Services Commission has thoroughly regulated RoboForex.

You can learn trading through the education tutorials and guides on the site and undertake demo trading. You can find the regulation information and security details on their website and begin transacting worry-free.

2. Vantage Markets

Vantage Markets is another excellent trading platform for active and social trading. It offers various financial instruments and has a super-active online trading ecosystem.

The tool provides numerous payment methods and advanced features for intelligent trading decisions. You can trade through proprietary terminals or mobile applications. The platform offers complete security by segregating accounts for each customer’s funds.

Established in 2009 under MXT Global, VANTAGE FX renamed itself in 2015 Vantage FX Pty Ltd. The Australian Securities and Investments Commission has issued it with an Australian Financial Services License (AFSL), making it a Vantage Global Prime Pty Ltd. (ASIC) member.

While the first launch of Vantage FX was targeted at the Australian market, the company has now expanded its services to the rest of the world. Clients of Vantage FX have access to RAW ECN spreads with STP execution on par with those offered by major banks.

Trust is high (79/99), and the spread is small. In a nutshell, Vantage FX is a trustworthy FOREX broker with low trading costs.

3. XTB

For more than 15 years, XTB has been a leading foreign exchange (FX) and contract for difference (CFD) publicly traded broker. XTB has offices in over a dozen nations and offers its clients a unique trading platform and round-the-clock customer service.

Some of the world’s largest and most respected regulatory bodies oversee XTB. The Financial Conduct Authority, the Cyprus Securities and Exchange Commission, and the International Financial Services Commission regulate XTB.

For no additional cost, XTB ensures their customers with Lloyd’s of London policies that cover up to one million euros, pounds, or Australian dollars. In a nutshell, XTB is a reliable broker with low-priced spreads on CFDs. It has a trust score of 92/100 and provides access to more than 2100 trading instruments.

4. XM

XM is a major Forex Broker that began operations in 2009 and currently serves clients in over 196 countries with a support team that speaks 30 different languages. They are among the most trusted Regulated Brokers, giving competitive spreads and other favorable trading circumstances.

Established in 2009 under the auspices of the Cyprus Securities and Exchange Commission, XM Group operates as a consortium of licensed internet brokers under the brand name XM (CySEC)

Though CySEC oversees operations in the company’s headquarters in Cyprus, its branches in Australia, the United Kingdom, Belize, Greece, and the Middle East and North Africa (MENA) area provide clients with a worldwide experience.

XM has won numerous prestigious awards for its accomplishments in the business, including “Best Forex Broker for Europe,” “Most Trusted Broker,” and many more.

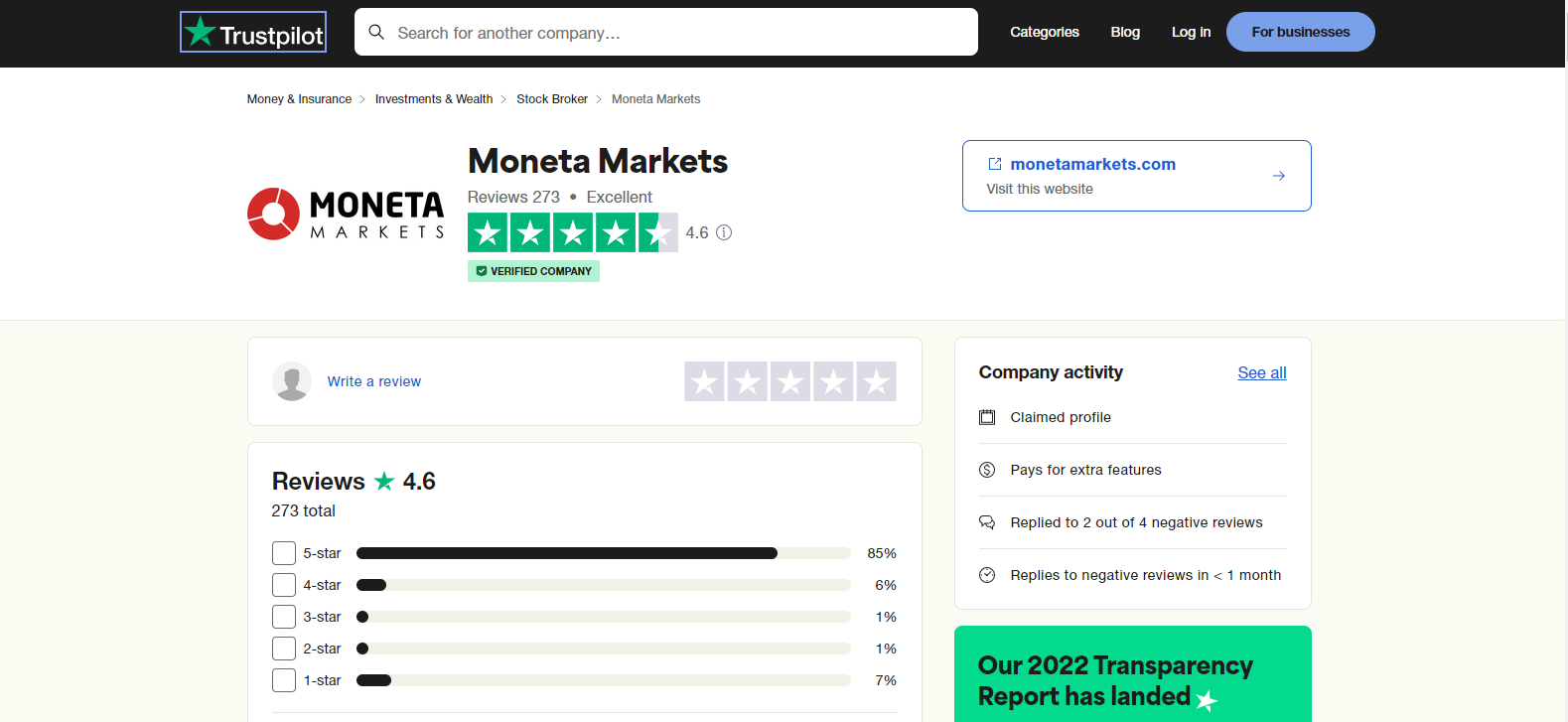

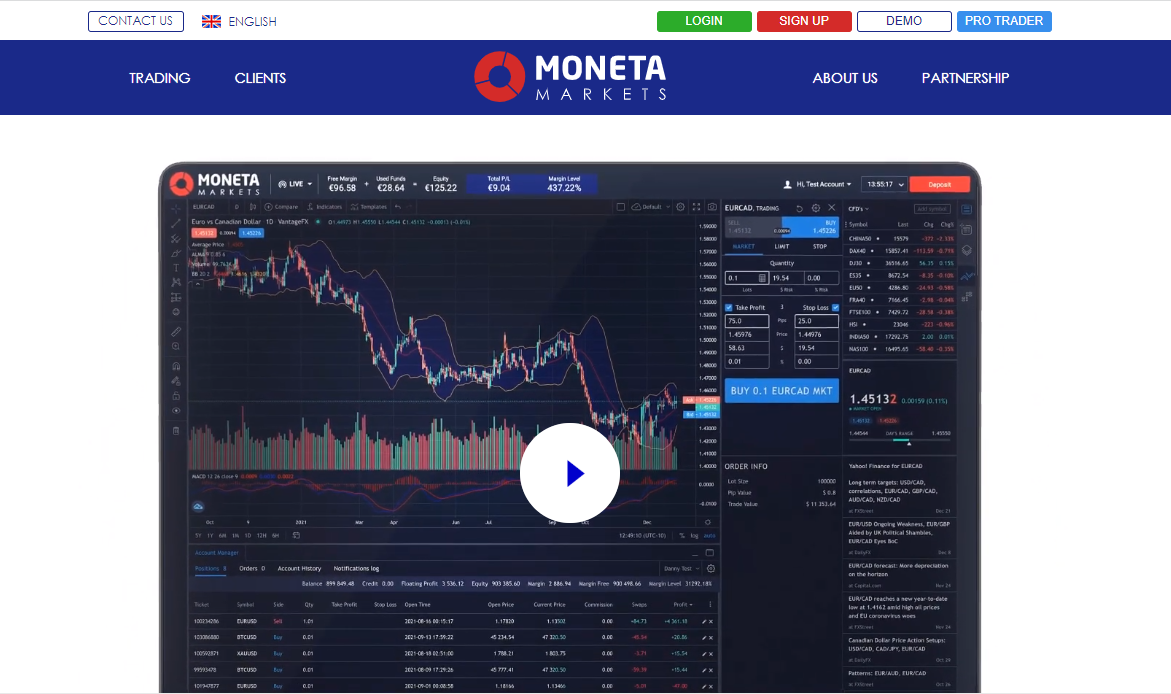

5. Moneta Markets

Moneta Markets is a global financial services provider with headquarters in the Cayman Islands. Moneta Markets is a wholly-owned subsidiary of Vantage International Group Limited (VIG), having served as a specialist in the international financial markets for over ten years.

M&A Today has recognized Moneta Markets as the provider of the “Most advanced web-based CFD trading platform.” In addition to winning “Best customer assistance” in the Corporate Excellence awards offered and provided by CV Magazine, Moneta Markets also won “Best overall company.”

To sum up, Moneta Markets provides its clientele with access to the whole MetaTrader suite and a standard mobile and web app. The average trustworthiness of Moneta Markets is 83 out of a possible 99. The highest Leverage you may get on Moneta Market is 1:500.

Conclusion about broker fraud and how to avoid it

Trusting a broker is a risky move. Even if you deal with a licensed broker, you’ll never know their unscrupulous actions until you suffer losses. The stakes are high financially and emotionally, so think things over carefully before acting. Due diligence and caution are necessary when looking for a broker.

You can rate brokers based on the 10 parameters enlisted in this post. Delving deeper into such factors will help you choose the right broker. Whenever in doubt, test them first and see if they deliver what they promised.

Trade more than 3,000+ markets from 0.0 pips spread without commissions and professional platforms:

(Risk warning: 78.1% of retail CFD accounts lose money)

FAQs – frequently asked questions about broker fraud

How can you check if a broker is real?

You can verify the authenticity and reality of your broker by checking their authorization status, registration, licensing, and any disciplinary actions taken against them on the official website of the state and financial regulators, FINRA, and SEC.

How can you check a broker’s license?

You can check the licensing status of your broker by checking the BrokerCheck website of FINRA and SEC’s Investment Advisor Public Disclosure. The broker’s platform will also have information about their licensing in the About Us section.

Which brokers are safe?

Regulated or licensed brokers who do not engage in illegal activities are considered safe. These brokers will ensure completely secure transactions without misusing your funds.

The following are the safest broker in the market:

– RoboForex

– Vantage Markets

– XTB

– XM

– Moneta Markets

– Fidelity

– TD Ameritrade

– E*TRADE

– Merrill Edge

– Charles Schwab

– Interactive Brokers

– Firstrade

– Webull

Last Updated on June 17, 2023 by Andre Witzel

(5 / 5)

(5 / 5)