HYCM withdrawal tutorial for investors – How to withdraw your money

Table of Contents

There will come a point when you want to reap the benefits of your trading activity. This is if you have been successful in your transactions, or you will simply require access to the money for just any cause.

It is necessary to first withdraw funds from your broker bank to complete this. Although this does not appear to be very complicated, brokers range significantly in terms of the withdrawal choices they provide, as well as the speed and convenience with which they process withdrawals.

Furthermore, while withdrawals at many brokers are generally free, some brokers and certain types of transactions may be subject to a fee under certain circumstances. As a result, how does HYCM score in this respect? Let’s find out.

How to withdraw money from HYCM:

HYCM broker offers a variety of withdrawal options. Withdrawal requests will be processed as promptly as possible. All legally required documentation is current and on file with the broker.

On the internet, it has been customary to have a good contract of recognition for how fast and easy to withdraw assets, every time with a nice icon.

It is necessary to complete the steps outlined below to withdraw money from HYCM:

- Login into the system if you have one.

- Choose ‘Withdrawal’ or ‘Withdraw money’ from the drop-down menu that appears.

- Choose the withdrawal method and/or your account to which you want to make the withdrawal (if more than one option is available)

- Enter the number to be withdrawn, as well as a brief reason or description if prompted by the system.

- Fill out the form to submit your request.

- Whatever method you choose, you will only be able to withdraw money from accounts or credit cards that are registered in your name.

(Risk warning: 72% of retail CFD accounts lose money)

CFDs are structured finance instruments that carry a probability of losing money quickly due to the use of leverage. Consumer accounts with this supplier lose money in the majority of cases (67.00 percent of all retail investor accounts).

Before trading CFDs, you should examine if you understand how they work and whether you would stand to incur the chance of losing all of your money.

Is it safe to withdraw money?

In accordance with the privacy agreement outlined in the customer agreement you consented to at the time of registration, HYCM assures that any documents supplied will not be shared with any 3rd party and would only be handled by experts in accordance with the privacy agreement.

In order to ensure the security of all customer information and transactions, HYCM has implemented a 128-bit encryption key. They have formed a partnership with VeriSign to provide clients with additional protection.

Each and every client transaction and detail is treated with the highest care and discretion.

HYCM takes excellent pleasure in the efficiency with which its fund withdrawal policies are implemented. These processes can be completed online, and they have been created with your privacy and safety in mind.

Your monies will be returned to the original provider to deposit into your account from whom you received them.

Wire transfer is the only method of withdrawal, and funds will be transferred to your bank account. Unless otherwise specified, this must be in the same name as the profile kept on record with HYCM.

(Risk warning: 72% of retail CFD accounts lose money)

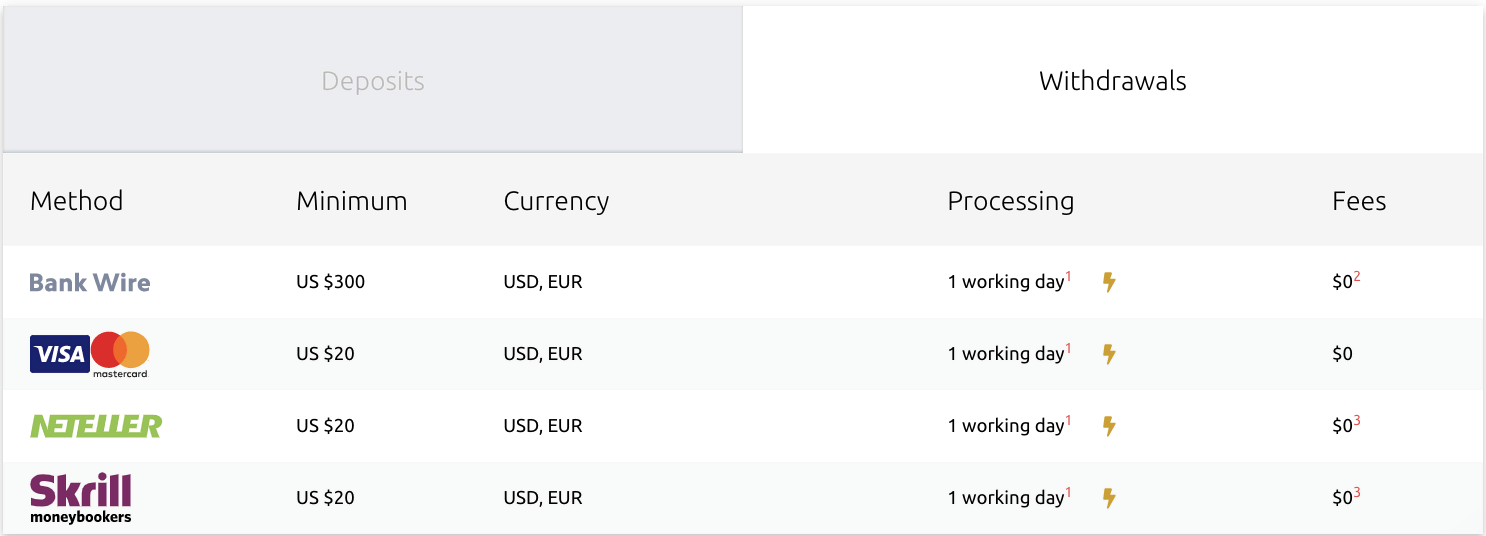

Payments method explained:

Withdrawing funds by bank transfer seems to be the most popular method of withdrawal. It is offered at virtually all dealers, and HYCM is not an exception to this rule.

As an alternative to bank transfers, HYCM also offers the option of withdrawing funds to a credit card or debit card account. This is a unique feature that not many brokers provide, making it a distinct advantage for HYCM.

You can also use your debit card to withdraw money into electronic wallets. While this is a convenient function, it is not offered by every broker. You can withdraw cash from HYCM to any of the following e-wallets: WebMoney, Skrill, and Neteller are all options.

It is also essential to move quickly. In contrast to specific deposit options, withdrawals are rarely instantaneous. It usually takes at least one business day, but more often than not several business days, for your money to reach its destination.

When we tried to withdraw money from HYCM, it took more than three business days, which is a little longer than average when compared to other brokers.

For a piece of more detailed information for each type of payment method, you can use:

- For Wire bank: the minimum deposit is 300 US dollars, while its supported currencies are as follows: USD, GBP, EUR, AED. For its working business days, it usually takes 1-5 days.

- For Mastercard or Visa: the minimum deposit is 20 US dollars, while its supported currencies are as follows: USD, GBP, EUR, AED, RUB, CAD. For its working business days, it usually takes up to 1 hour.

- For Webmoney: the minimum deposit is 20 US dollars, while its supported currencies are as follows: USD and EUR. For its working business days, it usually takes up to 1 hour.

- For Neteller, Skrill, and Perfect Money: the minimum deposit is 20 US dollars, while its supported currencies are USD and EUR. For its working business days, it usually takes up to 1 hour.

Also, here are some general rules you should follow if planning to withdraw:

- By default, the monies you remove will be returned to the source of deposit from which they were initially received.

- The withdrawal of funds from an account held in a name other than your own will not be processed.

- A US$30 processing fee will be applied to all withdrawals made via wire transfer that are less than US$300 in value.

- It is possible that your MoneyBookers, Credit Card, WebMoney, or other associated accounts will expire and that a withdrawal request will not be processed. In this case, a Wire Transfer will be issued, and a fee of US$30 per transaction will be charged if your withdrawal request is for an amount less than $300.

Days are provided for illustrative purposes only, and HYCM will not be accountable for any delays in processing that occur due to circumstances beyond our control.

Withdrawals above US $300 are free of charge at HYCM; however, there may be bank fees charged from the value you will get at the end of the transaction.

Please keep in mind that withdrawals to Neteller or Skrill above $5,000 will be liable to a 1% transaction fee.

(Risk warning: 72% of retail CFD accounts lose money)

Fees and costs

While most deposits into a brokerage account are free, this is not always the case when withdrawing funds from an account.

International bank transfers, particularly wire transfers, can occasionally incur high costs. So always double-check to see whether that’s something that would relate to your particular transaction before proceeding.

We have some fantastic news for you, friends: essential withdrawals at HYCM are utterly free of cost.

However, the fees associated with HYCM withdrawals vary based on the form of payment you choose.

Depending on the broker, different withdrawal procedures must be followed for monies to be removed from your online trading platforms.

This is due to the fact that each brokerage business will have a different withdrawal method. Depending on the payment provider, each issuing bank may have an extra transfer processing cost, processing time, and possibly currency conversion fee.

The Conversion cost is determined by the base currency, the receiving currency, and the payment provider you use to process your transaction.

For example, HYCM allows you to withdraw your funds to a variety of payment methods, including debit cards, credit cards, bank transfers, WebMoney, PayPal, and Payoneer.

(Risk warning: 72% of retail CFD accounts lose money)

Withdrawal duration

Numerous security procedures must be completed before a withdrawal can be processed to ensure the protection of your cash and that all funds are returned safely.

Although HYCM executes your withdrawal request within one business day, it may take up to four to eight business days.

This is for your bank to credit your credit card statement monies. This is a typical operating procedure for the majority of financial institutions.

Conclusion: Fast and easy withdrawals are available

It is usually free of charge to withdraw money from an HYCM account. You have a number of different alternatives for doing so, making it reasonably simple to have access to your assets.

(Risk warning: 72% of retail CFD accounts lose money)

FAQ – The most asked questions about HYCM withdrawal :

Is it possible to get all of my profits returned to my debit or credit card?

In order to avoid any confusion, HYCM will only process the amount of your original deposit back to your credit card. All other transactions will have to be reversed and credited back to your checking or savings account. As a result, in order for us to perform these transactions, you must send us a fully completed money withdrawal form.

Is it possible to deactivate my card?

If you do not want to use a card, you are under no obligation to do so. Nonetheless, HYCM must preserve records of all cards used for regulatory purposes. Professionals maintain the strictest level of secrecy in all situations.

HYCM offers the ability to transfer money across accounts. If I have two accounts with HYCM, can I move money from one account to the other?

The HYCM system does allow you to transfer money from one account to another, though. To do so, navigate to the Trading Accounts area of the Client Profile and follow the Inter Account Transfer process, selecting the two accounts and the amount to transfer, and the transfer will be performed automatically.

Is it possible to link more than one credit card to my profile?

To your HYCM account, you have the option to register as many credit cards as you want. However, in order to be able to use your card, you will need to send a photocopy of the card as well as all of the card information to your account manager.

My transaction has been denied for some reason. Why?

There could be a variety of reasons why your payment did not go through.

First and foremost, you must confirm that all pertinent information has been input accurately into the system.

It’s possible that your card has expired.

There are no funds left on the card at this time.

Your card has been identified as having been lost or stolen during a security check.

They cannot accept your credit card type (please try another method).

What should I do now that my transaction has been declined?

If your transaction has been refused, make sure to contact your area manager as soon as possible or come into the Live Person chat, where one of our customer care representatives will help you in re-establishing credit to your account. Keep in mind that if your card has been declined, you should not attempt to deposit again. This is since this may generate security alerts, which could result in your card being blocked.

Is it possible to cancel a withdrawal?

You have the option to decline your withdrawal request within 24 hours of submitting your withdrawal request. Within 48 hours, you will receive a credit to your account for your paid amount.

Is it possible to use a friend’s credit card to finance my account? Is it possible to make a withdrawal onto someone else’s card?

Both of the examples above are unacceptable in the context of HYCM. When making a deposit or withdrawing funds from your account, they do not allow any third-party funds transfers. All payments from third parties will be denied and will not be processed.

Is it possible for me to lose or cancel the card I was using during withdrawing or depositing my winnings?

All credit card deposits are made instantly. As a result, your account will be funded independently of whether you have misplaced your card or canceled it after the transaction. The exception is that if your card is withdrawn or lost during the withdrawal procedure, you will need to notify your bank to rectify the situation. HYCM will continue to perform the withdrawal to your bank account (until it is canceled within 1 day) even if you cancel it.

How long does it take to make an HYCM withdrawal?

Before a withdrawal, a number of security procedures must be finished to guarantee the protection of your funds and the safe return of all funds. HYCM processes your withdrawal request in one business day. However, depending on your bank or credit card provider, the money may take three to seven days to reach your account.

Is it possible to deactivate my other credit card for HYCM withdrawal?

A credit can be removed from/ unlinked from the trading account easily. If you wish to unlink a card (whose details are saved on the web browser), then you can change the browser settings. Moreover, the broker platforms usually don’t save card details.

How to cancel a mistakenly placed HYCM withdrawal request?

If a transaction request is placed by mistake, contact your account manager and seek a withdrawal if you accidentally duplicated a payment. Please be advised that this will be treated as a regular withdrawal and that the processing time may be up to 10 days. The standard withdrawal procedure must be followed if you unintentionally made a payment to HYCM.

Are there any hidden charges for HYCM withdrawals?

HYCM is quite transparent in terms of its payment. Additional charges or fees might be levied on your final amount by the bank or during the bank processing of a withdrawal.

(Risk warning: 72% of retail CFD accounts lose money)

See more articles about forex brokers here:

Last Updated on January 27, 2023 by Arkady Müller