HYCM review for traders – Is it a scam or not? – Test of the broker

Table of Contents

HYCM’s long and illustrious history is commendable. The company never fails to impress when it comes to FX and CFD trading across its global brands. Effective spreads are extensive across all account settings. Studies and research are sub-par compared to the competition’s best-in-class offerings.

But is it really worth investing your money there? – In this review, we will give you a detailed overview of the broker. We tested all trading conditions for you.

Review: | Regulation: | Markets: | Spreads from: | Min. deposit: |

|---|---|---|---|---|

(5 / 5) (5 / 5) | CySEC, FCA, CIMA, DFSA | 250+ | 0.1 pips | $ 100 |

(Risk warning: 72% of retail CFD accounts lose money)

What is HYCM? – The company presented

HYCM, formerly known as HYMarkets, is widely regarded as one of the most successful forex brokers globally. It currently has more than 40 years of expertise in the forex industry. In addition, the broker is a part of the Henyep Group, a multinational financial holding firm founded in 1977 with its headquarters in London, United Kingdom.

It operates in the financial services, higher education, and real estate sectors.

The essential advantage of the HYCM firm is the stringent regulation that the broker maintains throughout its offices in major cities around the world. This includes Limassol (Cyprus), Dubai, London, and Hong Kong while adhering to the requirements of regulatory agencies in each of these locations.

In addition, HYCM maintains significant trading capabilities, providing a comprehensive choice of trading instruments, and providing dedicated service to its clients.

It provides CFD trading on various financial instruments, including FX, indices, commodities, equities, and cryptocurrency. Exchange-traded funds (ETFs) were added to the company’s CFD service in February 2020, making it the first company to do so (ETFs). CFDs (contracts for difference) are derivative securities that allow consumers to bet on the asset’s value without actually having the assets themselves in their accounts.

The companies that are part of the HYCM Group are governed by several jurisdictions. HYCM may be a good choice for traders looking for a licensed and transparent broker that provides access to more than 200 forex and CFD instruments.

Facts about the broker

K

⭐ Rating: | 5 / 5 |

🏛 Founded: | 1977 |

💻 Trading platforms: | MetaTrader 4, MetaTrader 5 |

💰 Minimum deposit: | $100 |

💱 Account Currencies: | EUR, USD |

💸 Withdrawal limit: | No |

📉 Minimum trade amount: | $1,000 trading volume / 0.01 lot |

⌨️ Demo account: | Yes |

🕌 Islamic account: | Yes |

🎁 Bonus: | Yes |

📊 Assets: | Forex, Indices, Stocks, Commodities, Cryptocurrencies |

💳 Payment methods: | Bank transfer, credit-debit card, Neteller, Skrill, Bitcoin, Perfect Money |

🧮 Fees: | From 0.1 pip spread, variable overnight fees |

📞 Support: | 24 / 5 support via live chat, e-mail, and phone |

🌎 Languages: | 14 languages |

(Risk warning: 72% of retail CFD accounts lose money)

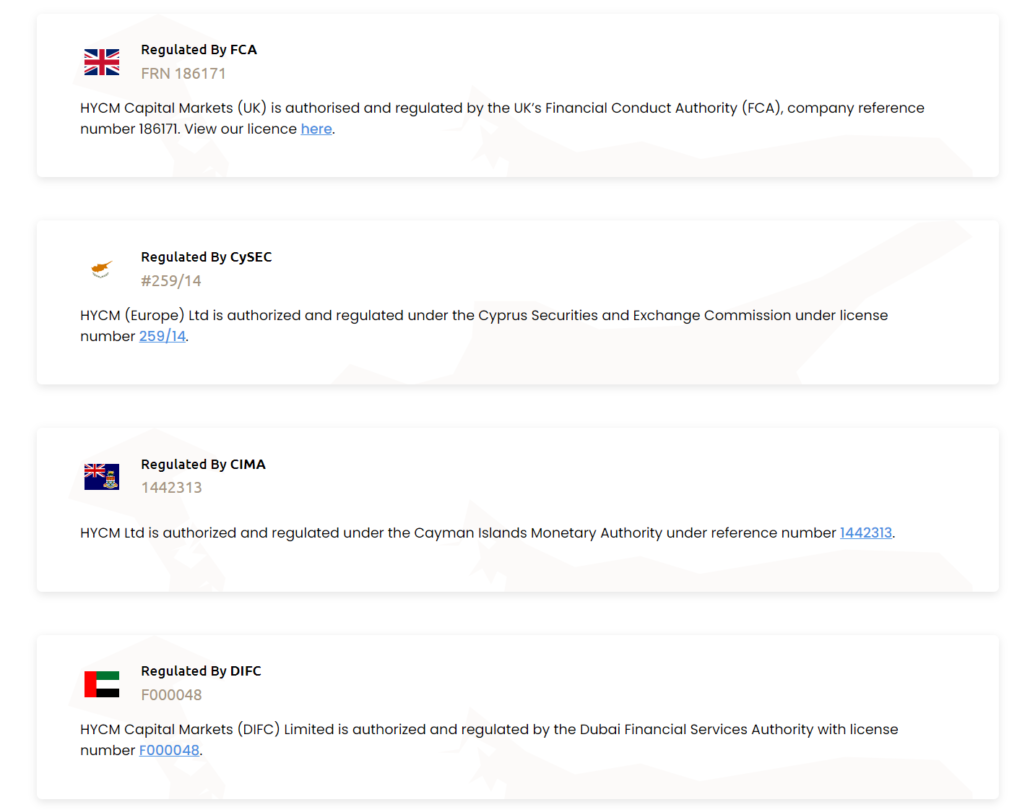

Regulation & safety for investors:

For license approval, brokerage firms must adhere to some norms and criteria set forth by a recognized international organization to guarantee secure trading and remain licensed. The goal of regulation is to safeguard HYCM traders and create a secure trading environment. The importance of license approval and financial regulation cannot be overstated.

With an overall Trust Rating of 84 out of 99, HYCM is of moderate risk. HYCM is not a publicly-traded company, although it does run a bank. Two tier-1 regulators (high trust), two tier-2 regulators (medium trust), and one tier-3 regulator have all approved HYCM (low trust).

- The Securities Futures Commission (SFC) and the Financial Conduct Authority (FCA) are tier-1 regulators that have approved HYCM (FCA).

- HYCM Ltd and Henyep Capital Markets (DIFC) Limited are regulated by the Dubai Financial Services Authority (DFSA) and Cayman Islands Monetary Authority (CIMA), respectively.

- HYCM Limited is a Saint Vincent and Grenadines-based international business company. Tier-1 banks hold negative balance security exits and segregated client deposits, and HYCM has a spotless regulatory track record across the board.

A Tier 1 bank is the most secure and safest in terms of client capital. Tier 1 is a word that describes a bank’s financial strength. Tier 1 banks have significant core capital reserves and are preferred by financial regulators because they can absorb unexpected financial losses.

Please keep in mind that trading in financial assets might result in capital loss. Accounts can lose money if not enough effort is put into studying the markets if the trader lacks experience, or if the trader fails to use the tools given by the brokerage system.

It is not uncommon to lose money quickly when trading financial investments such as CFDs and Forex. Only incur the trading risk if you understand that market volatility might put your invested funds at risk at any time. Losses can exceed deposits, as HYCM plainly states on its website.

Also, market prices will not be manipulated by regulated brokers. This will be honored if you file a request form to HYCM. HYCM’s authorized status could be revoked if they break any regulatory guidelines.

(Risk warning: 72% of retail CFD accounts lose money)

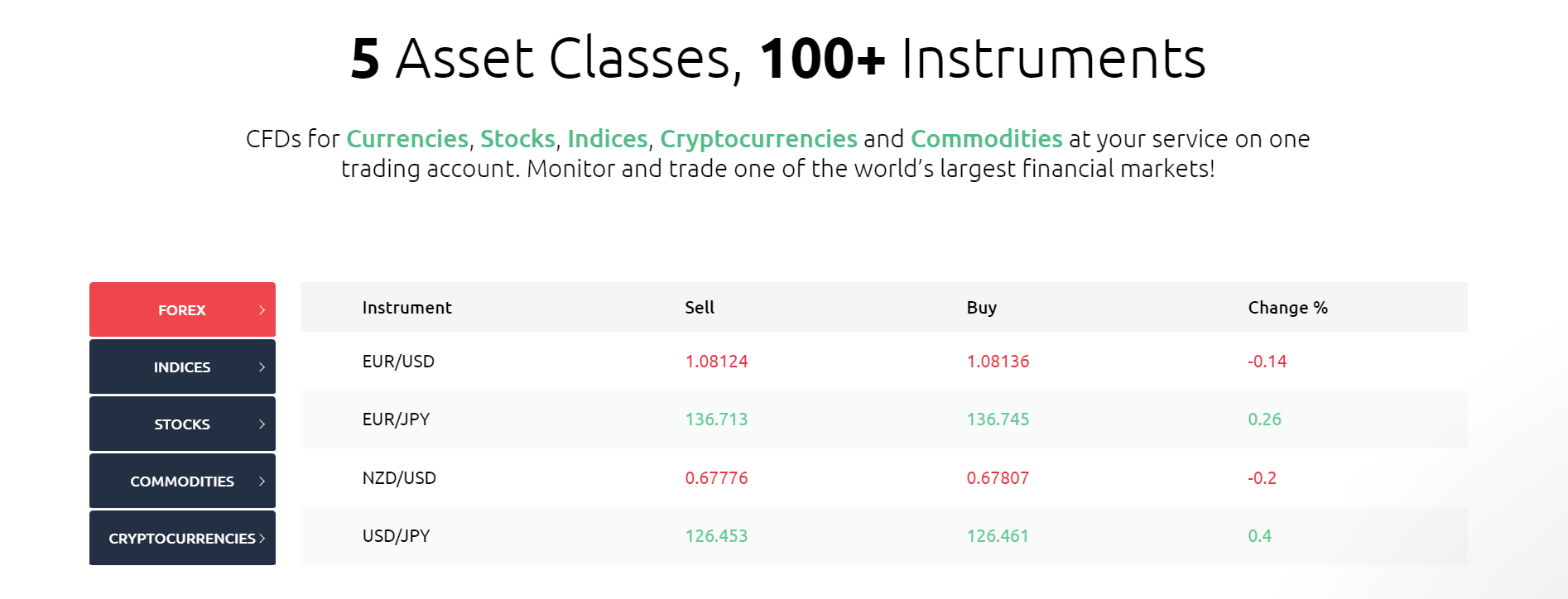

Offers and conditions for trading

HYCM has altered the terms and conditions of several instruments in its vast array of goods. Major foreign exchange and precious metals instruments now have updated spreads across all account types, with some as minimal as 0.1 pip.

This modification was made following HYCM’s continued commitment to providing its clients with the best available trading conditions.

Overview of the trading conditions:

- Different account types for trading strategies

- Spreads from 0.1 pips

- Over 250 markets to trade (forex, indices, crypto, stocks, ETFs)

- Leverage up to 1:500

- Fast execution of trades

- Automated trading is supported

- Start with a free demo account

- The minimum deposit is only $ 100

(Risk warning: 72% of retail CFD accounts lose money)

What are the pros and cons of HYCM Markets?

Now, let’s take a look at the pros and cons of the broker. Given the fact, that HYCM Markets in around for more than 40 years, you can definitely assume, it has some great benefits and we were excited to carefully test the company. You will find your conclusion in the table below.

Pros of HYCM Markets | Cons of HYCM Markets |

✔ Highly trusted broker with a long and successful history | ✘ MetaTrader platform has a steep learning curve for beginners |

✔ Company has two Tier-1 regulations | |

✔ Most popular Trading platforms MetaTrader 4, and MetaTrader 5 are available | |

✔ Large number of indicator and analysis tools are available | |

✔ Great team of multi-lingual and dedicated customer support team | |

✔ Large number of tradable assets | |

✔ Very fast execution within only 12 milliseconds on average |

How good is the usability of HYCM Markets?

We are very impressed with the usability of HYCM Markets. Take a look at some key features and ratings below.

Criteria | Rating |

General Website Design and Setup | ★★★★★ The platform is optimized for both, mobile and desktop versions and has a minimal design, while still offering a lot of helpful resources and information |

Sign-up Process | ★★★★★ Sign-up process for a demo account was very fast and easy, and opening a live account is completely hassle-free as well |

Usability of trading area | ★★★★ Both trading platforms offer everything a professional trader needs, but MetaTrader has a kind of steep learning curve for beginners |

Usability of mobile app | ★★★★ HYCM Markets offer solid mobile trading app for both IOS and Android devices |

Is HYCM a market maker?

Yes, which means that it matches orders within the company. Yet, we remain wary of dealing with a brokerage that does not provide Direct Market Access to its customers. This is if the company appears to have sufficient FX rates to meet its traders’ requests internally without the need for a connection to a liquidity provider.

The broker sets necessary minimum deposit requirements, which are often required to qualify for an ECN account at other competitive brokers. We might have understood the broker’s plan if they had offered lower funds with less demanding trading criteria.

Still, it is evident that the company aims its VIP account products squarely at the wealthiest of customers. HYCM, on the other hand, does not break from its regulatory obligations when delivering services to the customer, which should foster a high level of confidence among traders.

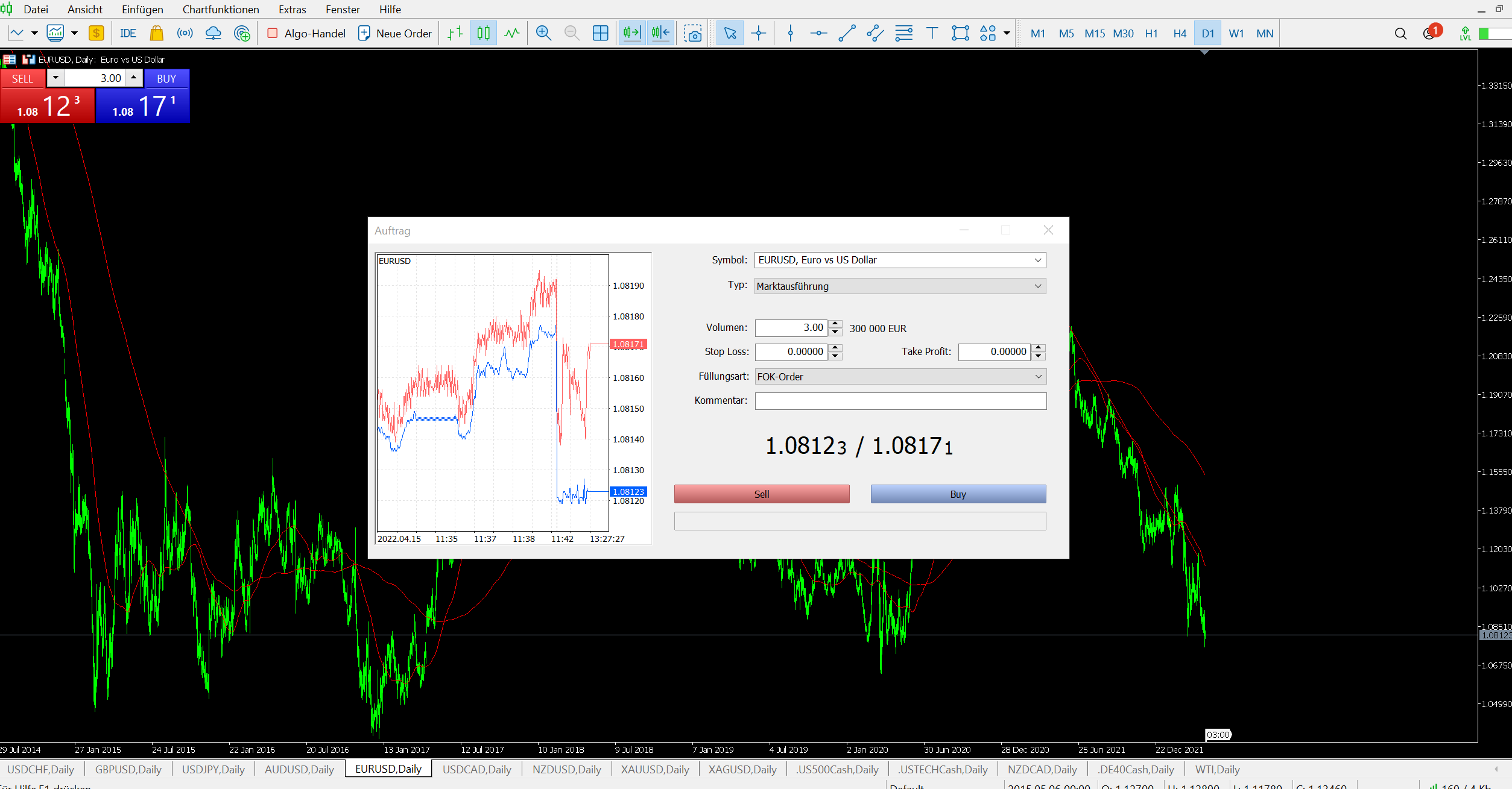

Test of the trading platforms:

HYCM offers the following platforms:

- MetaTrader 4

- MetaTrader 5

These platforms are available as mobile apps (iOS, Android), desktop versions, and web versions.

HYCM provides access to the widely used MT4/MT5 forex trading platform. While on the go, HYCM also offers mobile applications for Android and iOS devices and desktop platforms, making keeping track of and executing transactions more straightforward.

MetaTrader 4 is the most widely used trading platform on the internet, as more and more traders turn to the internet to conduct their business. It is accessible as a web-based application that may be used through a web browser on your computer.

It offers the same simple-to-use capabilities as the Windows desktop and includes:

- Advanced charting.

- A highly configurable trading environment.

- Easy-to-access online trading tools.

- A wide variety of indicators.

MetaTrader 4 web software is available in both English and Spanish. You can trade in the Raw Pricing environment without needing a Dealing Desk from any location in the world. You can trade with HYCM either through the HYCM app or the MetaTrader 4 application, both available on the Apple app store.

(Risk warning: 72% of retail CFD accounts lose money)

To get started, go to the Apple App Store and download the Metaquotes MetaTrader 4 app for nothing. The financial markets are available to HYCM customers immediately, and they have the option to manage their portfolios entirely from their mobile devices.

The Android operating system is used by many people worldwide on their mobile devices and tablets. For consumers to observe the financial marketplace and trade directly from their Android-based tablets and smartphones, HYCM accesses the platform on devices supported by the Android operating system.

The Android HYCM MetaTrader 4 allows traders to use a variety of advanced trading capabilities that would enable them to monitor and trade Forex fast, quickly, and safely while on the go.

Trading Centrals Alpha Generation Signals is a collection of three major indicators, which include the following indicators:

- Leadership and critical stages will find Analyst Perspectives to be an invaluable resource.

- Indicators such as adaptive candlesticks can be used to identify chart patterns that indicate significant shifts in demand and supply.

- Adaptive Divergence Convergence (ADC) – This indicator is similar to MACD. Still, it is more beneficial for shorter periods and offers more immediate signals.

Trade with confidence using HYCM’s advanced trading tools for MetaTrader 4. These tools improve the overall trading experience while giving traders a strategic edge. Access to 20 exclusive instruments is provided by HYCM, including feature-rich trade execution and administration programs, smart notification alarms, communications capabilities, novel market data, and other valuable resources.

MetaTrader 4 MultiTerminal is an intuitive and simple-to-use interface that allows traders to simultaneously operate and supervise many trading accounts. You will be able to handle up to 100 accounts simultaneously.

This is done by placing market orders, and pending orders, viewing live market prices, and tracking all funds and equity in real-time. All trading accounts must be on the same MetaTrader host. Expert Advisors and other automated trading scripts are not supported by MultiTerminal.

HYCM Autochartist offers the world’s first Market Scanner accessible for MT4/MT5 based on an Expert Advisor script not used for trading. Using a single graph, you may scan the markets for market opportunities while simultaneously monitoring all symbols and time intervals.

You no longer have to waste time opening an excess of graphs and then forgetting which currency you’re looking at when you get to the end of them. Autochartist provides a straightforward user interface that may be tailored to your specific trading preferences.

Furthermore, MT4 is excellent for beginning traders. It includes features such as security and 24-hour support, the ability to automate trading, integrated technical analysis techniques and signals, streaming market updates, personalized VIP dealer operations, expert advisers, and many more.

(Risk warning: 72% of retail CFD accounts lose money)

Different account types at HYCM Markets

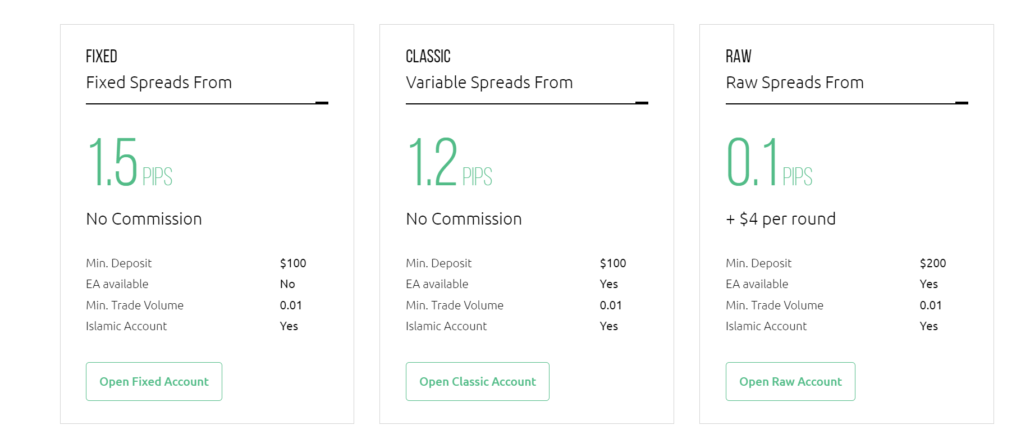

It is possible to choose between three different account kinds with HYCM: Fixed Spread, Classic, and Raw.

Fixed Spread | Classic | Raw | |

Spread | 1.5 pips | 1.2 pips | 0.1 pips |

Comission | No comission | No comission | $4 per side |

Minimum Deposit | $100 | $100 | $200 |

EA Available | Yes | Yes | Yes |

Minimum Trading Volume | 0.01 lot | 0.01 lot | 0.01 lot |

Islamic Account | Yes | Yes | Yes |

Fixed spreads of 1.5 on the euro against the US dollar (EURUSD), variable spreads started at 1.2 on the classic account. And raw spreads start at 0.1 cents on the raw account, with a limit and stop level of 3 for all account types.

Currently, the British Pound vs. the US Dollar (GBPUSD) trades at a fixed spread of 2.0. This is with variable spreads starting at 1.3 for traditional accounts. A raw spread starts at 0.4 with a limit and stop level of 4 for all account types.

XAUUSD Spot Gold (100 oz.) now features a fixed spread of 35 cents. A variable spread starting at 25 cents with a classic fund, and a raw spread beginning at 17 with all account types, with a limit and stop value of 7.

HYCM has provided a diverse choice of goods with favorable trading circumstances as one of the top forex traders. The company is committed to exceeding the expectations of even the most discriminating traders. Last year, HYCM announced the release of another 20 exchange-traded funds (ETF) products and 83 stocks to its portfolio. The company wants to expand its portfolio to exceed the goals of every trader.

How to trade on HYCM – Beginners tutorial

Starting up is a straightforward process that may be completed in six simple steps:

Step 1: Complete the registration process.

Complete the three-step registration process. You will be able to fill in your personal information, select an account type, and set your password, among other things, on this page.

Step 2: Fill out the Financial Profile form.

It is necessary to complete a Financial Profile after you have completed your registration. HYCM is committed to complete financial transparency and must ensure that CFD trading is appropriate for all of our customers.

(Risk warning: 72% of retail CFD accounts lose money)

Step 3: Confirm your identity and residential address.

Upload the necessary documents to prove your identity and residency address on the website.

Step 4: Make a deposit into your account.

Following the completion of the account setup process, you will begin trading. The demo account is an excellent place to start if you are a newbie trader. This allows you to trade in the same market conditions as you would with a live account but with virtual funds instead of real money.

This is an excellent opportunity to develop and test a trading strategy to better prepare yourself for trading in the real world.

You can deposit dollars into your account and begin trading if you are an experienced trader. Deposits are made without the payment of any commission. Choose the deposit type that is most convenient for you and start trading on a live account right now!

Step 5: Install the trading platform on your computer.

Forex trading at HYCM is conducted using MetaTrader 4, the most reliable and secure Forex trading platform available anywhere in the world. Clients can choose between the desktop version, which provides comprehensive functionality, and the MT4 mobile version, which allows them to trade while on the go.

The mobile application provides you with all of your capabilities to manage your trading positions. And interact with your account anywhere. All of the trading platforms are completely free.

Step 6: Log into the MT4/MT5 platform.

Open the trading platform and select File -> Open to Trade account from the drop-down menu.

Suppose you want to open a demo account within MT4/MT5. In that case, you can do so by selecting Open an account, setting the Henyep-DemoEU server, and clicking on the Next button. You will subsequently be issued the login information for your sample account.

If you know the login and password for your live trading account, click Login to Trade Account, and select the Henyep-Live server. Then enter the login and password for your live trading account.

(Risk warning: 72% of retail CFD accounts lose money)

HYCM minimum deposit – How to deposit funds on your account:

When it comes to funding your HYCM account, you can choose from the following options:

- Debit card or credit card deposits are accepted (Visa or Mastercard)

- Deposits can be made via Skrill, Neteller, or Webmoney.

- Wire transfer is the mode of payment.

The card’s front used as a funding source must be copied and sent to HYCM if you choose to deposit using a Mastercard or Visa. When making payments anonymously, you can use e-wallets. These are Neteller or Skrill if you do not want to share your credit card information with anyone.

On deposits made using one of the supported ways, HYCM will not charge any commissions. However, if you opt to execute a bank wire transfer, you may be charged bank fees, which might be significant.

When opening a trading account with HYCM, a minimum deposit of 100 GBP/USD/EUR must be made.

A minimum deposit is the bare minimum amount of money that HYCM requires from you to start a new online trading account with them. Don’t be put off because some brokers, such as HYCM require a minimum investment to create a trading account. Brokers with higher minimum deposit requirements frequently provide additional premium services on their systems that are not freely available on other platforms.

Brokers who need a higher minimum deposit amount typically have a wider variety of trading options available on their trading platforms as a result. These brokers frequently have more in-depth technical techniques and analysis tools and superior risk management capabilities.

HYCM only requires a minimum deposit of $ 100. If you want to use the RAW spread account, you have to deposit at least $ 200.

Minimum deposit requirements for opening a real-time trading account have decreased. This is due to a growing number of brokers competing for new customers as more and more online trading platforms have entered the market.

In some cases, depending on the type of brokerage account you choose, you may be required to make a minimum deposit as high as 6500 GBP or USD. Some brokers are willing to go as high as 10,000 GBP/USD on some exchanges.

(Risk warning: 72% of retail CFD accounts lose money)

Charges and fees for payments:

HYCM does not charge any fees for deposits. Although bank and third-party merchant fees might arise.

Because some brokers may charge a fee when funds are transferred from your form of payment to your trading account, it is always a good idea to double-check deposit fees. This is due to the possibility that the payment method you select to fund your account will incur a cost.

Method | Minimum Amount | Currency | Processing Time | Fees |

Bank transfer | $250 | USD, EUR, GPB, AED | 1-7 working days | $0 |

Credit- debit card | $20 | USD, EUR, GPB, AED, RUB, CAD | Up to 1 hour | $0 |

Neteller | $20 | USD, EUR | Up to 1 hour | $0 |

Skrill | $20 | USD, EUR | Up to 1 hour | $0 |

Bitcoin | $30 | BTC | Up to 3 hours | $0 |

Perfect Money | $20 | USD, EUR | Up to 1 hour | $0 |

When you deposit a specific fiat currency into your account, the charge may be a one-time fixed amount. When transferring funds from a credit card, for example, it is well known that costs are considerable. This is only applicable if your broker permits credit card deposits into your account.

Withdrawals – How to withdraw money and profits:

Fund withdrawals can be completed using the same payment methods used to make the initial deposit. Following a successful withdrawal, your funds will be sent back to the original source from which they were received.

However, actual withdrawals may take anywhere from three to seven business days to settle into your bank account. This is while HYCM will execute your withdrawal request within one business day. It also depends on your bank or credit card provider.

See the withdrawal options:

Method: | Minimum withdrawal: | Duration: | Fees: |

|---|---|---|---|

Bank wire | $ 300 | 1 to 5 working days | $ 0 |

Credit cards | $ 20 | Up to 1 hour | $ 0 |

Neteller | $ 20 | Up to 1 hour | $ 0 |

Skrill | $ 20 | Up to 1 hour | $ 0 |

Bitcoin | $ 30 | Up to 1 hour | $ 0 |

Perfect money | $ 30 | Up to 1 hour | $ 0 |

Keep in mind that if you withdraw less than $300 by wire transfer, HYCM will charge you an additional $30 processing fee on top of your deposit.

Also, each broker has its own set of withdrawal restrictions that limit how you can get money out of your account. This is because each brokerage business will have varied withdrawal options. Each issuing bank may charge different transfer processing costs, have varying processing timeframes, and charge a currency conversion fee.

You can withdraw money from HYCM to debit cards, credit cards, bank transfers, Payoneer, Paypal, and WebMoney, for example.

Available payment methods:

- Credit cards

- Debit cards

- Bank transfer

- WebMoney

- Cryptocurrencies (Bitcoin)

- and more e-wallets

Is there negative balance protection?

Yes, HYCM offers negative balance protection to its clients. This will give you additional peace of mind, especially as an inexperienced trader. You might be surprised how fast the markets can move in certain circumstances, and negative balance protection to is an essential piece in your risk management.

How does HYCM make money from you?

Like many other trusted and regulated brokers, HYCM will make the majority of their income from the added spreads and commissions, depending on your account type. From our experience, the cost structure is more than fair and also additional fees such as overnight fees are very reasonable. They are also transparent about their costs and don’t charge any deposit or withdrawal fees, which is a great plus as well.

(Risk warning: 72% of retail CFD accounts lose money)

Is the customer support at HYCM any good?

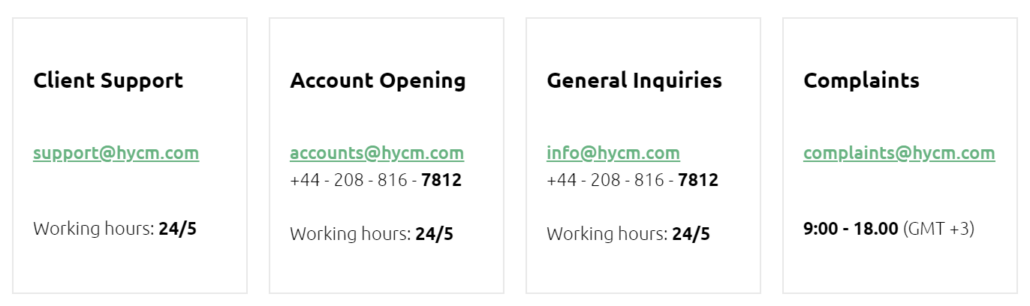

Reliable customer service in case you experience any problems is absolutely crucial. From our experience, the company’s customer support is very fast, reliable, and always on top of their game. There are multiple ways for you to contact customer support. Unsurprisingly, the broker was also awarded for their customer support by reputable sources.

In case you ever need to contact their support, they are available 24 / 5 via e-mail, live chat,, or phone. Depending on your issue, there are multiple helplines available. In our experience, it took customer support less than two minutes to solve a slight issue we experienced, so we can confidently confirm their customer support is top-notch.

Are you not convinced yet? – Here are the best HYCM alternatives

Before we conclude the article, here are your favorite alternatives – all of them are at least as well-trusted and regulated as HYCM.

Capital.com

If you are looking for a trusted, beginner-friendly trading platform with more than 3,000 assets to choose from, capital.com is definitely among the best options. The low minimum deposit of $20 is also a great advantage for trading beginners just starting out and looking to get a first glimpse at the trading universe. The availability of online classes, webinars, and their own educational app called Investmate is great for trading newbies and intermediate traders alike. Read the detailed test of our experience with capital.com here.

RoboForex

For intermediate to advanced traders, RoboForex is a highly interesting alternative mainly due to its large variety of more than 12,000 assets to trade and the industry-leading leverage of up to 1:2000. With RoboForex, you can not only trade less popular currencies and assets with very attractive spreads, you can also choose from five flexible and adjustable trading platforms. In our review, some of the broker’s highlights were a very fast execution of orders as well as the above-average civil liability insurance program.

XTB

Last but certainly not least on the list of potential alternatives to consider, XTB, as one of the world’s largest Forex brokers, can’t be ignored. This European broker was founded back in 2002 and is traded on the Polish stock market since 2016. Interestingly enough, the company gained 4% in value on the first day after doing so and currently has offices in 12 countries. The main advantages of the broker are they provide access to one of the best trading platforms currently available (Station 5) and the are very transparent with their fees and commissions.

Conclusion: HYCM is a reputable online broker!

The HYCM brokerage firm has a solid and trustworthy reputation in the current global economy. The timely broker provides professional services to traders while being strictly regulated and respected by them.

Small retail traders can start a live trading account with as little as a $100 deposit. Beginners are also welcome at the organization, with a top-notch customer service team and a solid educational or research foundation.

(Risk warning: 72% of retail CFD accounts lose money)

FAQ – The most asked questions about HYCM:

What is the HYCM’s minimal deposit amount?

HYCM requires a $100 minimum deposit before you can begin trading. After that, $20 must be deposited as a minimum before using e-Wallets or Visa/MasterCard to top off your account. For Islamic accounts opened with HYCM, different minimum deposits could be required.

Does HYCM levy commission fees?

Your chosen account type will determine the commission fee. You can select from three different account types: fixed, classic, and raw accounts. The fixed and classic accounts don’t have any commission fees attached. The minimum wire transfer deposit is $250.

Does HYCM give demo accounts?

Yes. Demo accounts are available from HYCM for training and educational purposes. Through a demo account, you can trade the financial products that are offered by HYCM. The virtual trading is free of charge and simply requires your HYCM login information.

What documents are necessary for a demo account of HYCM?

For HYCM demo accounts, no documentation is necessary. You only need to register for HYCM. In order to register, you must submit personal information about yourself, like your name, residential address, email address, etc. After email verification, you can proceed to create a demo account for yourself.

See other articles about online brokers:

Last Updated on June 28, 2023 by Res Marty