HYCM minimum deposit – How to deposit money (step-by-step process)

Table of Contents

You’ve probably heard that the average Forex trading exchange is in the billions of dollars. This is fantastic, but not everyone is a multimillionaire.

So, with how much money can you begin your Forex trading career? One of the most popular brokers for currency trading is HYCM, but how much money do you need to start trading with it? In this guide, we will talk about the minimum deposit!

(Risk warning: 72% of retail CFD accounts lose money)

What is the HYCM minimum deposit?

HYCM provides you with several options for filling your account. It promotes openness and fair trading standards throughout the account financing and withdrawal procedures. The minimum deposit amount required to start a real trading account with HYCM is 100 (one hundred) US Dollars (or equivalent) (get the correct answer in the content).

The minimum deposit required for first-time traders may differ depending on the chosen trading type of account. The activation of a deposit can take up to 72 hours.

When enrolling for a live account, the minimum deposit amount of US Dollar 100 is comparable to ZAR1,838.08. This is at the current currency rate between the United States Dollar and the South African Rand on the day that this article was written, similar to ZAR1, 838.08.

In addition to being approved and supervised by some of the most stringent regulatory bodies, such as the FCA and CySEC and the DFSA and CIMA, they are also required to maintain client money in segregated accounts as part of their regulatory compliance obligations, as explained above. As part of this, and in addition to various other stringent laws and regulations, all customer funds must be kept isolated from the broker account. It can only be used by dealers to conduct trading activities.

Along with maintaining client funds in segregated accounts, licensed brokers such as HYCM are obliged to be a part of a compensation plan or fund. This pays out a specific amount to qualified clients in the event of a company’s failure to operate.

Also, it does not charge a fee for making a deposit. This is advantageous since the broker will not charge anything from your deposits. You will only be responsible for calculating the charges incurred by the bank or third party through which you transmit the money.

(Risk warning: 72% of retail CFD accounts lose money)

While there are no deposit fees at HYCM, the deposit options that are available to you are also significant to you.

The average time for transfer using different payment methods is usually two to three business days if using wire transfer. Then, instantly or a few hours if using a debit or credit card. Every account has a currency pair, which indicates that the broker will store the money you deposit in that currency until it is converted to another. Some brokers also allow you to have multiple trading accounts with various base currencies simultaneously.

HYCM accepts significant currencies such as the British pound, US dollar, and the euro but does not accept minor currencies. Suppose you were going to deposit in a primary currency anyhow. In that case, the online broker won’t have to exchange it for you, saving you money.

Suppose you make a deposit in a minor currency that is not supported by HYCM. In that case, your deposits will be converted, and you will be given a currency conversion fee.

If you wish to finance your brokerage account with a less widespread currency (or just a currency that is distinct from your existing bank account), opening a multi-currency digital bank can be a convenient way to save on currency conversion fees.

When you open an account with a digital bank, it takes only a few minutes. Following which you may upload your old money into your new account, convert it in-app at excellent rates, and then transfer the funds into your trading account for free or at a low cost.

Payment methods explained

HYCM takes several various types of payments from its customers. The list of accepted payment methods includes:

- Mastercard, Visa as well as WebMoney.

- Wire transfer.

- Other variety of other localized payment options: Skrill, Neteller, Perfect Money

Here is a piece of detailed information for each type of payment method you can use:

- For Wire bank: the minimum deposit is 250 US dollars, while its supported currencies are as follows: USD, GBP, EUR, AED. For its working business days, it usually takes 1-7 days.

- For Mastercard or Visa: the minimum deposit is 20 US dollars, while its supported currencies are as follows: USD, GBP, EUR, AED, RUB, CAD. For its working business days, it usually takes up to 1 hour.

- For Webmoney: the minimum deposit is 20 US dollars, while its supported currencies are as follows: USD and EUR. For its working business days, it usually takes up to 1 hour.

- For Neteller, Perfect Money, and Skrill: the minimum deposit is 20 US dollars, while its supported currencies are USD and EUR. For its working business days, it usually takes up to 1 hour.

(Risk warning: 72% of retail CFD accounts lose money)

Account types

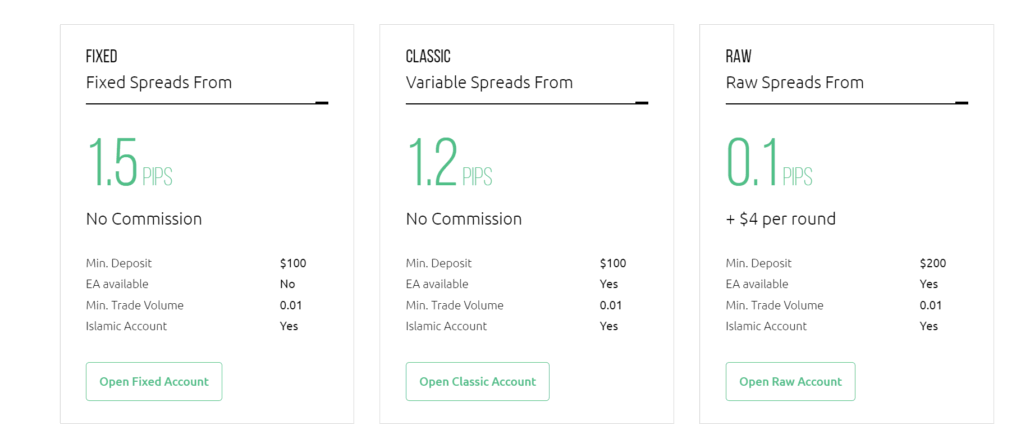

HYCM offers different types of accounts, each with an Islamic Account available option on each type of account. Each account has its own set of trading conditions that are specific to it, with the overall intention of providing users with a flexible trading environment and experience.

These are the following accounts: Fixed, Raw, Classic, VIP, Demo, and Islamic.

The following features are included in the HYCM Fixed Account:

- A deposit of at least US Dollar 100 is required.

- The smallest possible trade volume is 0.01 lots.

- Spreads start at 1.8 pips.

- Trading without having to pay commissions.

- Converting the account to an Islamic account is an option you can take advantage of.

The following features are included in the HYCM Classic Account:

- A deposit of at least US Dollar 100 is required.

- The smallest possible trade volume is 0.01 lots.

- Spreads begin at 1.2 pips.

- Trading without having to pay commissions.

- Converting the account to an Islamic account is an option you can take advantage of.

- Expert Advisors are available upon request.

The following features are included with the HYCM Raw Account:

- A deposit of at least US Dollar 200 is required.

- The smallest possible trade volume is 0.01 lots.

- Spreads start at 0.2 pips.

- Fees of US Dollar 4 are payable for each round of trading that takes place.

- Converting the account to an Islamic account is an option you can take advantage of.

(Risk warning: 72% of retail CFD accounts lose money)

VIP account

HYCM also provides professional traders with the option to gain additional benefits by offering them a VIP account that can be used when transacting in significant quantities of currency.

The VIP Account provides traders with access to reduced, tight spreads, a personalized account manager, and detailed market analysis and research.

Demo Account

HYCM provides traders with the option of creating a Demo Account, which may be used in a variety of ways, including but not restricted to:

- Practice accounts are available for new traders who want to enhance their trading abilities and experience in a risk-free environment by trading with virtual funds.

- Traders who are assessing and analyzing brokers and who would like to experience HYCM’s trading conditions in a risk-free setting, as well as traders who are analyzing and comparing brokers

- Traders who want to test their trading methods in a live trading environment similar to the real thing without endangering their funds.

Islamic Account

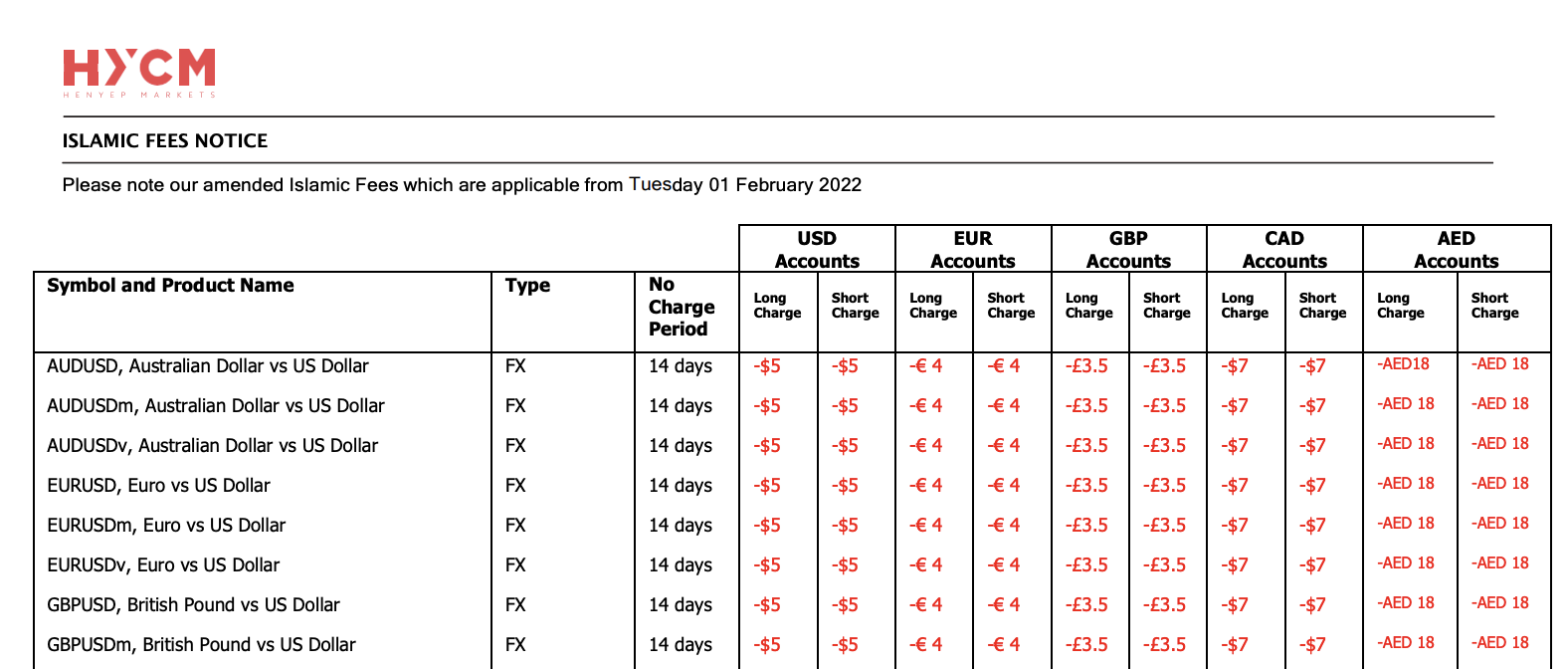

The goal of an Islamic Account is to provide a specialized service to Muslim traders who closely adhere to Sharia law in their transactions. Interests, such as overnight costs, considered wasteful or exploitative by the law are prohibited from being paid by those who adhere to it.

Overnight costs are levied to traders who keep positions open for longer after the trade day has ended. This sort of account allows traders to avoid paying such as interests or fees if they keep positions open for longer.

On all types of accounts offered by HYCM, an Islamic Account is available. On several financial products, there is no statement of whether Muslim dealers will be subjected to additional expenses such as greater commissions, spreads, or administration fees.

(Risk warning: 72% of retail CFD accounts lose money)

How to deposit (tutorial)

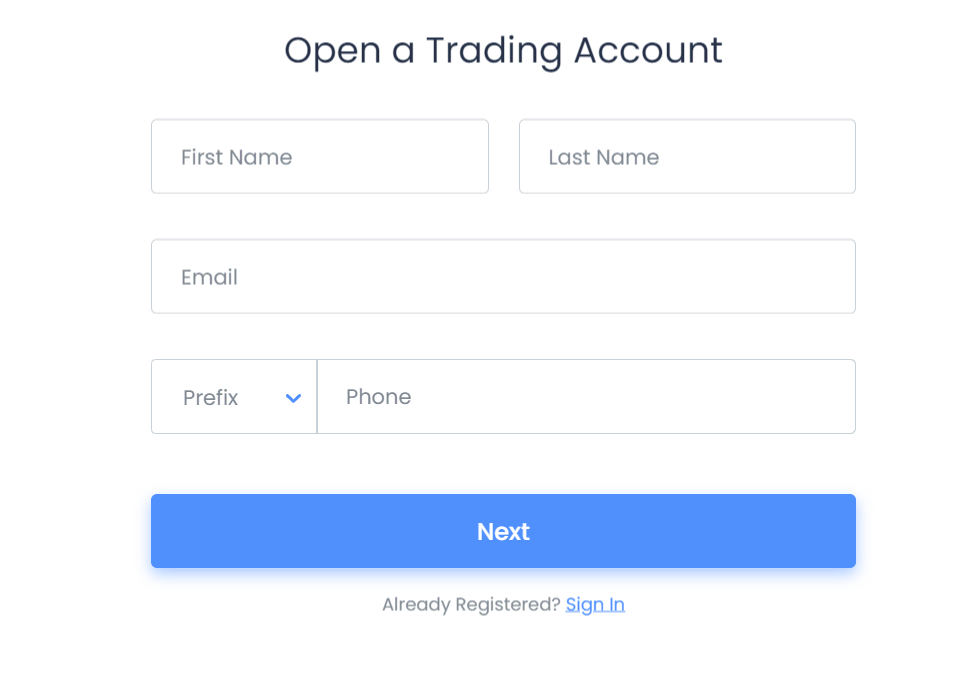

The method of making your downpayment to HYCM may differ slightly from the steps below, but in general, the steps are as follows:

Step 1: Create an account with a broker.

You may open a trading account with most brokers online. To set up an account, you must supply personal information such as your birthdate or job status and take a financial awareness test. The confirmation of your identification and residency is the final stage in the account opening process. A duplicate of your ID card and a record that verifies your evidence of residence, such as a bank statement, are normally required for this verification.

(Risk warning: 72% of retail CFD accounts lose money)

Step 2: Put down a deposit

To begin, log in to your already established trading account and locate the depositing interface. After that, you choose one of the payment options supported by the broker, input the deposit amount, and complete the transaction.

Some or all of the following deposit methods are available:

You must enter your bank account information in the payment interface to make a bank transfer (also known as a wire transfer). You must have a bank account in your name. Following that, you must initiate a money transfer from your account.

The broker will provide you with a reference number, which you must provide in your transaction as a comment. They will be able to recognize your deposit as a result of this.

Debit or credit cards: You must input the same card information as you would for any other online purchase. But, unlike any other online transaction, you must use a credit card registered to your name. In other circumstances, such as with IC Markets, you’ll also have to scan and email your card to the broker to validate it. On their part, this is simply another anti-money laundering measure.

The most common and convenient method of deposit is via credit card. However, some brokers have a limit on card deposits, so if you need to deposit a bigger amount, you may need to use a bank transfer.

Skrill, Paypal, Neteller, and other online wallets work the same way as any other online purchase. The wallet’s interface will appear, prompting you to input your information (password and username) and complete your transaction.

Step 3: Go over your transaction again.

It may take a few days for your deposit to appear on your brokerage account, based on the mode you used. The brokers will normally send you an email to verify the deposit’s receipt when this occurs.

Fees for payments

HYCM does not charge any fees for either deposits or withdrawals. However, some minimum conditions must be met. All financial transactions are safe and secure since their servers are encrypted using 128-bit keys and personal. Account information is protected using 128-bit SSL certificates that have been provided by VeriSign.

Conclusion: You can start with a $ 100 minimum deposit

The stockbroker is one of the most well-established in the financial services business, with administrative centers in major cities across three continents, including Dubai and Kuwait. Henyep Markets, a broker with over 30 years of experience in the industry, is an excellent choice for both experienced and novice traders.

To set up an account with HYCM.com, traders must deposit only $100, which is a comparatively cheap minimum starting amount.

(Risk warning: 72% of retail CFD accounts lose money)

FAQ – The most asked questions about HYCM minimum deposit :

What is the HYCM VIP account minimum deposit?

There is a minimum deposit of $10,000 for the HYCM VIP account. HYCM provides customers with s a VIP account that can be used when trading in considerable volumes of currency. Traders who have a VIP Account have access to lowered, tight spreads, a dedicated account manager, and thorough market research and analysis.

What currencies can I utilize to make an HYCM minimum deposit?

The British pound, US dollar, and euro are among the important currencies HYCM allows; lesser currencies are not accepted. Imagine that you would have to deposit in a major currency anyhow. The online broker won’t have to swap it, saving you money. So, if you deposit in a minor currency that HYCM does not accept. Your deposits will be converted in that scenario, and a currency conversion fee will be charged to you.

What is the average time an HYCM minimum deposit takes to reflect in a trading account?

If you are using a wire transfer, the transfer typically takes two to three business days on average when using different payment options. Then immediately or after a short period if using a debit or credit card. Each account has a currency pair, which means the broker will keep the funds you deposit in that currency on hand until they are translated into another.

See more articles about forex brokers here:

Last Updated on January 27, 2023 by Arkady Müller