Olymp Trade in India – Is it legal or not?

Table of Contents

Olymp Trade is an international online broker with up to 25,000 active daily traders spread across Asia, Africa, Europe, and Latin America. Headquartered in St Vincent and Grenadines, it is registered with and regulated by the International Financial Commission (FinCom). Are its services also available in India? Here you will find out.

Introduction to Olymp Trade:

Trading fixed-time trades with Olymp Trade represents one of the most profitable, and thus popular ways to make money on the internet. Fixed time trades are a derivative instrument that allows you to speculate on the probable movements of financial asset prices. In essence, fixed-time trades allow you to “bet” or “stake” (based on careful analyses) on the direction of the movement of assets such as stocks, cryptocurrencies, commodities, and of course, forex. In this case, you are not really interested in the underlying assets. Instead, you are just interested in the directions their prices will most likely move. If the price goes in the upward direction, you go for a “Buy,” and if you believe the price will go downwards, you will enter a “Sell” trade. All these and more can be done over the internet.

However, to trade fixed-time trades, you need to get registered with an online broker, who will then give you access to its platform, from which you can trade. There are many brokers out there, and in the mix, we have phonies as well. Hence, traders must go for only brokers that maintain a commendable track record and are recognized in the industry. They must also be registered with notable regulatory authorities. One of such brokers that possesses these features and much more is Olymp Trade.

(Risk warning: Your capital can be at risk)

What is Olymp Trade for Indians?

Olymp Trade is an international online broker that boasts up to 25,000 active daily traders spread across Asia, Africa, Europe, and Latin America. Headquartered in St Vincent and Grenadines, it is registered with and regulated by the International Financial Commission (FinCom). OlympTrade is an award-winning broker, having clinched the “Best Broker” by Forex Expo in 2017, amongst several others.

Olymp Trade in India

Olymp Trade’s services are available worldwide, except in certain countries such as the USA, Japan, Israel, Canada, Russia, and a few others, where fixed-time trades as investment instruments need a special regulations or have restrictions. Since the Indian government did not place a ban on binary options, Olymp Trade is much available in India. In fact, the broker has dedicated customer service options for Indian traders.

Olymp Trade India regulation

Olymp Trade globally is well regulated. As mentioned earlier, it is a member of FinaCom, a well-respected regulator of derivatives brokers. However, Olymp Trade is not registered with or regulated by any Indian government financial regulatory agency such as the Securities and Exchange Board of India (SEBI). What this means is that in cases of infractions, no Indian body can take up issues with or sanction OlympTrade. However, we must say that this is really nothing to worry about as Olymp Trade has been certified by many other regulatory bodies to be a credible broker.

See the regulation of Olymp Trade:

What markets can you trade on OlympTrade India

Olymp Trade India allows you to speculate on the direction of prices of assets listed on the major world’s financial markets, using binary options. On Olymp Trade, you can trade:

- Currencies/forex (28 pairs)

- Commodities (metals)

- Indices

- ETFs

- Cryptocurrencies

It appears there are no individual stocks to trade on Olymp Trade, however.

(Risk warning: Your capital can be at risk)

Status Programme on OlympTrade India

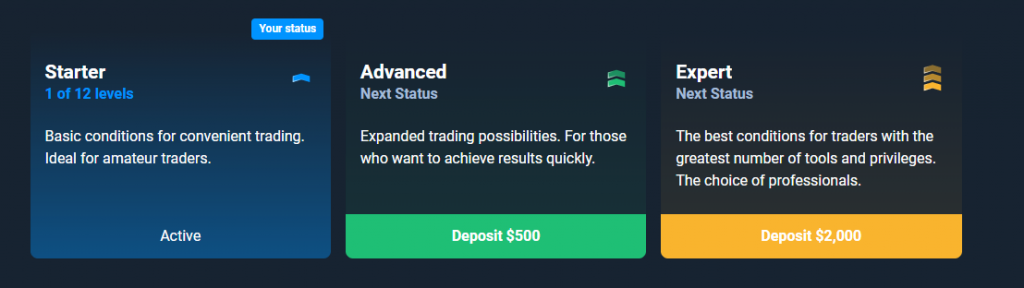

Olymp Trade has a demo account that is freely available when you sign up. If you wish to open a live account with Olymp Trade in India, there are 3 available types of accounts from which you can choose. These accounts are termed “statuses.” The status or category you belong to entirely depends on the amount of capital you deposit into your trading account with Olymp Trade India, each coming with its perks. Below is a summary of those available account types:

1) Starter Status

The Starter Status account is the most basic type of account. It becomes activated for you when you deposit the minimum allowable balance of $10. The maximum payout rate for a winning trade on this account is 82%.

2) Advanced Status

You need to deposit a minimum of $500 and a maximum of $1,999 to clinch the advanced status. Perks attached to this status include an increase of the payout rate for successful trades to 84%, the ability to open up to 20 trade positions at the same time, access to consultation with a personal analyst once every month, 7 already built-in trading strategies, and access to webinars and educational resources.

3) Expert Status

To be a part of this, you need a deposit of at least $2,000. The benefits of this status include the increase of payout rate on winning trades to 92%, the ability to open up to 30 positions, regular one-on-one training and access to a dedicated personal analyst, 15 built-in trading strategies, daily exclusive trading ideas, amongst others.

However, you can upgrade from your current status to a higher one if you earn enough experience points (XP). These points will be given when you make trades in a live account.

Services available on OlympTrade India:

Apart from being a bespoke broker allowing you seamless access to the financial markets, Olymp Trade India also provides some other services to make your client’s trading life much more comfortable. They include:

- Daily & Weekly Review: Being experts in the financial markets themselves, analysts at OlympTrade provide daily and weekly analyses of events and happenings in markets across the globe, helping you make sense of trends and charts and how they affect your trading, thus assisting you in achieving more profitability.

- Trader Education: There is a comprehensive course for traders to learn essential topics on the markets, including fundamental analysis, technical analysis, trading psychology, and risk management. There is also a weekly blog that shares tips on market and lifestyle topics, geared toward making you a better trader.

- Customer Care: Olymp Trade India gives you access to 24/7 customer care that you can access via phone, email, or live chat on their website.

- Bonuses: One really unique service that OlympTrade India provides its traders is a trading bonus. OlympTrade India provides you with several bonus types; one of such is the Welcome Bonus.

The Welcome bonus is given just for registering and depositing capital into your account; you are given up to 100% for just signing up. However, you must use this bonus in only 1 hour, or you lose it.

Then there is a Deposit Bonus. Anytime you deposit new capital into your trading account, you are given a percentage as a bonus. The bonus percentage ranges between 20% to 50% of the amount you deposit, depending on the amount deposited.

(Risk warning: Your capital can be at risk)

How to make deposit and withdrawal with Olymp Trade India

The minimum deposit threshold for Olymp Trade in India is only $ 10.

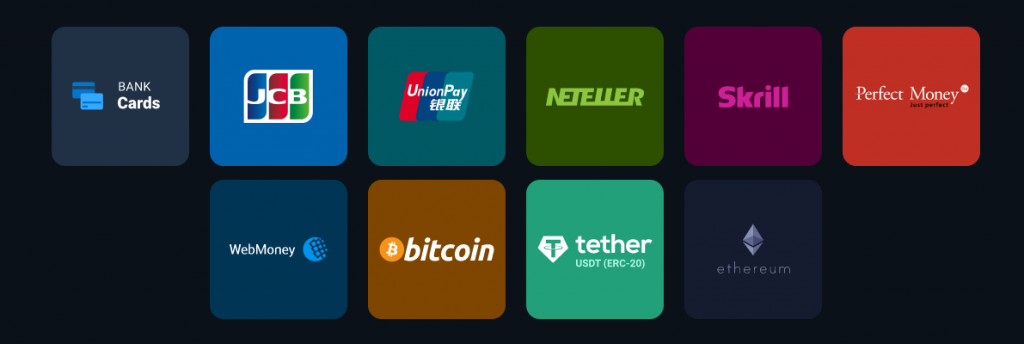

To deposit you can make use of Visa or MasterCard debit or credit cards, as well as e-wallets such as Neteller, GlobePay, AstroPay, FasaPay, Skrill, WebMoney, as well as Bitcoin.

If you want to make withdrawals, you also use the same above channels. The minimum withdrawal amount is $ 10. There are no fees or commissions for your payments. You can do the payments every time you want. Olymp Trade is known for its fast withdrawals.

Conclusion: Olymp Trade is legal in India

Trading forex and fixed-time trades are still one the most profitable ways to make money over the internet in India, and a good broker makes your trading trajectory much easier. Olymp Trade is one of such good brokers.

As a result of our review, we can promise you that Olymp Trade is legal in India and there are no bans or restrictions. Olymp Trade is a regulated company with millions of customers. The platform gives you the chance to earn money in the financial markets. We can recommend this service.

See our other articles about Olymp Trade:

- Withdrawal proof and tutorial

- Trading strategy

- Trading platform tutorial

- Tips and tricks

- Is a robot legal?

- Mobile app tutorial

- Olymp Trade Indonesia

- Olymp Trade India

- Forex trading tutorial

- Deposit

- Fixed time trades tutorial

- Olymp Trade Africa

- Bonus

(Risk warning: Your capital can be at risk)

FAQ – The most asked questions about Olymp Trade India :

Is Olymp Trade legal in India?

Olymp Trade is one of the best online broker platforms where traders and investors can access many markets. In India, the government has yet to lay out strict regulations and rules. Therefore, if any Indian trader or investor wants to open an account on Olymp Trade, they can easily do so from their PC or mobile.

Is Olymp Trade associated with any Indian regulatory body?

So far, Olymp Trade is not associated with any regulatory body in India. It is not under the control of the Securities and Exchange Board of India or any other organization. However, it is under the authority of the international financial Commission association, so trusting this website won’t be a bad idea.

What are markets tradable on Olymp Trade in India?

Since Olymp Trade is one of the best trading markets in the world, it offers several options for trading markets. For instance, it allows traders and investors to deal with the forex market using 28 different currency pairs, commodities, EFT, indices, and cryptocurrencies.

What are the different account levels at Olymp Trade in India?

Olymp Trade India offers three account levels: Starter, Advanced, and Expert. The total deposit to be made and the payout percentage will vary from one account type to another.

See other articles about online brokers:

Last Updated on January 27, 2023 by Arkady Müller