NAGA broker review and test – How good is the platform?

Table of Contents

REVIEW: | REGULATION: | MIN. DEPOSIT: | ASSETS: | MINIMUM SPREAD: |

|---|---|---|---|---|

(5 / 5) (5 / 5) | FSA (Seychelles) | $250 | 950+ | from 0.0 (cryptos) |

If you haven’t heard about NAGA yet, you will very soon. It’s on a classic fintech ‘rising star’ trajectory as it builds what will arguably be the most advanced social investing network to date.

Forget eToro; NAGA is where it is happening now. It is diligently developing an entire ecosystem of financial innovations to allow everyone to trade and invest in the financial markets, cryptos, and virtual goods.

(Risk warning: 75.53% of CFD accounts lose money)

What is NAGA?

NAGA was founded in 2015 and set out on a laudable mission to revolutionize and disrupt the financial market by decentralizing its underlying technology. And giving everyone access to the best tools to participate.

Just two years later, NAGA was floated on the Frankfurt Stock Exchange in what was to prove to be one of the top 50 Initial Coin Offerings of all time. The Offering turned out to be the world’s eighteenth-largest token sale, with over 63,000 debut subscribers and reaching a valuation of more than $50 million in a matter of months.

Determined to plow a distinctive furrow, NAGA applied its vision to account types. Instead of a suite of different accounts aimed at specific traders, NAGA instead opts for an all-in-one approach. There’s no need to compare and contrast accounts. There is only one. And it pretty much does everything. While a one-size-fits-all approach may raise a few eyebrows, it does make sense. You have access, for example, to trade and invest in over 750 instruments, including forex, commodities, cryptocurrencies, indices, and more besides.

Plus, you get access to NAGA’s social trading features, a NAGA-branded MasterCard. You can trade in cryptos and store coins in a secure NAGAX wallet. What also sets NAGA apart is that it’s a genuine community of traders that interact to discuss and analyze market conditions via secure one-to-one, group, and public chats.

The backstory of NAGA is an interesting tale and worthy of retelling. The chili-logoed company was created in October 2015 by Yasin Sebastian Qureshi and Benjamin Bilski when they unveiled their innovative social trading app, NAGA trader. Within months, NAGA had secured funding from one of Germany’s oldest banks and won its first international award in London. By mid-2017, NAGA had won further funding from one of China’s largest investment companies and floated on the Frankfurt Stock Exchange. The debut reached a Return on Investment of 260% based on the issue price.

The following year was equally eventful, with NAGA founder Benjamin Bilski being added to the Forbes Under 30 list and sealing his rep as one of technology’s brightest young stars. 2018 also saw further product launches of NAGA’s crypto-wallet, trading of virtual gaming items, and digital asset exchange.

In 2019, NAGA launched its linked MasterCard to manage funds in NAGA Trader. And since then, it has been a litany of further innovation and progress.

⭐ Rating: | 5 / 5 |

🏛 Founded: | 2015 |

💻 Trading platforms: | Naga Webtrader, MetaTrader 4, MetaTrader 5 |

💰 Minimum deposit: | $250 |

💱 Account currencies: | USD, GBP |

💸 Withdrawal limit: | No |

📉 Minimum trade amount: | $1,000 trading volume / 0.01 lot |

⌨️ Demo account: | Yes |

🕌 Islamic account: | Yes |

🎁 Bonus: | No |

📊 Assets: | Forex, Stocks, Cryptocurrencies, Indices, Futures, ETFs |

💳 Payment methods: | Credit- debit card, E-wallet, or various local payment methods, depending on your location |

🧮 Fees: | Starting at a 1.2 pip spread, variable overnight fees |

📞 Support: | Support via e-mail, live chat, or phone Monday to Friday 07:30 am-02:00 am EEST |

🌎 Languages: | 10 languages |

(Risk warning: 75.53% of CFD accounts lose money)

Regulation and safety of NAGA

NAGA is a Germany-based financial technology company that’s Stock Exchange-listed in Frankfurt as The NAGA Group AG (WKN: A161NR). Its International Securities Identification Number (ISIN) is DE000A161NR7, and the ticker symbol is N4G.

The company is operating with a nominal capital of 42,049,903 EUR, approximately $50 million. It is part of NAGA Global Ltd., incorporated in St Vincent and Grenadines, and registered as an international business (IBCN24501IBC2018). The company and its subsidiaries are licensed and regulated by the Financial Services Authority Seychelles (FSA) (License No. SD026).

The registered offices are located:

- NAGA Global (Saint Vincent) registered office is Trust House, Bonadie Street, Kingstown, St. Vincent and the Grenadines.

- Meanwhile, NAGA Global (Cyprus) Ltd has a registered office on the third floor of the Euro sure Tower in Nicosia, Cyprus.

- And the company’s NAGA Technology registered office is in Hamburg at Neustadter Neuer.

In total, NAGA operates out of seven offices worldwide and employs a workforce of 150 professionals.

Company Terms:

You can download the company’s terms of business and other legal documents from their website’s legal documentation page. The documents that can be downloaded comprise their Client Agreement, Risk Disclosure and Warnings Notice, Privacy Policy, and Cookie Policy.

(Risk warning: 75.53% of CFD accounts lose money)

What are the pros and cons of Naga?

Naga has more than one million registered clients, according to their website, and leaves a highly reputable first impression, but is this actually the case, and what are the pros and cons of the broker? In this section, we will share our experiences to help you make your own informed decision.

Pros of Naga | Cons of Naga |

✔ Reputable company listed on the Frankfurt Stock exchange | ✘ The minimum deposit of $250 is higher than with some other brokers |

✔ The Naga web trader is very beginner-friendly | ✘ Customer support is available Monday-Friday only |

✔ Highest security standards with a two-factor authorization | |

✔ Large variety of more than 750 tradable markets | |

✔ Very friendly and knowledgeable customer support | |

✔ Highest security standards with a two-factor authorization | |

✔ A lot of happy customers and an excellent reputation in the industry |

Trading conditions

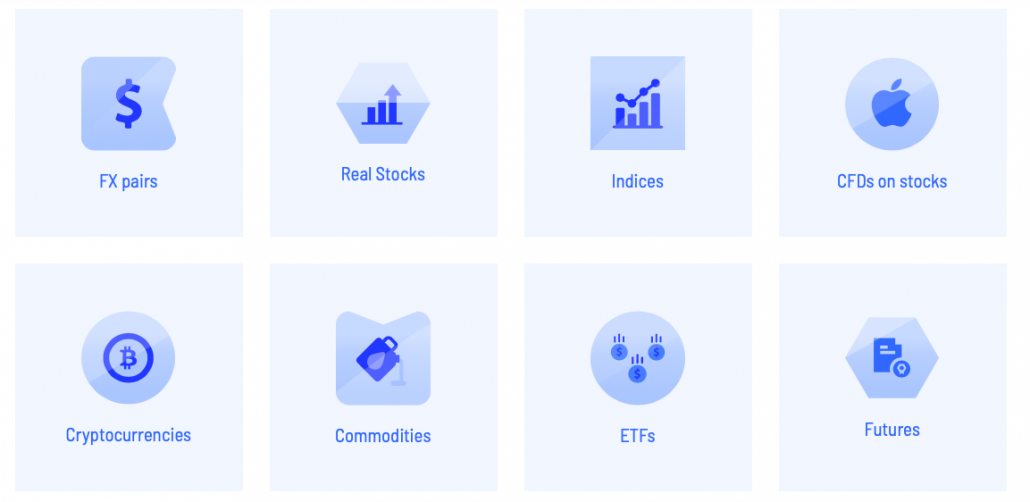

NAGA is probably one of the brokers with the most extensive spectrum of trading assets around.

You can trade:

- Forex

- Real stocks

- CFDs

- ETFs

- Cryptocurrencies

- Indices

- Commodities

- and Futures

However, suppose you prefer to get your hands dirty and fly under the radar. In that case, you can trade as usual on NAGA’s other platforms, MetaTrader 4 and 5 for desktop and mobile, and web. In total, there are over 950 instruments and low fees, low spreads on major currencies, real-time chart data, fractional pip pricing, and ultra-fast market execution. Trading in real stocks is commission-free.

NAGA says its users enjoy low market spreads because they are continually adjusting spreads to give clients the best conditions across all the markets. It’s worth noting, however, that NAGA’s spreads are variable and as such, tend to be pitched lower than fixed spreads. For this reason, there’s no insurance premium payable. Unlike other forex brokers, NAGA does not impose trading restrictions during breaking news and events.

Pips:

They are different, too, with their fractional pip pricing. Unlike the standard 4th decimal place rule, NAGA rounds up their pips up or down to the 5th decimal to secure a better price for clients from NAGA’s liquidity providers.

Does NAGA offer good usability?

Before we take a closer look at the NAGA trading platform, you should also consider the usability of trading platforms. It is actually a very important factor. How comfortable you feel with the trading platform of your choice, the better your chances of success.

Criteria | Rating |

General Website Design and Setup | ★★★★★ Clean website with professional design. The 2-Factor authorization for the client account is an outstanding feature |

Sign-up Process | ★★★★ The sign-up Process is clear but takes slightly longer than with some of the competitors. Sign-up for live and demo accounts is combined |

Usability of trading area | ★★★★★ The NAGA web trader is perfect for beginner and advanced traders alike. |

Usability of mobile app | ★★★★★ Very good NAGA app is available for both IOS and Android devices, with all the same features as the web version |

(Risk warning: 75.53% of CFD accounts lose money)

Testing the NAGA trading platform

You can access NAGA’s services on multiple devices from anywhere in the world, as you would expect. There are five options to choose between: MetaTrader 4 and 5 for desktops, the NAGA web app, and MT4 and five mobile options for Android and iOS. But you can use a mix of them all if you wish if you use many different devices.

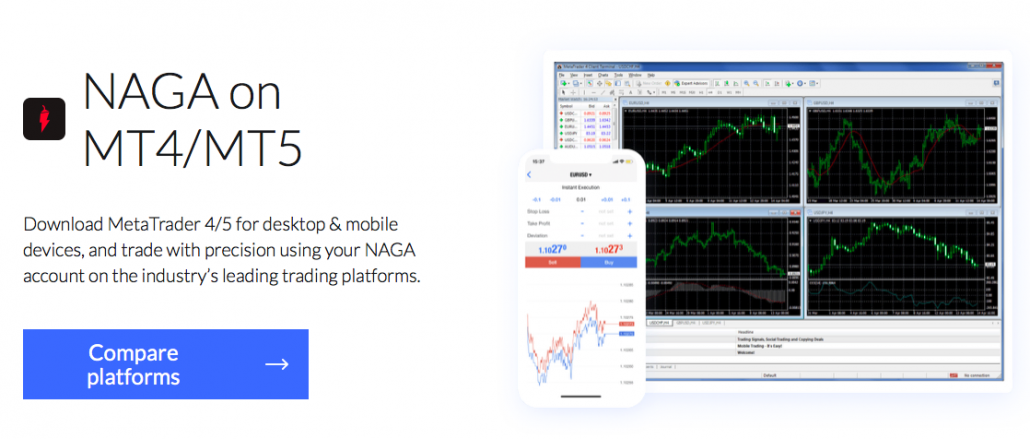

MetaTrader 4 and 5 are best for experienced traders who need an advanced platform with heavy-weight tools to trade multiple instruments. Each is customizable so that you can arrange the indicators, toolbars, and other furniture to mirror your trading style and personal preferences.

Both variants are very much hands-on and trading-focused, with an extensive array of tools and charts.

MetaTrader 4

MetaTrader 4 is iconic and an industry platform standard. It’s simple, if slightly clunky in some aspects.

It’s familiar to many and a proper old-school trading tool that still cuts the mustard in today’s frenetic environment. Plus, it syncs with your profile so that you won’t miss out on auto-copying followers and a little side cash.

MT4 features:

- A customizable interface

- Three order execution types

- Four pending orders

- 30 built-in technical indicators

- And 31 graphing objects.

MetaTrader 5

The more agile and flexible MetaTrader 5 lets you trade a wider variety of assets, including real shares. So if you are looking to get dividend payouts in your portfolio, MetaTrader 5 is the MT version to go with.

Other MT5 features are:

- Customization

- Our order execution types

- Six pending order types

- Fund transfers between accounts

- 38 technical objects

- And 44 graphing objects

Other features in MetaTrader 5 that you don’t get with 4 are:

- Netting

- Market depth

- Economic calendar

- Multi-threaded strategy tester

- And embedded community chat

Both MetaTrader 4 and 5 can be downloaded directly from the NAGA website. It is available for Android, iOS, Windows, and macOS.

(Risk warning: 75.53% of CFD accounts lose money)

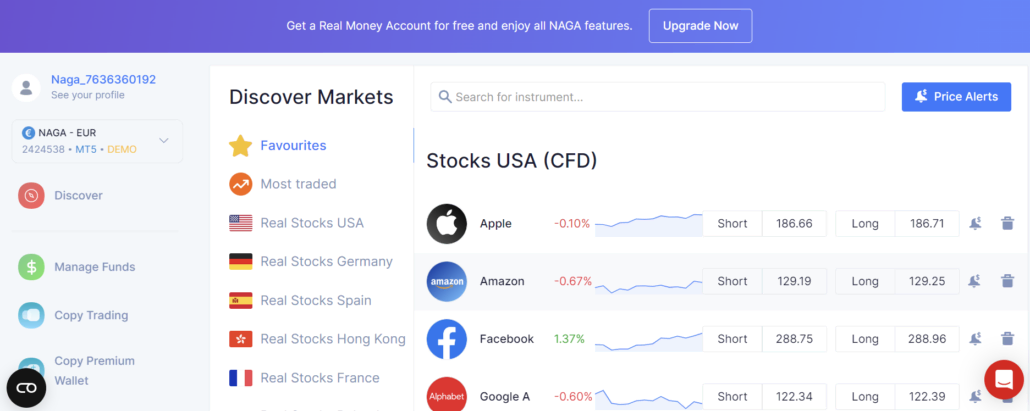

NAGA web app

If you’re not a big MT fan, you can access all of NAGA’s features and tools directly from your browser instead. You can access everything from setting up alerts to auto-copying.

The NAGA web app gives you access to almost all the features, including social trading, that are available on the other platform options. You can trade over 500 instruments in a web platform that’s both advanced and user-friendly.

To get a flavor of the web experience, you can sign in as a guest here.

NAGA for iOS

The Apple app is available from the App Store, where it gets a very high rating of 4.8 out of 5. The app requires iOS 13.0 or later and 140 MB of storage space.

NAGA Android

Over on Google Play, the NAGA app rates only a 3.7 out of five scores from almost 4,500 ratings. The higher iOS rating was based on just 45 reviews.

While the iOS users are pleased with the app, it’s recently been the opposite sentiment generally from Android app users.

Two other great reasons to download NAGA are:

- You get a personal account manager who will provide professional support by phone, email, or chat.

- And NAGA Messenger, the world’s first trading instant messaging service.

Which account levels are available on NAGA?

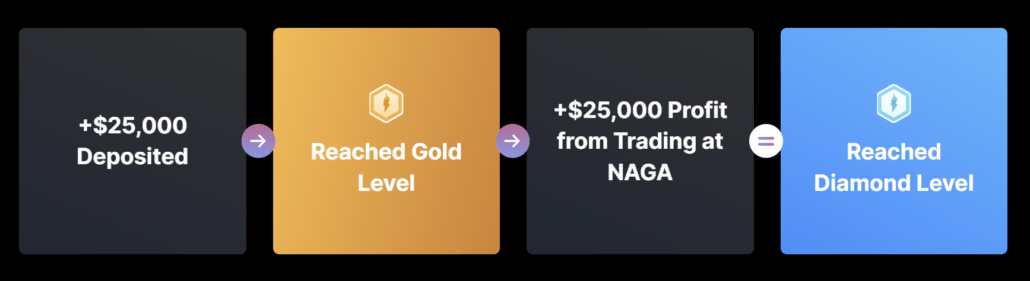

Though NAGA says they only have one account, there are six tiers within it. Each has varying specifications and conditions, as well as minimum deposit limits.

The first tier is Iron Trader, followed by Bronze, Silver, Gold, Diamond, and Crystal. With each tier, the deal and the features get better and better. Though what is common to them all is access to 1:1000 leverage.

However, allegedly, the most popular tier is Gold, and it has the best mix of features and trading conditions to suit most people. However, the minimum deposit is a hefty $25,000, so you may wish to test the water with Iron Trader and a $250 minimum deposit first. Below you will find a detailed overview of the benefits of each account level.

Iron | Bronze | Silver | Gold | Diamond | Crystal | |

Minimum amount | $250 | $2,500 | $5,000 | $25,000 | $50,000 | $100,000 |

Withdrawal Fees | $5 | $4 | $3 | $2 | $1 | No |

Webinars | Acess to webinars | Access to webinars | Access to webinars | Access to webinars | Access to webinars | Unlimited access to webinars |

One on One tutoring | No | No | No | One time | 2 per month | 4 per month |

PI Dashboard | No | Yes | Yes | Yes | Yes | Yes |

Because the minimum amount can be quite high, it is good to know that you can accumulate investments and profits. For example, for you to reach the Diamond level, it requires an account balance of $50,000. You can achieve that by investing $25,000 and adding up the other half over time with your trading success. Also, you will never lose an account status due to losses while trading, but it is possible to be downgraded if you withdraw funds and fall below the required minimum amount for that specific account level.

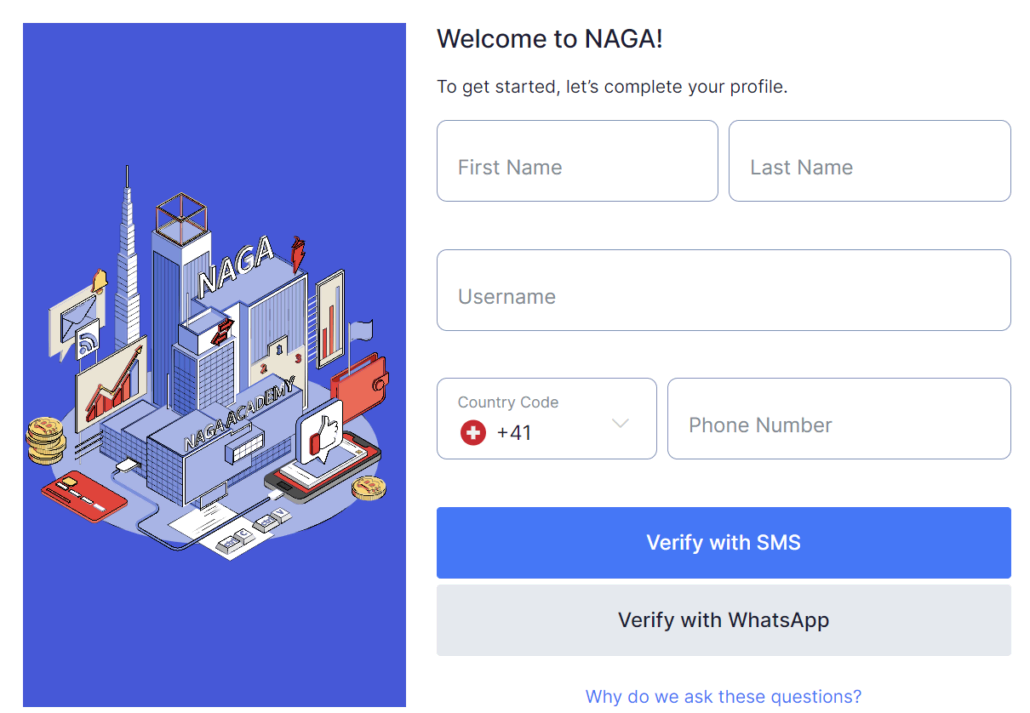

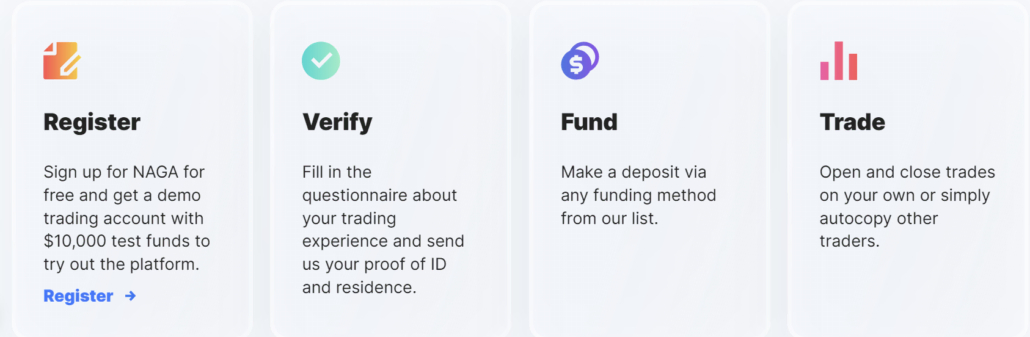

How to open an account

Opening an account with NAGA is straightforward. Click the Sign-Up button on their website home page. You will then be asked to sign up via email using the online form or via your Facebook or Google account. When that’s done, the next hoop is to begin the verification process. For verification, you will need to supply:

- A phone number

- Picture ID

- And proof of your address

To start the process, you need to upgrade your default demo account to a live trading account. You do this in the Upgrade section, where you need to complete a questionnaire fully.

(Risk warning: 75.53% of CFD accounts lose money)

When this has been completed, you will then be redirected to the Verification area to upload the necessary documents. Verification is required to comply with anti-money laundering and Know Your Customer regulations.

For Proof of Identity, you need to upload a color, legible and valid copy of:

- A government-issued ID

- Or a passport

If the document isn’t in English, you must provide a translation.

For Proof of Residence, you need to provide a document bearing your current physical address. Acceptable documents include bills or statements from:

- Utility companies

- A government-issued document

- Or judicial authority

Demo account

All users, experienced or not, can have a demo account to practice or try out new trading strategies, in addition to a live trading account.

Demo accounts are a practical, risk-free method to familiarize yourself with the NAGA platform, figure out how it works, and flex your new trading muscles with a virtual account balance. However, even with the best efforts, a demo account is only a facsimile of the live trading conditions. In NAGA’s case, some of its features, such as copy trading, need a fully functional live account.

That said, a demo account is a great introduction, is risk-free, and there’s no way you can lose your shirt if your trades go pear-shaped. Once you register with NAGA, you get a demo trading account by default. It’s free, and there’s no obligation to continue to a live account.

How to trade

While you get a demo account as standard when you sign up for a NAGA account, don’t be tempted to think this is enough to get you started.

Take advantage of the demo account, for sure. But bear in mind that it’s fantasy money, and even the best demos are but pale imitations of the real thing. Look on a demo account as a means of figuring out the NAGA platform and becoming familiar with all the dials and levers. In itself, it is not an entry point into the world of trading. But rather a walk-through of the controls.

A demo account is a risk-free environment for more experienced traders to test-drive new trading strategies and ideas without putting real money on the line.

Novice traders should use the demo account in conjunction with the educational and training resources provided by NAGA. Compared to many other competitors, what they have on offer is refreshingly comprehensive. Combined with their FAQs and the help center, most people should at the very least, get a good grounding on what to do next.

You can get a good picture of what to expect by entering the NAGA website in guest mode. You can access the NAGA Academy and find out for yourself the level of learning materials that are on offer. Between the FAQs and the NAGA Academy, most of the vital issues are well covered.

But don’t overlook the blog. This is a treasure trove of articles and information ranging from starting trading as a complete novice to a complete guide on leverage and how you can use it successfully.

(Risk warning: 75.53% of CFD accounts lose money)

(Risk warning: 75.53% of CFD accounts lose money)

Educational resources

NAGA doesn’t do special offers in the shape of deposit bonuses or loyalty schemes. This is becoming increasingly rare nowadays as financial regulators worldwide crack down on these types of incentives. However, NAGA does have a barrowload of resources for their 500,000-plus and growing customer base.

Their help center, for one, is impressive. You should check it out as it has comprehensive FAQs that cover getting started, account verification and documents, deposits and withdrawals, copy trading, My Profile, and My Feed, account security, NAGA wallet, trading hours and fees, and other miscellaneous issues.

If you can’t get the answer, you can click through to the support center for even more FAQs and articles. Alternatively, you can initiate a live chat or find a telephone number to get support.

Or you can head over to the equally impressive NAGA academy for free education articles, videos, webinars, and tutorials. There’s everything there to get you up to speed on trading and avoid blowing up your account in the first week.

NAGA deposit and withdrawal policies

With 20 ways available to fund your account, you are unlikely to be stuck trying to deposit to your NAGA account. Some are country-specific, but the main methods are:

- Credit/debit cards: MasterCard, Visa, Maestro

- Wire transfer: Banks, including Eurobank, Donner & Reuschel, Guaranty Trust Bank, and four Thai banks

- Alternative payments: Sofort, Neteller, Skrill, Giropay, EPS, iDeal, p24

- Cryptocurrencies: Bitcoin, Ethereum, Bitcoin Cash, NAGA Coin, Litecoin, Dash.

Regardless of which way you opt to pay, the minimum deposit is $250. However, you should not attempt to deposit your account until your identity and payment method have been verified and approved by NAGA. Getting all three of these sorted first will save a headache later. Your ID documents also need to be verified before you can make a withdrawal. For credit cards and bank transfers, you need to provide NAGA with a copy or scan of the card or a bank statement.

You can check your payment method status by logging in and opening the Payment Methods page. Here you will see at a glance whether you need to obtain approval. You can upload any requested documents via the Document Management section. Withdrawals, meanwhile, are instant for sums up to $1,000 depending on the payment method used. You can also only withdraw a set amount over three days.

Is there negative balance protection?

Yes, but you need to dig through the Client Agreement to find any mention of it. What is much more accessible is NAGA Protector, which helps traders minimize losses and lock in profits.

This requires user input to set the stop loss and take profit parameters. When the trade reaches your pre-set values, NAGA Protector steps and closes the trade. To set up NAGA Protector, you enter the desired amount or rate. You then pull the trigger on the green Take Profit and red Stop Loss limits.

How does the broker make money from you?

If you are looking for a neutral broker with no interest in the outcome of your trades, NAGA is a very good choice. Naga does make the bulk of its revenue strictly through added spreads and commissions associated with trading, such as withdrawal fees, overnight commissions, and trough copy trading. A substantial part of these funds will be invested to improve the security, customer support, and reliability of the platform.

How good is the support and service at NAGA?

NAGA has some excellent self-service resources in its help center. It’s extensive and covers all the most common problems you are likely to encounter as a new customer. You should head there first and check out the FAQs and articles for an answer.

However, if DIY troubleshooting isn’t working for you, NAGA is easily contactable.

Their support team is available and eager to help Monday to Friday between the hours of 09.00 and 20.00 Eastern European Summer Time (EEST). EEST is UTC +3 hours.

The global support English language numbers are:

- +44 20 3318 4345

- +44 33 0808 8867

International office numbers are listed on the Contact Us page for:

- Cyprus

- South Africa

- Mexico

- Peru

- India

- Indonesia

- Malaysia

- Thailand

- Vietnam

- New Zealand

From the Contact Us page, you can also strike up a Live Chat with a service agent. For less urgent inquiries, you can email [email protected] and get a reply back in 48 hours. From our experience, the customer support at NAGA is very professional, knowledgeable, and helpful. Many clients also mention this as a major pro of the broker, and they have built up a reputation for their exceptional customer service over the years. The only downside is the limited office hours of the support team. The support team is available when the largest markets are open, but 24 / 7 customer support isn’t something NAGA offers its clients.

(Risk warning: 75.53% of CFD accounts lose money)

Accepted countries and forbidden countries

NAGA, true to its ideals of accessibility, accepts clients living worldwide. However, there are some exceptions to this rule. NAGA cannot accept clients that are residents of the following countries:

- The USA

- Canada

- Cuba

- Iran

- Syria

- North Korea

- Iraq

(Risk warning: 75.53% of CFD accounts lose money)

What are the best NAGA alternatives?

Now, in this second last section, we will introduce some potential NAGA alternatives. Although the company is a highly recommended broker and one of our favorite options, you should be 100% confident you are making the right decision. These three alternatives are all regulated, trusted companies with thousands of satisfied customers.

Captial.com

Capital.com is our favorite broker for trading beginners and a tough competitor for NAVA. Founded in 2002, the broker offers generally slightly lower fees and spreads in our experience. While AvaTrade is slightly ahead in terms of the number of educational resources, Capital.com also comes with a very beginner-friendly trading platform, very good customer support a very low minimum deposit. Read our detailed review here and decide for yourself which broker better serves your needs.

RoboForex

The broker RoboForex is a great option with very low spreads and fees for less popular Forex pairs or assets. With more than 12,000 assets to choose from, you will never run out of options if you sign-up with this broker. The lucrative high leverage is another plus for more experienced brokers. If you have experience in the trading world and you know what you are doing, you might be better of with RoboForex than NAVA. Read our full review here.

XTB

XTB was founded in 2002 and is a great alternative for beginners and more advanced traders alike. The company is among the biggest and most trusted brokers in the industry, with designated support for every new client, competitive spreads, a fast and secure platform, and advanced analysis tools. Compared to NAVA, they offer a bigger amount of tradable assets and have better withdrawal and deposit options.

Conclusion of the review: NAGA is a new competitor of online brokers

NAGA is not just a social trading platform. Nor merely a broker or cryptocurrency exchange. It’s all of these and more. It’s the proverbial ‘greater than the sum of its parts’ entity.

Since being set up in 2015, NAGA has made rapid and giant leaps forward in disrupting and redefining the financial markets. It is committed to making online trading more open and accessible to all. Worthy ambitions, indeed. But while others jump on the newbie bandwagon, NAGA arguably got it moving in the first place. And over the past six years has been doing a great job of guiding the direction of travel with its innovations.

Crucially, though, NAGA has been social trading-oriented since day one and has invested significantly in education to ensure traders can make fully informed trading decisions. All in all, NAGA is not a scam.

(Risk warning: 75.53% of CFD accounts lose money)

FAQ – The most asked questions about NAGA:

What are the most popular Forex pairs?

The most well-known and most liquid forex available on the market is usually paired. In no particular order, these pairs are USDCHF, USDCAD, USDJPY, AUDUSD, GBPUSD, NZDUSD, EURJPY, EURUSD, and EURGBP.

Can you trade stocks in NAGA?

Stocks are one of the most popular markets out there, and you can trade stocks in NAGA.

Can I share my account with a business partner or anyone else?

Yes, you can share an account.

What is NAGA Crypto?

Naga is used for both investing and trading cryptocurrency in virtual goods, financial markets, and other cryptocurrencies. It is a type of decentralized cryptocurrency. NGC is defined as a utility token since it is utilized as a unit of account inside the ecosystem.

Can I buy crypto on NAGAX?

Yes, you can buy and sell cryptocurrency through NAGAX. It provides access to unlimited commission-free trading, and in fact, in NAGAX, you will be able to buy, sell and store your bitcoins. It’s linked with NAGA Wallet, making fiat-to-crypto transfers and asset management a breeze.

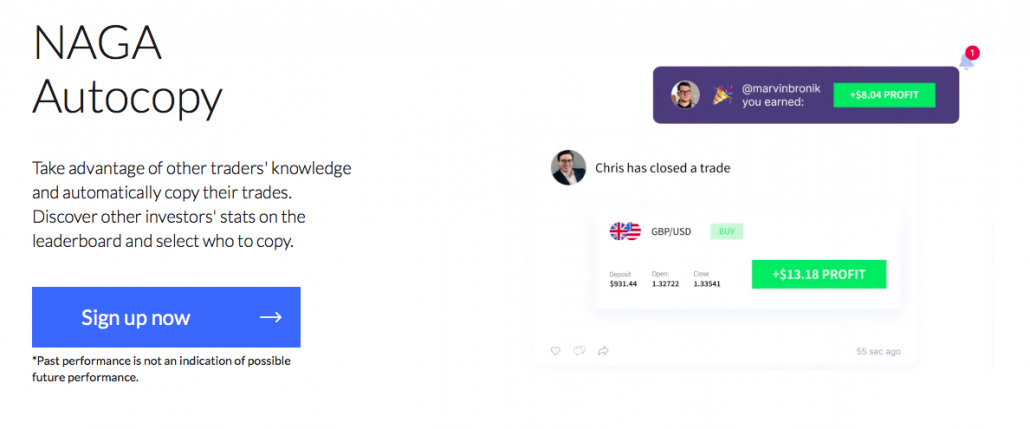

Is NAGA Auto Copy any good?

Yes, Naga Auto Copy provides a very reliable service for copy trading. NAGA is very easy to understand, and anyone, including those who are new to cryptocurrency trading, can easily use it. You can also subscribe to other traders with just one click, and you can also follow the news published with the help of strategy providers.

Where can I buy a NAGA Crypto?

There are many places where you can buy NAGA Coin, like Okex, Naga Wallet, Changelly, Cryptology, Bittrex, Upbit, HitBTC, etc. Among these, the Naga wallet is the most instant, safest, and easiest method for Naga coin purchases.

Learn more about trading:

[no_toc]

Last Updated on June 26, 2023 by Res Marty