Naga Social Trading: How to copy other traders – Review & tutorial

Table of Contents

The desire to grow is an inherent part of human lives. We all want to grow in all life aspects such as socially, intellectually, financially, etc. Though all other factors depend on the way of taking life ahead, financial growth is all about smart decisions. You need to understand the opportunities and act on them at the right time to grow your financial status.

When it comes to financial growth, you must focus on increasing the wealth you possess. So, it is essential to find a way that helps you multiply your assets instead of creating liabilities. There may not be a better way to increase wealth other than trading. It is perhaps one of the oldest aspects of human civilizations that have existed since ancient times. Earlier, people traded as a means to survive. But it has now grown into a domain where everybody can fulfill their desire of getting rich.

The need to make money applies to everyone, but some people are misguided by their desperation and lead towards the wrong path. On the other hand, for those who want to choose a smart way, trading offers them a way to earn faster profits. The technological advancement and increased awareness among people have paved new ways to trade as well.

Nowadays, online trading replaces all other traditional methods where people must be physically present and call for orders. So they can execute trades in multiple assets with a few clicks and scrolls. However, trading requires understanding the markets and developing strategies that can help you win trades. But, it should not prevent people from at least trying their luck. So more people are getting aware of it and showing a keen interest as well.

If you are a beginner trader, you can expect ups and downs that hinder your trading journey because it is filled with challenges. The market conditions may be surprising irrespective of the trader’s choice to trade in assets such as stocks, currencies, commodities, etc. So, a new trader can always look forward to incorporating a method that minimizes such unpredictable elements.

Social trading or copy trading is a beneficial tool that we can use in trading methods. It can help new traders progress in their journey, give new ideas, and minimize trading mishaps.

The concept behind copy trading is simple and lucid; it gives the trader an idea of which strategies would work and which may not. The new traders also get to use the trading community as their support system and as a place to learn ideas and discuss strategies with others.

However, it is often confused with social trading. But, there are subtle differences between social and copy trading. Though it appears that they both convey the same meaning, differentiating them is needful for their proper use. We can clarify all the differences and get a clear image of the two after understanding them one by one.

To use a copy trading strategy, the role of a broker in online trading is immeasurable. They are the mediators and guides to every transaction you make. So, if you search for a reliable broker, NAGA is a name that beats all other contenders to be your rightful partner.

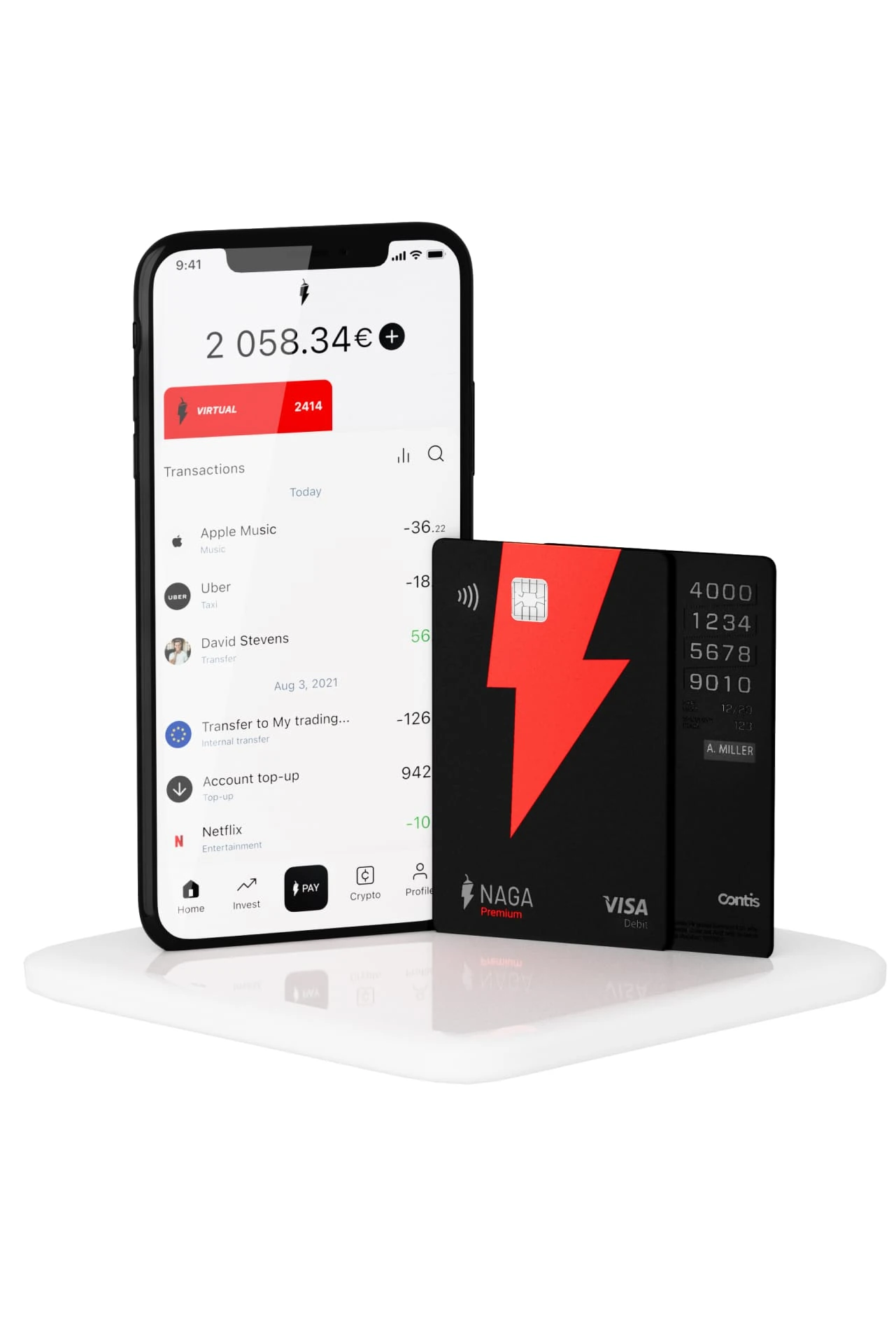

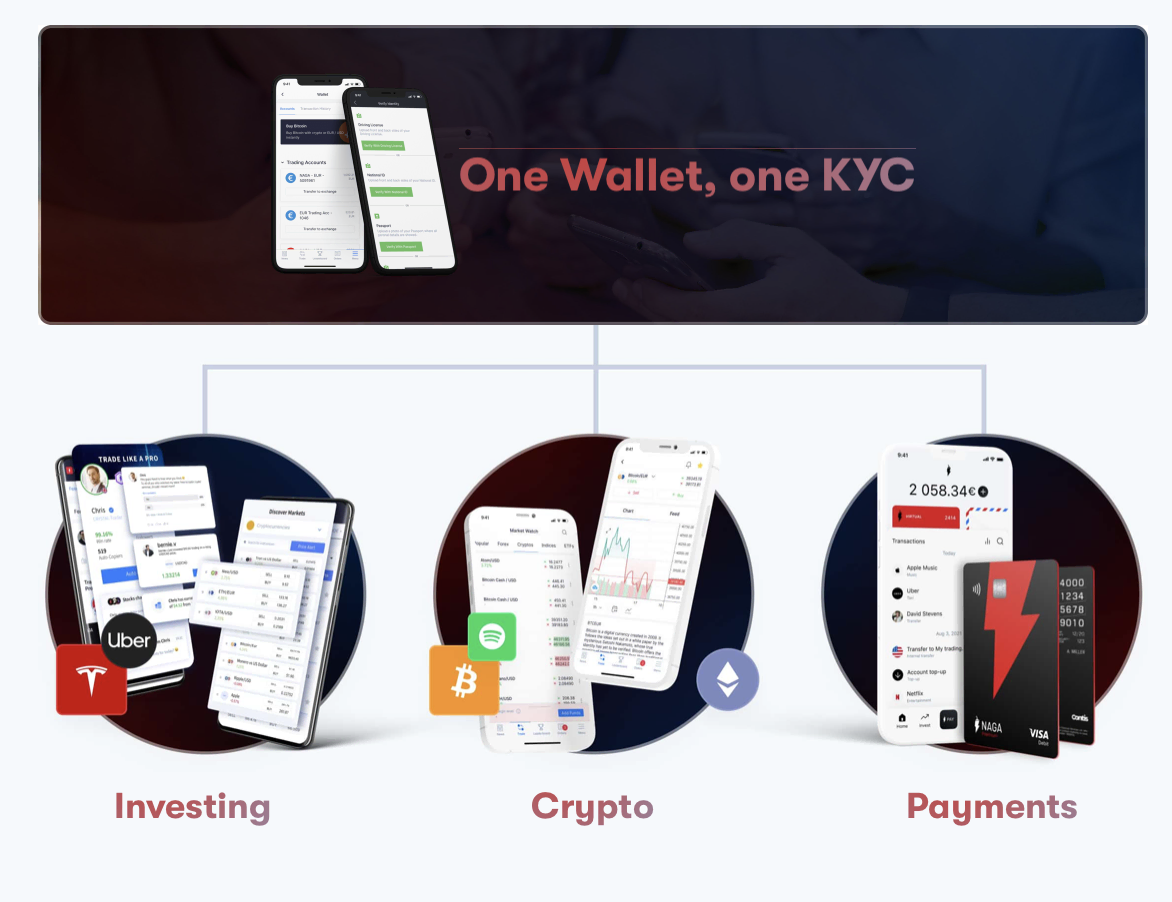

NAGA offers you the trading ground where you can trade in over 950 Instruments. That extends to multiple markets like Forex, Real Stocks, Futures, Commodities, and Indices. Once you open a NAGA account, you can try out the trading features that come with $10000 test funds. So we can say NAGA offers an all-in-one platform for investing, trading, and even copy-trading.

The year 2015 saw its launch into the trading business. However, the recent entry could not prevent it from becoming one of the most significant finance apps. It currently has over 1 million registered clients who earn potentially high rates of returns with its help.

NAGA is a broker that conducts millions of transactions regularly and has numerous investors across the globe joining its online trading platform. It is a publicly registered company with transparent operating procedures and business models. Moreover, it is regulated by authorities such as CySEC, FCA, etc. NAGA also offers a user-friendly interface that makes it easy for beginners to grasp the trading basics.

But, as we mentioned earlier, before choosing the broker, let us clarify what social and copy trading mean. Once we get an insight into these terms, we can leap forward to view the process of NAGA social trading and how to do it.

What is social trading?

We can understand social trading as a method that allows users to share information with other members through a virtual community in real-time.

It presents a new way of trading that allows the trader to have instant access to various market information directly through the internet.

Social trading differs from the other trading techniques, such as fundamental and technical analysis. That happens because other users only generate the information in social trading. Therefore, it allows the new traders to trade without conducting the analyses themselves.

With social trading, the traders can interact with others, watch them take trades, and duplicate their trades. They can learn the reason for the top performer to make a particular trade through that. Hence, traders get a better insight into the whole process.

Moreover, using social trading allows the investors and traders to incorporate social indicators from the trading data-feeds of other traders. Many brokers offer such a process through their social trading platforms. It forms the crux of social networking services by brokerages.

Social trading lets a trader base the investment decisions on the assessments that she receives from other traders. Therefore, we can view it as a way of sharing trading experiences. With its help, a trader can seek or aid others in the same field. So, it is most beneficial for the new traders.

However, that does not mean its application is limited, as experienced traders can benefit from it as well. They can also reap the benefits equally by improving their strategies and methods. However, the new traders benefit from it by shortening their learning curve.

Copy trading

Copy-trading and social trading are often confused together. People sometimes assume them to be the same. But like we mentioned before, they differ from each other.

As opposed to social trading, copy trading can be treated as a way to manage your trading portfolio. You can aim to find other investors who have an imitable track record through it. In other words, we can say it focuses on copying the trading methods, which are proven to be profitable.

Copy-trading enables the traders to observe strategies from other successful traders. So, they can use those for winning trades as it can be particularly useful for those who don’t have time to research the market themselves.

Copy-trading usually concentrates on short-term trading, particularly on day-trading and swing trading strategies. However, the traders can use several other strategies to generate profits.

It is not a method limited to only the assets in Forex as opposed to the common belief. Traders can use it on assets within other volatile markets as well. So, it can be effectively implemented while trading in crypto, commodities, stocks, etc.

Copy-trading may appear as an easy way out of all the trading problems. But it also includes risks. A new trader must always remember that past results are not an assurance of future returns. So, it does not always mean that copying the same trading strategy by an old user will result in the same result every time.

It is now clear that a trader can copy or emulate the trades executed by other investors with this method. So, the purpose of copy trading is for the trader to hold the same positions as the investor they wish to copy. But, a trader must also note that she does not receive the layout of that strategy alone when copying the trade. Instead, blindly emulating is what takes place here.

Copy-trading draws its roots to another method called mirror trading, which came into the open market in 2005. The traders focussed on copying the algorithms developed through automated trading back then.

Initially, the developers shared their trading history, enabling others to copy their strategies. But, it resulted in forming a social trading network instead. Consequently, the traders also started to copy trades in their trading accounts. That finally resulted in a method that allows copying another trader blindly rather than the strategy alone.

What is copy trading with NAGA?

NAGA Rating | 4.7/5 |

Copy Trading Availability | Yes |

Regulators | CySEC, FCA |

Trading Desk | NAGA Web Trader, MT4, MT5 |

Copy Trade Commission | Yes |

Total Currency Pairs | 48 |

Islamic Account | No |

Account Activation Time | 24 Hours |

Copying other’s trades is a smart way to improve your trades. NAGA understands the need for copy trading especially, for beginners. Therefore it offers an Autocopy feature through its platform.

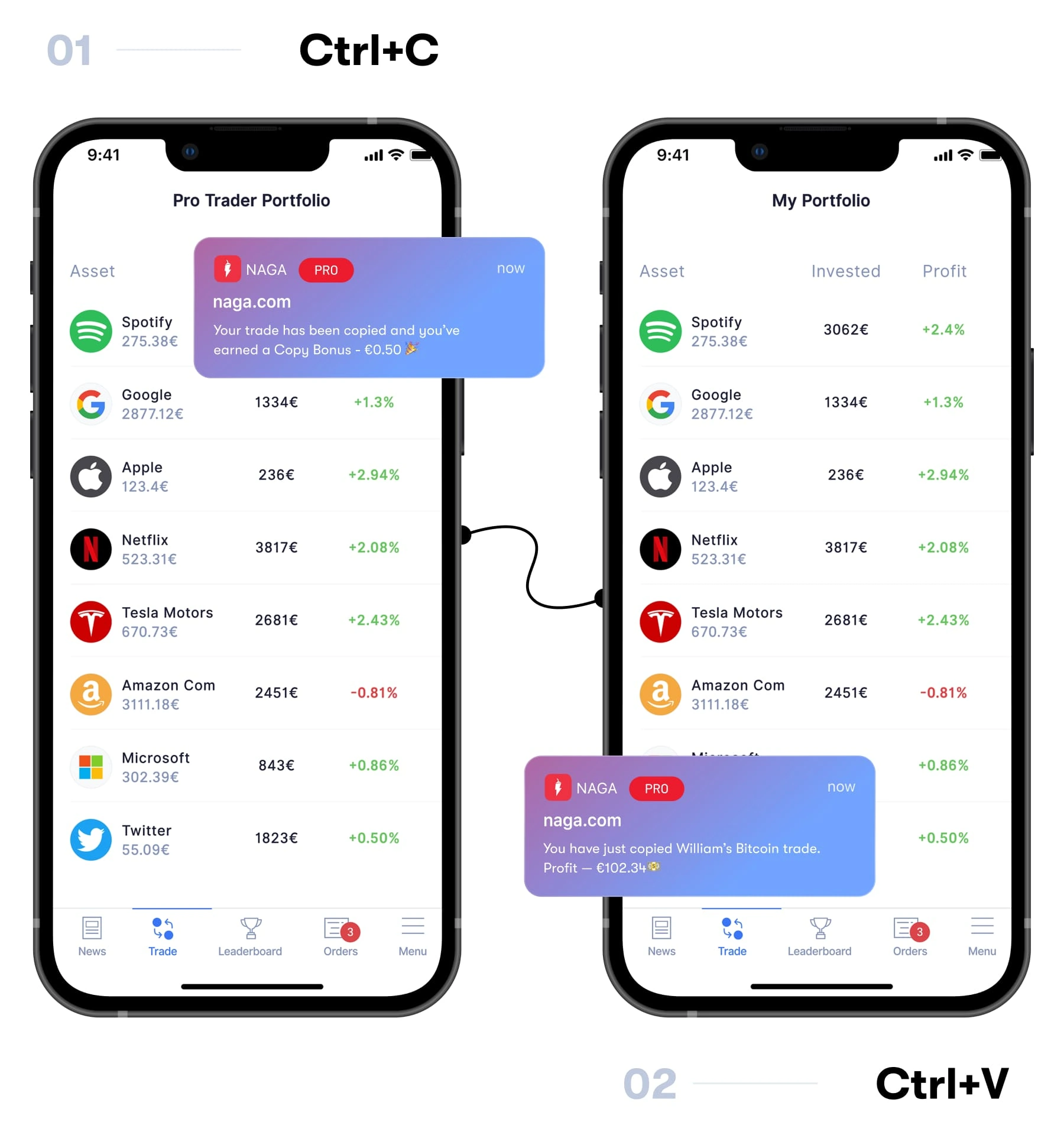

You can use it to spy on and copy the best traders who are the masters among thousands of NAGA traders. The Autocopy feature helps you mirror their trades, strategies, and activities with a single click. It offers a fully automated trading mechanism.

Auto Copy by NAGA is a state-of-the-art tool that any trader can use without prior experience or knowledge. So, you need not be an expert in the markets already. It lets you skip the need for acquiring all the market intel as you get to Auto copy with a simple push on a button. Finding the NAGA trader you want to Autocopy would be sufficient. However, if you are new to NAGA, you must choose the trader based on their trades and win rates and then push the Autocopy button.

Finding a suitable NAGA trader is another step, and it involves many things to be considered before finalizing the one for Autocopying. You need to first go to their profiles and then find their achievements.

You can view the statistics to get an overview of their performance. You need to take a deeper look at the number of trades they made till that time and compare it with their win rate. Only then can you be sure of the trader’s success you chose to Autocopy.

NAGA Autocopy begins with the user finding the top traders from the NAGA leaderboard. After that, you only need to click on the Auto copy button and whatever they trade gets copied effortlessly.

The NAGA Auto copy gives you full control, unlike other brokers. So, you get to mirror other traders’ trading activity, yet you can control what happens in your account. You can navigate to the My Trades tab and observe and manage your activity irrespective of your location or time.

A beginner NAGA trader must also know that there are also limits that you can set for both profit and loss you are willing to accept. NAGA will notify it accordingly.

Moreover, if you want to earn when other traders copy you instead, NAGA offers a chance. You can become a NAGA pro by getting more followers and traders who show interest in your trading. So, once you reach the NAGA pro-level, whenever someone copies your trade, you can get instant payouts.

Copy trading fees

The Auto Copy feature is an innovative way to copy other traders’ trades blindly in an automated manner. It is a profitable method of minimizing the risks and better familiarizing with the trading world. You can copy other traders blindly instead of mimicking only the layout. Since it is an exclusive feature, NAGA may charge a trading fee while you copy trade with it.

The fees are applied to the position that you copy from other users. With NAGA, you will be charged a fixed fee of €0.99, which applies to all copied trades. Moreover, as a copy trader, you may have to pay an additional 5%. That applies to all trades you win with a profit equal to or greater than €10.

How to do copy trading with NAGA?

- The first step is to find a top trader on the leaderboard.

- Next, you need to check out the leaderboard and search by profitability, ROI, number of auto copiers, and more.

- After finding the right one for you, the next step is to press the Autocopy button.

- After clicking on the Auto copy button, you can access the settings and essential trading indicators. They show how the master trader performs and how copiers can benefit.

- Now, choose the type of auto-copy along with the investment amount. Next, you can select the way you want to copy a trader with a percentage. You can also do that with a fixed amount per trade.

- Now, you must add individual Stop Loss and Take Profit triggers. A new trader must note that though you copy the Stop Loss and Take Profit settings after your leader, you can still set the limits yourself. You can customize them for each trade in your trades menu.

- The next step involves confirming settings and starting Autocopying. You need to enter the ratio or amount and click on Start Autocopying. You will automatically begin mirroring the trader’s positions. You can also monitor your progress and change your Autocopy settings at any time.

- Lastly, after confirming your Autocopy settings, the algorithm will automatically mirror any eligible trade opened by the master trader. It suggests that any order falling, your parameters will get copied instantly. Moreover, you can simultaneously copy a limitless number of traders with NAGA.

Advantages

- NAGA is a regulated broker, so copy trading with it does not lead you to any legal trouble. So you can safely copy other traders.

- The Autocopy feature has a simple interface and many functions. So you can use it even without any technical expertise.

- NAGA is a renowned name in the trading world and contains a social network of traders. So copy trading with it would enable you to have immense exposure.

Disadvantages

- Even professional traders can commit mistakes, and since a trader follows them blindly in copy trading, there is a chance of losing funds.

- Every copy trader has to pay copy trading fees with NAGA. It also increases to an additional 5% with every profit you make.

Conclusion

NAGA is one of the most reliable brokers out there in Forex and CFD trading. It also has particular expertise in social trading, because of which it offers an innovative feature called Auto Copy.

The feature has a simple process with easy steps that allow traders to benefit readily. Though NAGA charges a nominal fee to copy other traders, we can still appreciate Auto Copy’s features and simplicity to new traders. Therefore, we can conclude that NAGA can be an ideal broker if you look forward to social trading.

FAQ – The most asked questions about Naga Social Trading :

Is the NAGA copy trading good?

NAGA is a reliable broker that offers a great social trading feature with its Auto copy. The feature offers an easy pathway for beginners to copy trades from the experts and connect with the virtual community. However, it is not a free service as it charges a small amount as auto-copy fees. However, it also depends on the winning trades. So, we can say that NAGA is among the best social trading platforms for those who are not hesitant to pay a small fee for quality services.

Are there any fees for copy trading?

Yes, NAGA copy trading comes with copy trading fees. It is set at €0.99, which is a nominal amount. But you may also have to pay an additional fee of 5% with every profit you make equal to or greater than €10.

Is there a minimum amount needed to copy another trader?

The amount depends on the option you choose. So, if you choose the “Relative to Leader” option, the minimum amount you can Autocopy is the minimum available position of an instrument. On the other hand, choosing the “Fixed Amount” option would require a minimum of $50.

Is the Naga social trading feature trustworthy?

Yes, Naga is a legal and regulated broker. It owns a CySEC license and is allowed to work in numerous countries worldwide. So, as a trader, you can consider Naga social trading the best. It is one of the best to start your trading journey. Also, users can get access to competitive spreads. And it has a wide range of markets, making it a great option for experienced traders.

Are there any Naga social trading fees?

You have to pay Naga social trading fees to access Naga social trading. However, it is about €0.99, which is a negligible amount. Though you may also have to pay an extra fee of 5% with every earning you make equal to or greater than €10.

How can I use Naga social trading?

Traders would need to sign up to use the Naga social trading feature. The broker offers you social trading in the ‘features’ section. You can choose this feature to trade with your friends and family on Naga. Thus, if you are a beginner, you can take your baby steps in trading by learning from your friends, family, or experienced traders. You can even access the trading strategies of leading traders with this feature. So, if your friends and family are making profits while trading on Naga, you can do so by following them.

See more articles about forex trading:

Last Updated on January 27, 2023 by Arkady Müller