How to trade forex with Olymp Trade:

Table of Contents

Introduction to the forex market:

The Forex market is renowned for being the largest of all the financial markets by trading volume. A 2019 report by the Bank of International Settlement (BIS) put the daily trading volume at $6.6 trillion, a figure that is expected to grow at an average of 8% every year. As a result, the forex market attracts hundreds of thousands, if not millions, of traders. Even more and more newbies keep flocking to the market to tap into its unique features. But what exactly are those features?

Step by step Olymp Trade forex trading tutorial:

In the following steps we will exactly explain to you how to trade forex with the popular broker Olymp Trade:

1. Open your free Olymp Trade trading account

First of all, you should open your free trading account with Olymp Trade in order to get access to the forex market. The broker allows you to trade with more than 30 different currency pairs on one platform. You can use the web trader, mobile app, or MetaTrader 4 for forex trading.

Signing up with Olymp Trade is very easy. You just need your email address and a secure password. After that, you should verify your email address and continue with completing the account profile. It is important to insert the correct data of your identity.

Olymp Trade may ask you to verify your identity with different documents. The detailed instruction you will find on the website.

- Register with your email address

- Fulfill the account application

- Start trading with the demo account

- Or deposit real money

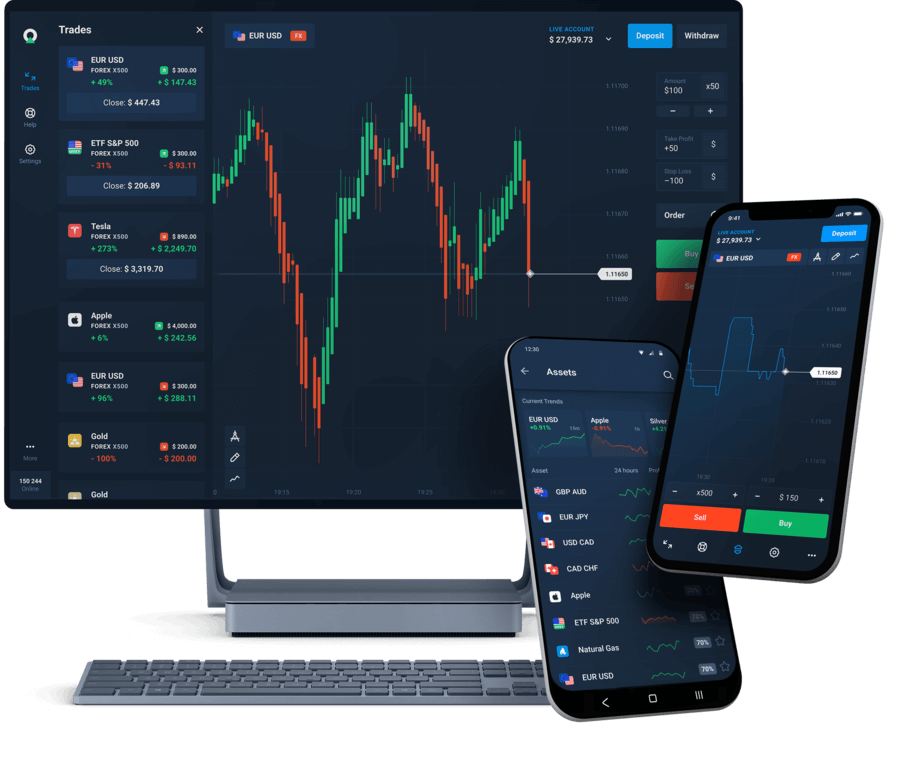

2. Platform overview – Choose the forex market

In the picture above you see the Olymp Trade platform. On the right side, you will find the menu for choosing the right asset. For your information, you can trade also other assets like commodities, crypto, or ETFs on this platform.

There are 2 ways to trade forex with Olymp Trade:

- Fixed time trades (trading on falling and rising prices with fixed time and payout)

- Real forex trading (you will profit from the strength of the price movement)

In this tutorial, we will concentrate on real forex trading with buying and selling currencies. You can trade all popular currency pairs like EUR/USD, AUD/USD, GBP/USD, and many more. Choose the market you want to trade in and analyze it. The price chart will open in a new chart window.

(Risk warning: Your capital can be at risk)

3. Make a forex analysis

Olymp Trade offers you a lot of tools to analyze the market and do a forecast of the price movement. There are different chart types, timeframes, and indicators for the analysis. Also, you can use drawing tools to mark the prices.

Helpful tools for forex trading:

- Chart types

- Timeframes of the charts

- Technical indicators

- Drawing tools

(Risk warning: Your capital can be at risk)

For example, you can use a trading strategy with the RSI and Bollinger Bands indicator. On the left side, there is a menu for adding tools and indicators. The tools are customizable.

For beginners, there is a section with trading strategies and tutorials. You can start learning how to trade successfully with Olymp Trade if you need it. From our experience, beginners should start with the free demo account and find out a working strategy before they start with real money.

For forex trading, you will need a forecast of the market. Ask you the question, what will the markets do next? Where is a support or resistance level? Where should I enter and exit a trade? You need a plan for your forex trading. That is the key to success.

4. Open the trade and manage it

As a beginner, you may ask, how does it work to buy and sell currencies? In the following section, we will show you how to open the trade and manage it.

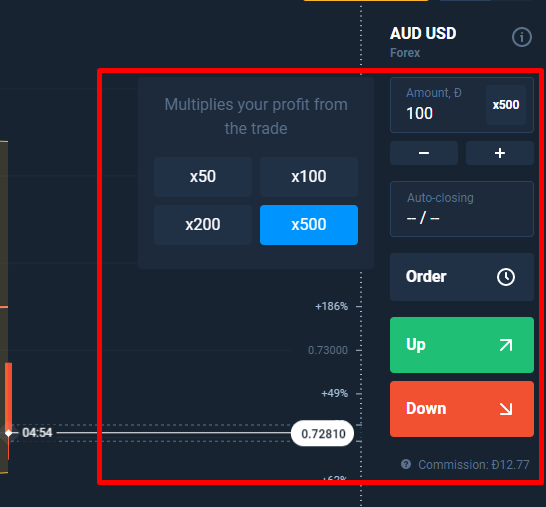

After you have a plan for forex trading you can open the order on the right side of the Olymp Trade platform. It is very easy to open a trade in a few seconds. See the picture below:

First of all, you have to insert the amount of money you want to invest in the trade. You can start with the trading of $ 1. But be careful because forex trading is leveraged. The maximum leverage is 1:500. You will see it by clicking on the menu. The multiplier multiplies your inserted amount of money. For example, investing $ 100 with a leverage of 1:500 will result in a position amount of $ 5.000. You will need this high leverage because the forex market is moving very slowly and has high liquidity.

The “auto-closing” function is for you to manage the position. You can insert a limit order where you want to automatically close the trade when you made a loss or profit. With this function, you limit your risk in the market. It is very important to use this function.

Pending orders (limit orders) are also available on the platform. It is depending on your trading strategy if you want to use them. A pending order means you will buy or sell at a certain price. For example, you say I will buy when the EUR/USD hit the 1.20000 price.

Now you open the by clicking on “up” or “down”. Below the buttons, you see the commission of the trade which you have to pay to the broker. There is a fixed commission. The commission is depending on your trading volume and the asset you want to trade.

- Choose the investment amount

- Choose the multiplier (leverage)

- Use the auto-closing function for risk management

- Use pending orders for buying or selling if the price reaches your target

- Invest in falling or rising currency prices

(Risk warning: Your capital can be at risk)

Unique features and benefits of the forex market with Olymp Trade

1. Largest market in the world

As earlier stated, the forex market is the largest in the world, with $6.6 trillion in daily trading volume. This means that the market is always liquid. That is, there is almost always activity in it. A trader cannot get “stuck” in this market, as there is always a counterparty to take the other end of his/her trades.

2. Flexibility and trading hours

One very unique feature of the forex market is that it is open for 24 hours for at least 5 working days of the week. This is unlike many other financial markets. The stock market, for example, typically opens at 9 am and closes in the evening. As a result, you are limited to just making profitable trades as a stock trader during those hours. However, a forex trader can tailor his trading to his current lifestyle and daily living without really upsetting anything. Consequently, the forex market is compatible with many strategies – you can be a scalper, a day trader, or a long-term investor. Hence, no matter your approach, the forex market is almost always open for you.

3. Accessibility and low barriers to entry

In addition to the above benefits, the forex market is surprisingly one of the easiest markets to enter, due to the ridiculously low entry barriers compared to other markets. For instance, the price of just one single share of Amazon Inc. hovers around $2,000. That means for you to take a position on this stock, you must have up to $2,000, and that is still for a single share! Also, to trade commodities such as oil or gold, you either need to set up complex infrastructure or spend large sums of money to actually buy those materials. An ounce of gold, for instance, costs approximately $1,800. Needless to say, this factor prohibits many retail traders from participating in these markets. The only option most of them have, therefore, is derivatives. On the other, with leverage, you only need to put down a small amount of money (as low as $500, or even smaller) to take up large positions in the forex market.

4. Ability to make a lot of profits

Due to the benefits that leverage provides, small price movements in the forex market can be magnified into bigger returns. However, leverage can potentially work against a trader as well when those movements are in the opposite direction to his trades.

How to trade forex:

While there are several ways to make money from speculating on the forex market, the two broad classifications are the Physical market and the Electronic market.

1. Physical market

The physical market involves the actual buying and selling of one country’s currency in exchange for another. In essence, you give up the currency you have with you in exchange for another country. You normally do this when you want to conduct a transaction with the other country’s currency, and not really for speculation or investment purposes. The risks involved are great, but the potential profits are usually not worth it.

2. Electronic market

Here, you don’t need to buy and own any currency or exchange one currency for another. Usually, you are not interested in the underlying currencies but rather in their price movements. Both retail and institutional investors play in this market for profit’s sake. There are several ways or “products” with which traders speculate in this market, and they are collectively known as derivatives. Those ways are summarised below:

3. Forex futures

Forex Futures are agreements between certain parties to buy or sell a currency (forex) at a future date, hence why they are called “futures.” In essence, forex futures agreements contain the price at which the currency will be bought or sold and the particular date at which the exchange will be done. You profit from the market when your prediction of what the market will be at that specific date or period turns out to be right.

4. Forex ETFs

Like stock ETFs, forex ETFs essentially follow the performance of the particular underlying currencies for which they were designed. That is, their value moves in correlation with their underlying currencies. So, for example, an ETF that was designed to track the movement of the Dollar will increase if the dollar increases. Correspondingly, it will fall when the also Dollar falls.

5. Forex spread betting

Forex spread betting essentially involves taking a bet on the direction of a currency pair. Your profit (or loss) depends on how the market moves in favor of your trade, or against it.

6. Forex CFDs

Forex Contracts for Difference (CFDs) entail profiting from the difference in underlying currency pairs’ prices. That is, here, what the trader is concerned about is the movement or change in the price of a currency pair at any point in time.

7. Forex (fixed time trades)

By far, this is the fastest-growing means to trade forex. First, forex fixed-time trades give you the ability to bet on currency pairs’ directional movements. With them, if you believe that the price will go up, you choose a “Buy” or “Up” trade. If you speculate it will go otherwise, you choose a “Sell” or “Down” trade. Olymp Trade offers ample opportunities to make profits from the directional movements of currency pairs. You can be given a fixed payout of as high as 90% or even more just for getting market moves correctly after a set time.

As you are already aware, to trade in any financial market at all, you need a broker. One of the best online brokers you can find around is OlympTrade. So, what should you know about them?

(Risk warning: Your capital can be at risk)

Why should you trade forex with OlympTrade?

OlympTrade offers one of the best platforms to make profits from the forex market, through the instrumentality of fixed-time trades. It provides an array of services designed to make your trading much easier. These services include:

- Trading Bonuses: OlympTrade supports your trading “hustle” by giving you trading bonuses. These, from the welcome bonus given when you sign up to the regular deposit bonuses, as well as promotional bonuses doled out from time to time, are added to your account to provide you with the ability to take up more positions.

- Regulation: OlympTrade derives its credibility from being registered with one of the most notable financial regulators in the world, the International Financial Commission (FinaCom).

- Customer Support: OlympTrade offers 24/7 customer service channels accessible via the phone, email, and live chat function on its website. Realistically, this is somewhat rare in the brokerage world.

- Trading Education: OlympTrade gives you access to a structured trading course as well as well-prepared educational materials. It also posts weekly blogs teaching trading and trader lifestyle.

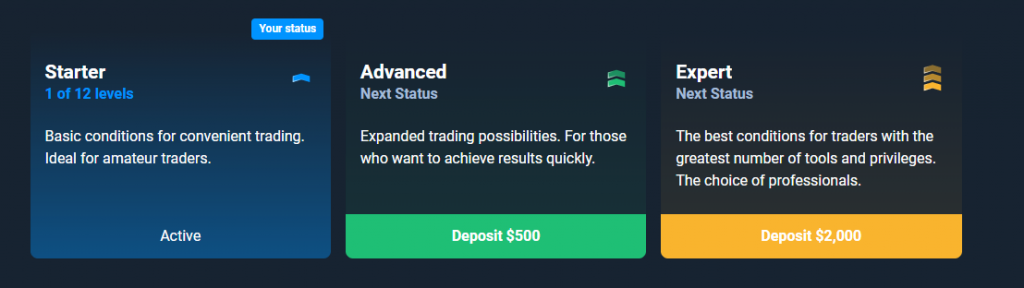

Types of OlympTrade forex trading accounts

There are basically, three types or “levels” of live accounts that you can choose from as an Olymp Trade forex trader. They are:

- Starter Status: The Starter Status account is issued when you deposit between $10 and $499. 82% is the maximum payout rate for a correct trade.

- Advanced Status: When you deposit between $500 and $1,999, you are issued an Advanced Status account. Benefits that come with this include increased payout for successful trades to 84% as well as access to numerous trading strategies and guides.

- Expert Status: This is issued when you deposit anything from $2,000 and above. Benefits attached to this include a maximum payout rate increasing to 92% and the ability to make risk-free trades.

Conclusion on Olymp Trade forex trading

There are several ways to profit from the movements in the prices of currency pairs of countries globally. One such way is through trading fixed-time trades. To, however, experience stress-free trading, you need a good forex broker. OlympTrade forex trading is arguably one of the best recommended you can find.

(Risk warning: Your capital can be at risk)

See our other articles about Olymp Trade:

- Withdrawal proof and tutorial

- Trading strategy

- Trading platform tutorial

- Tips and tricks

- Is a robot legal?

- Mobile app tutorial

- Olymp Trade Indonesia

- Olymp Trade India

- Forex trading tutorial

- Deposit

- Fixed time trades tutorial

- Olymp Trade Africa

- Bonus

FAQ – The most asked questions about Olymp Trade forex:

How to open a Forex account on Olymp Trade?

If you are new to Olymp Trade and haven’t signed up as an end user yet, you have to open a new forex account. For this, register yourself with your e-mail address and submit the account application with all the correct details concerning your identity, personal information, and so on. You will be given a demo account with $10,000 as the demo amount deposit. You can use this account to trade in the forex market and learn how it works, access the different features of Olymp Trade, and many other things. Once you are sure of yourself and the skills you’ve gained, you can start trading in real.

What are the Forex trades allowed by Olymp Trade?

Olymp Trade allows two types of forex trades, which are real forex trading and fixed-time trades.

Does Olymp Trade come with any analytical tools for the Forex market?

Yes, Olymp Trade comes with several analytical tools that will help you to understand the forex market better period; these are chart types, technical indicators, timeframes of the charts, and drawing tools.

What are the account types on Olymp Trade for Forex trading?

A trader can sign up for a starter, advanced, or expert account according to the skills and minimum deposit at Olymp Trade.

See other articles about online brokers:

Last Updated on January 27, 2023 by Arkady Müller