Purple Trading fees & spreads – How much does it cost to trade?

Table of Contents

A smart trader should not just go by the broker’s name alone. She should conduct her own research and know about the broker before choosing. The focus should be particularly on the fees. When you don’t know about the charges of a broker, that can cause you unanticipated losses. Therefore, checking any broker’s fees prior to joining it is essential. Here, we shall highlight all about the fees and spreads of Purple Trading. So, if you wish to join this broker, you do not need to dig deeper to know how much it would cost with this broker.

(Risk warning: 63% of CFD account lose money)

Overview of the Purple Trading fees and spreads

Established in 2007, Purple Trading has come a long way. It aims at providing fair and just services to trading enthusiasts worldwide. Born out of the efforts of a group of young trading enthusiasts from Slovakia and the Czech Republic, Purple Trading has crossed borders in providing services at fair prices. It aims at providing business conditions at the most reasonable prices and fees.

Through its world-class technologies, Purple Trading can be your perfect trading partner. Many traders might assume it has hidden fees and spreads because of the quality services it provides.

However, like any trustworthy broker, it also believes in maintaining an open fee and spread structure. That is why it can show you the right path to succeed in trading.

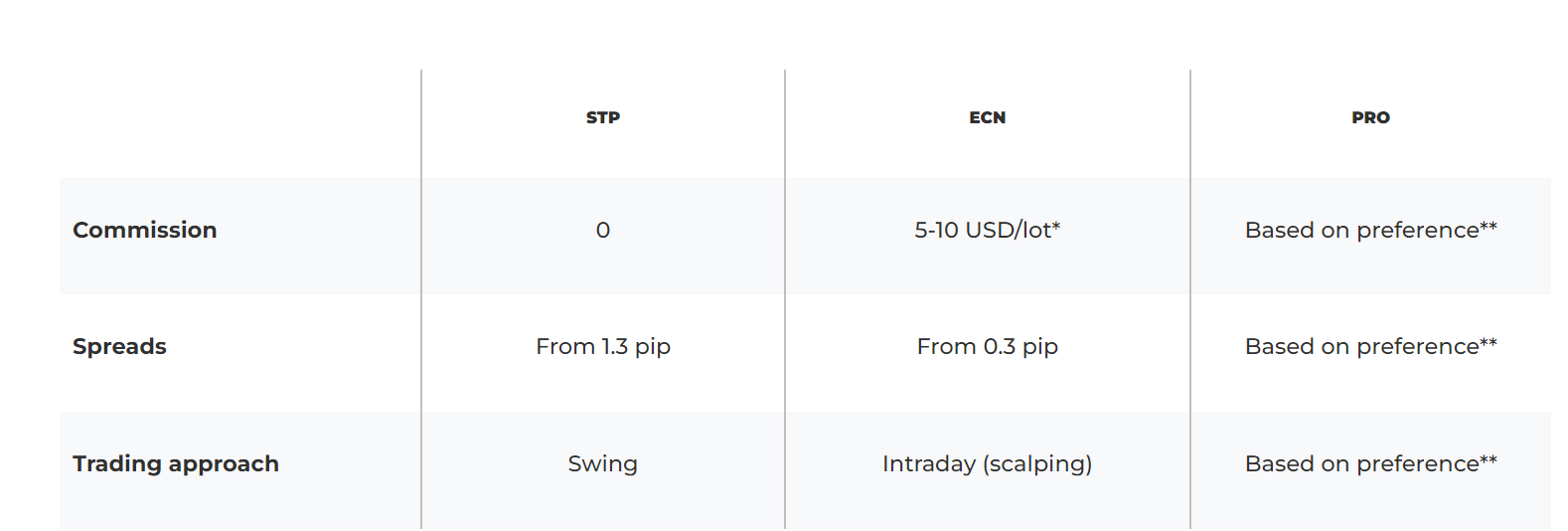

The fees and spreads of Purple Trading depend mainly on two types of accounts. These two account types may have different fees and commissions. So, based on what you are willing to pay, you can choose the account.

The three different accounts also come with different status levels. All the clients with Purple Trading are eligible to acquire any status from the three levels, namely, Standard, Prime, and VIP.

A trader can know about that by contacting the broker.

(Risk warning: 63% of CFD account lose money)

Purple Trading spreads:

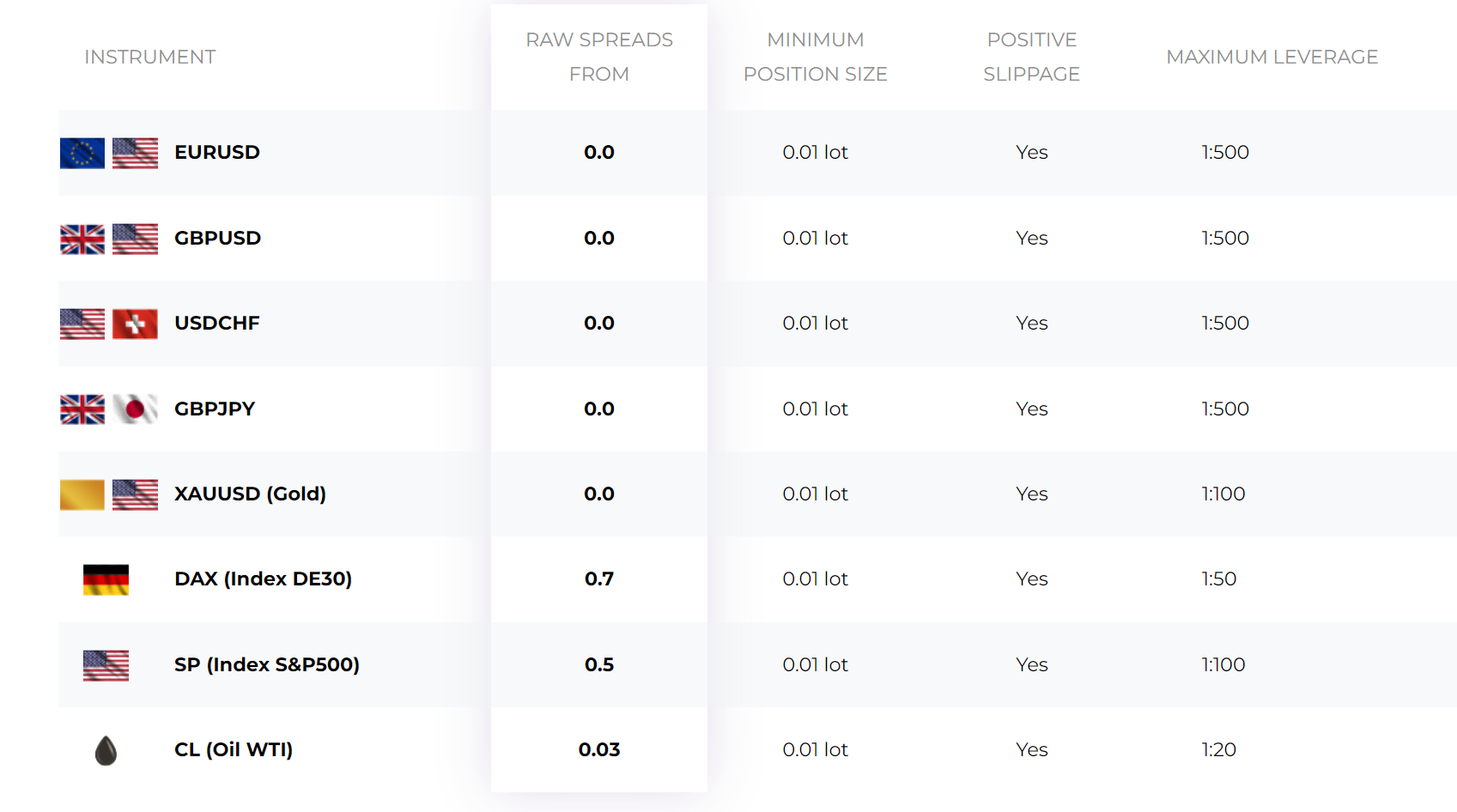

Purple Trading is a broker that believes in fair trading practices. That is why it offers reasonable spreads to its customers. As we mentioned before, the spreads can depend on the account types: STP and ECN accounts. It can also vary depending on the status level. For the STP accounts, it starts from 1,3 pips. On the other hand, for the ECN accounts, the spread begins at 0.3 pips.

Indices spread:

Symbol | Avg Spread ECN A/C | Avg Spread STP VIP A/C | Avg Spread Prime A/C | Avg Spread Standard A/C |

DAX | 0.6 | 1 | 1 | 1 |

CAC | 1.8 | 2.8 | 2.8 | 2.8 |

ASX | 4.8 | 5.3 | 5.3 | 5.3 |

NIKKEI | 7 | 8 | 8 | 8 |

NSDAQ | 0.8 | 1.6 | 1.6 | 1.6 |

DOW | 1.8 | 4.7 | 4.7 | 4.7 |

Forex spread:

Symbol | Avg Spread ECN A/C | Avg Spread STP VIP A/C | Avg Spread Prime A/C | Avg Spread Standard A/C |

AUDCAD | 0.00016 | 0.00023 | 0.00026 | 0.00028 |

AUDCHF | 0.00016 | 0.00021 | 0.00024 | 0.00026 |

AUDJPY | 0.014 | 0.02 | 0.023 | 0.025 |

AUDNZD | 0.0002 | 0.00029 | 0.00032 | 0.00034 |

AUDSGD | 0.00023 | 0.00032 | 0.00035 | 0.00037 |

AUDUSD | 0.00009 | 0.00014 | 0.00017 | 0.00019 |

Commodities spread:

Symbol | Avg Spread ECN A/C | Avg Spread STP VIP A/C | Avg Spread Prime A/C | Avg Spread Standard A/C |

XAUUSD | 0.21 | 0.31 | 0.31 | 0.31 |

XAGUSD | 0.014 | 0.024 | 0.024 | 0.024 |

XPTUSD | 3.85 | 4.05 | 4.05 | 4.05 |

XPDUSD | 25.59 | 25.69 | 25.69 | 25.69 |

CL | 0.048 | 0.058 | 0.058 | 0.058 |

BRENT | 0.048 | 0.058 | 0.058 | 0.058 |

(Risk warning: 63% of CFD account lose money)

Purple Trading additional fees

In addition to its reasonable spreads, Purple Trading also charges a nominal fee in certain cases.

Fees for deposits & withdrawals

Usually, many brokers levy a high amount while a trader deposits and withdraws funds. However, with Purple Trading, you need not pay any fee if you use domestic payment or card payment. But, it charges a fee of 0,5% if you make International payments in currencies other than CZK and PLN. Also, if you use Neteller or Skrill for depositing and withdrawing, you need to pay a 2% fee while depositing. Whereas, for withdrawing, it charges 2% from Neteller users and 1% from Skrill users.

Swap fees

Purple Trading charges a swap fee from those customers who hold their position more than the time limit. However, the charges are under their discretion and can depend on the sudden market fluctuation.

Inactivity fees

Often traders take a sabbatical from trading and leave their accounts dormant for a long time. That can cause a broker to bear additional losses. So, many brokers keep inactivity fees to prevent their clients from staying dormant for a long time. Purple Trading also charges an inactivity fee. However, the fee is quite low, and the trader has to pay it once per quarter. The inactivity fee is 15 USD/15 EUR/70 zł.

Commission

Purple Trading charges no commission to the customers using the STP account. They are liable for the spread alone. However, if you are an ECN standard account user, you must note that there arises a commission. The ECN traders need to pay a $10 commission per lot for the standard account holders. In contrast, the prime account holders need to pay $8 per lot.

(Risk warning: 63% of CFD account lose money)

What do spread and fees tell you?

Spreads and fees are the two most common terms that we hear when it comes to the costs of a broker. Let us first understand what a spread means.

It is nothing but a difference between the bid and ask price of an asset you trade. This difference arises as a cost that you eventually pay to the broker for its services.

So, we can say that a spread can influence the overall cost of your trade. That is why it can be helpful in determining the costs that you may have to bear in the whole process.

For instance, a lower spread will suggest that your trade with that broker will be less costly. A spread is the most common way to mention a broker’s pricing. It is what generates the revenue for the broker primarily.

However, that does not mean it replaces the fees and additional commissions completely. Many brokers charge additional fees along with their basic spread structure. But, some brokers provide all their services at the cost of just their spreads alone. A spread may be flexible as compared to fees. Usually, brokers do not change their fees and keep them at a fixed rate.

The main reason for a broker to employ a spread is to compensate for the trading expenses. When a trader executes a trade, the broker has to take care of various costs associated with it.

For example, it can include the costs of creating and operating the systems, marketing, employee payment, etc.

We can say that through fees and spreads, the brokers are able to finance their functioning. However, the spread is not always the broker’s primary way of earning profit. For certain assets such as stocks, spreads may be excluded. A commission is levied in such asset trading, although additional commissions may also occur with certain brokers for non-trading services.

Therefore, depending on the broker and the asset type, you may have to pay either commission or spread or both.

How spreads are calculated

Before we know the spread calculation, we must understand that a spread is represented in pips-percentage in points. It signifies the minor shift that occurs with the value of an asset.

That is why we can see the brokers stating their spreads as in pips. Now, the calculation of spread takes place on its own while you enter a trade. Depending on the asset type, it can range from one particular pip to another. But, the settlements you pay in turn are automatically deducted. So, you don’t have to send the spread rate separately to the broker after making a trade.

Conclusion: Low trading fees on Purple Trading

The fees and spreads of a forex trading broker decide the overall cost that a trader must bear while trading. So, a wise trader would always seek a broker with the most reasonable spread and fees. Also, if the broker waives the additional commissions and charges, it would be the ideal choice. Purple Trading can fall into the category of the most reasonable broker due to its low spread and fee structure. Depending on the account type, the spreads can go as low as 0.3 pips. Therefore, a trader who looks forward to reducing the trading expense can join Purple Trading without thinking twice.

(Risk warning: 63% of CFD account lose money)

FAQ – The most asked questions about Purple Trading fees :

Is Purple Trading fees affordable on this trading platform?

Purple Trading is an affordable platform, as it does not charge any purple trading fee for commissions from traders. Besides, this trading platform’s spreads are the best in the market. Therefore, traders can enjoy Trading on Purple Trading while securing a greater part of their profits themselves. Besides, this trading platform has no deposit or withdrawal fees. So, Purple Trading is lucrative for traders.

Do Purple Trading fees include an inactivity fee?

Yes, Purple Trading fees charges an inactivity fee from traders, just like any other trading platform. So, if you stay dormant while trading on this platform, you will need to pay an inactivity fee. Thus, additional losses will accrue if you don’t use your Purple Trading live account. This inactivity fee amounts to $15.

Should I sign up with Purple Trading, keeping the Purple Trading fees in mind?

You can sign up with Purple Trading to trade your favorite underlying assets. The benefit of trading with this platform is that it offers competitive spreads to traders. In addition, they can enjoy Trading with the vast educational resources that it offers. Besides, Purple Trading considers every trader’s needs and offers them the best. So, you should sign up with Purple Trading to switch your trading platform. Also, they do not charge any purple trading fees from its clients.

See article about other online brokers:

Last Updated on January 27, 2023 by Arkady Müller