10 best MetaTrader 4 (MT4) brokers in comparison – Reviews:

Table of Contents

The ultimate trading experience of any broker would depend upon the kind of broker he chooses. So, if you wish to trade on MetaTrader 4, you would need a list of reliable MetaTrader 4 brokers.

The problem with MetaTrader 4’s understated elegance and simplicity is that it has become ubiquitous. It is the Microsoft Word of forex trading platforms. Even if MetaTrader 4 offers excellent services, you still have to depend on a broker to fulfill your trading needs.

As a result, it is a truly mammoth task to pin down who’s the best MT4 broker. However, we are more than a match for the challenge. Using the same criteria you would use, we have managed to find not one ‘best’ broker, but 10! In reality, any of these 10 forex brokers could have bagged the top spot. So, we have a list of MetaTrader 4 brokers that allow you a perfect trading experience.

See the list of the 10 best MetaTrader 4 brokers:

MetaTrader 4 Broker: | Review: | Regulation: | Spreads & Assets: | Advantages: | Free account: |

|---|---|---|---|---|---|

1. Vantage Markets  | Regulated by the CIMA & ASIC | From 0.0 pips spread + $ 2 commission per 1 lot trade 1,000 markets+ | # Regulated and safe # Real ECN trading # Fast order execution # No hidden fees # Free bonus available # Leverage up to 1:500 | Live account from $ 50 (Risk warning: Your capital can be at risk) | |

2. RoboForex | Regulated by the IFSC (Belize) | From 0.0 pips spread + $ 4 commission per 1 lot trade 16,000 market | # Leverage up to 1:2000 # Free demo account # Professional support # 16,000+ markets # Bonus program | Live account from $ 10 (Risk warning: Your capital can be at risk) | |

3. Moneta Markets | Regulated by the VFSC | From 0.0 pips spread + $ 3 commission per 1 lot trade 800 markets+ | # Great for beginners # User-friendly interface # Sufficient educational tools # No deposit fees # Low spreads and commissions | Live account from $ 50 (Risk warning: Your capital can be at risk) | |

4. OctaFX | Regulated by the FSC (Maurituis) & CySEC (EU) | From 0.0 pips spread + $ 3 commission per 1 lot trade 800 markets+ | # Spreads from 0.2 pips # Minimum deposit only $100 # Deposit bonus available # Leverage up to 1:500 # Free demo account | Live account from $ 100 (Risk warning: Your capital can be at risk) | |

5. FBS  | Regulated by the IFSC & CySEC | From 0.0 pips spread + $ 5 commission per 1 lot trade 250 markets+ | # Bonus program & events # Leverage up to 1:3000 # Live account from $1 # 250+ markets available # Low spreads | Live account from $ 1 (Risk warning: Your capital can be at risk) | |

6. Tickmill | Regulated by the FCA (UK), CySEC (EU), FSA (SE) | From 0.0 pips spread + $ 2 commission per 1 lot trade 1,000 markets+ | # High customer safety # Excellent execution speed # Good support # Low trading fees # High liquidity | Live account from $ 100 (Risk warning: 70% of retail CFD accounts lose) | |

7. XM  | Regulated by the IFSC, CySEC, ASIC | From 0.0 pips spread + $ 3.5 commission per 1 lot trade 1,000 markets+ | # 1000+ assets # No hidden fees # Professional support # 3 account types # Regulated and safe | Live account from $ 5 (Risk warning: 75.59% of retail CFD accounts lose) | |

8. BlackBull Markets  | Regulated by the FSPR, FSCL | From 0.0 pips spread + $ 4 commission per 1 lot trade 26.000 markets+ | # 24-hour support # No hidden fees # Free demo account # Leverage up to 1:500 # Excellent liquidity | Live account from $ 200 (Risk warning: Your capital can be at risk) | |

9. IC Markets | Regulated by the ASIC, FSA, CySEC | From 0.0 pips spread + $ 3 commission per 1 lot trade 1.200 markets+ | # Free demo account # Spreads from 0.0 pips # Low commission # Real raw-spread trading # Big liquidity providers | Live account from $ 200 (Risk warning: Your capital can be at risk) | |

10. Admiral Markets | Regulated by the ASIC, CySEC, EFSA, FCA | From 0.0 pips spread + $ 4 commission per 1 lot trade 3.000 markets+ | # Competitive spreads # Regulated broker # Wide range of markets # High security # User-friendly platforms | Live account from $ 1 (Risk warning: 76% of retail CFD accounts lose money) |

Who is the best broker for the MT4?- List:

There’s very little separating the brokers we are showcasing. However, while there may not be much between these ten, they are far and away the sector’s best. We would defy anyone to rank them in order and get any consensus. What we can definitively say is that there’s a gulf between the brokers we spotlight and the rest of the herd.

The brokers we have chosen are, in our opinion, the standouts leading from the front. Please read on to get our lowdown on the top dogs for MT4.

List of the best MT4 brokers:

- Vantage Markets – The best MetaTrader 4 broker with competitive conditions

- RoboForex – High leverage up to 1:2000

- Moneta Markets – Excellent execution speed broker

- OctaFX – Low-cost trading platform with high leverage

- FBS – The broker with a low minimum deposit

- Tickmill – Well-regulated in multiple jurisdictions

- XM – Very strong in the education and learning section

- BlackBull Markets – ECN trading at its best

- IC Markets – High and deep liquidity

- Admiral Markets – MetaTrader 4 addons supported

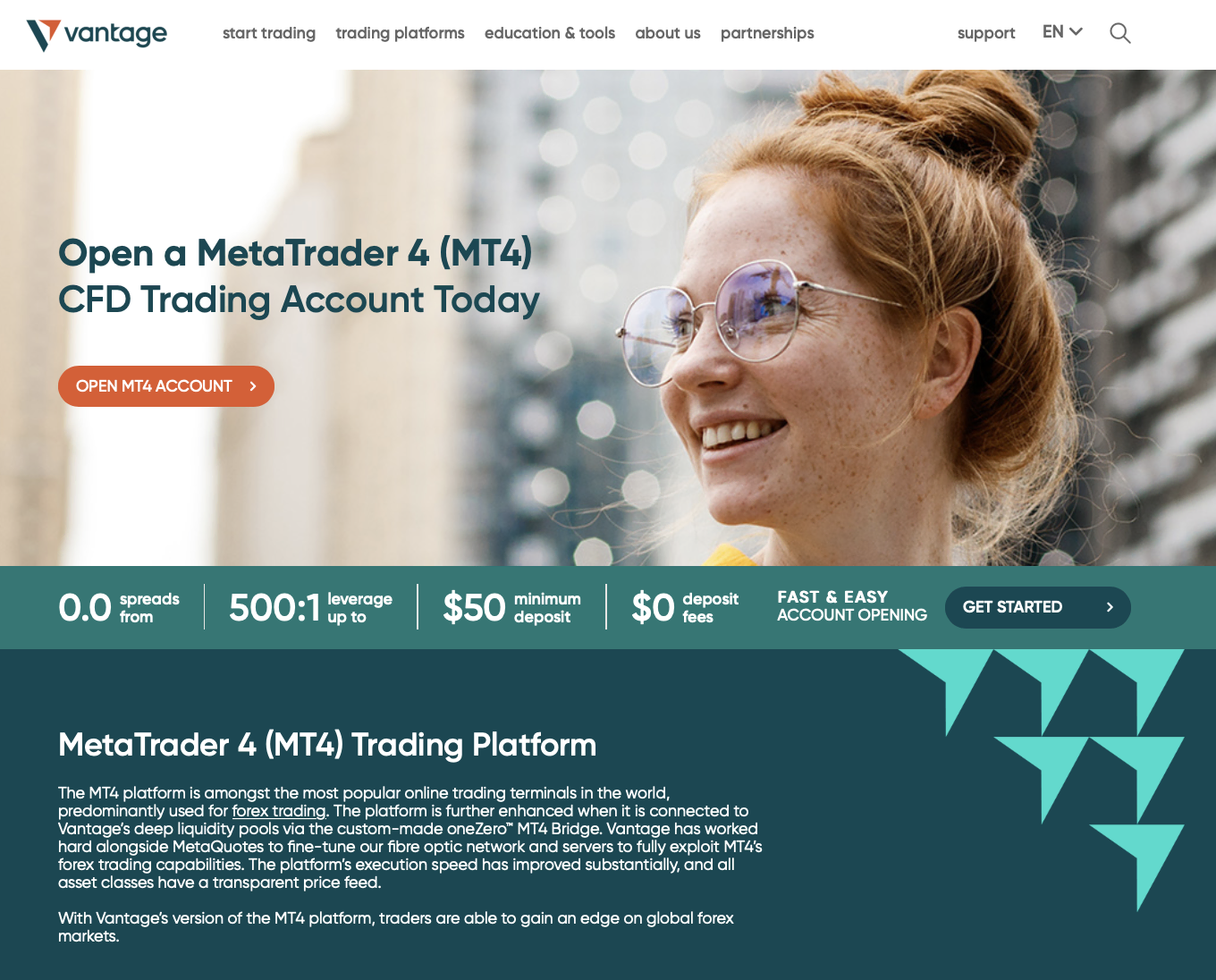

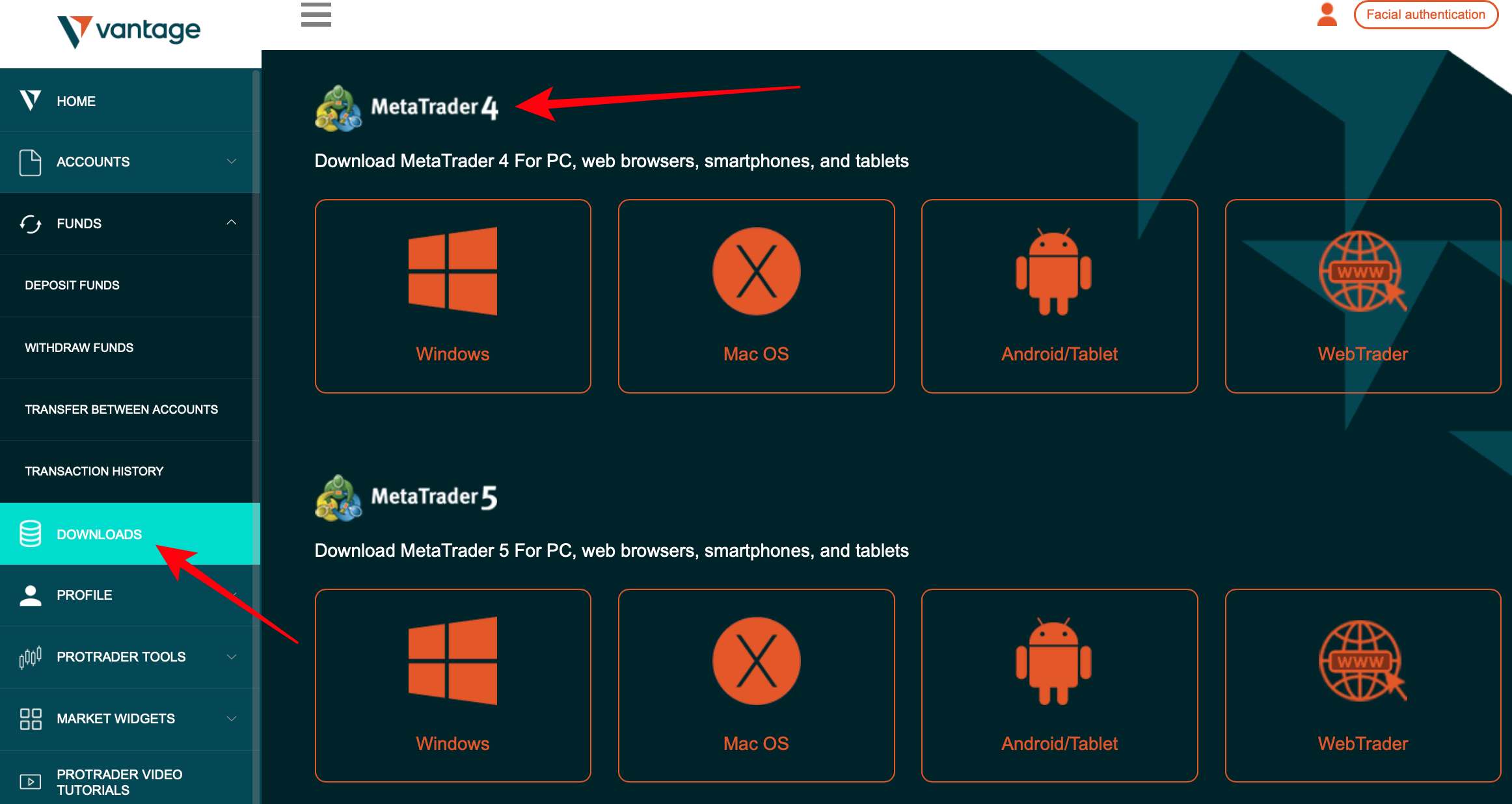

1. Vantage Markets – Spreads from 0.0 pips

On their website, Vantage Markets reveals that their version of MT4 has been fine-tuned in conjunction with the developers. This tweaking enables MT4 users to squeeze the maximum benefit out of Vantage Markets’s fiber-optic network. Vantage is our winner in this comparison because it offers the most competitive fee structure for trading.

At the very least, it’s a good marketing line. However, Vantage Markets does go on record to say their network gives extra stability when running forex robots.

There are MT4 accounts to select from Standard, Raw, and Pro.

Standard is custom-built for novices, allowing trading on 44 currency pairs and STP order execution. The minimum deposit on Vantage Markets is $50, and there’s no commission payable.

Raw is ECN-based and requires a $500 deposit, while the Pro requires a minimum $20,000 deposit. Both have spread from 0.0 pips.

(Risk warning: Your capital can be at risk)

Benefits of Vantage Markets:

- Optimized for MT4

- Leverage of up to 1:500

- Spreads from 0.0 pips

- $50 minimum deposit

- Zero deposit fees

- Social trading

- Long track record

- Multi-award-winning regulated broker

This broker offers inexplicably well services to traders. Vantage Markets is the best broker to fulfill your trading requirements. Traders have a great deal of fun when they choose Vantage Markets among all MetaTrader 4 brokers.

Good to know!

The services of Vantage Markets are excellent. The trading platform has all the top features that any trader would love.

Some Vantage Markets features will help you understand why it is the best of all MetaTrader 4 brokers:

(Risk warning: Your capital can be at risk)

Vantage Markets features

The features offered by any trading platform make trading on it the best.

- Traders trust Vantage Markets to fulfill their trading needs because of its reliability. This trading platform’s operations are under the supervision of ASIC and FCA.

- Vantage Markets has low fees. Thus, even beginners can join Vantage Markets without worrying about giving away a greater part of their profits to the brokers.

- This trading platform offers all the leading software to traders. Be it MT4 or MT5. You can access both software on Vantage Markets. It is what makes Vantage Markets the best of all MetaTrader 4 brokers.

- This broker offers a lot of symbols to traders. Besides, the availability of the tools and technical indicators is also in plenty.

- Traders can access all the greatest underlying assets on these trading platforms, such as forex, cryptocurrency, etc.

Vantage Markets offers exceptional features to traders looking forward to enhancing their trading experience on MT4.

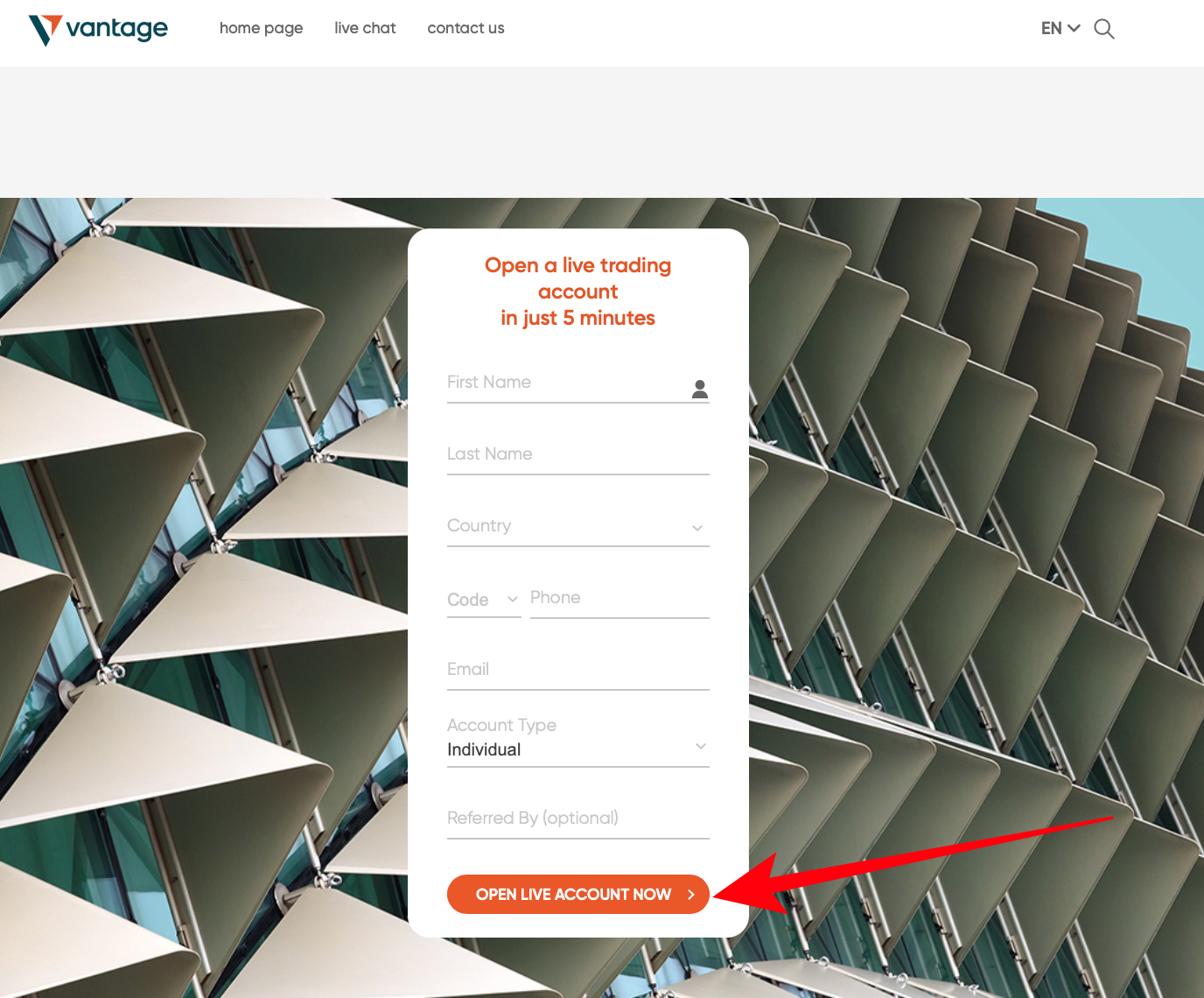

To choose Vantage Markets as their preferred broker out of all MetaTrader 4 brokers, a trader can follow the below steps.

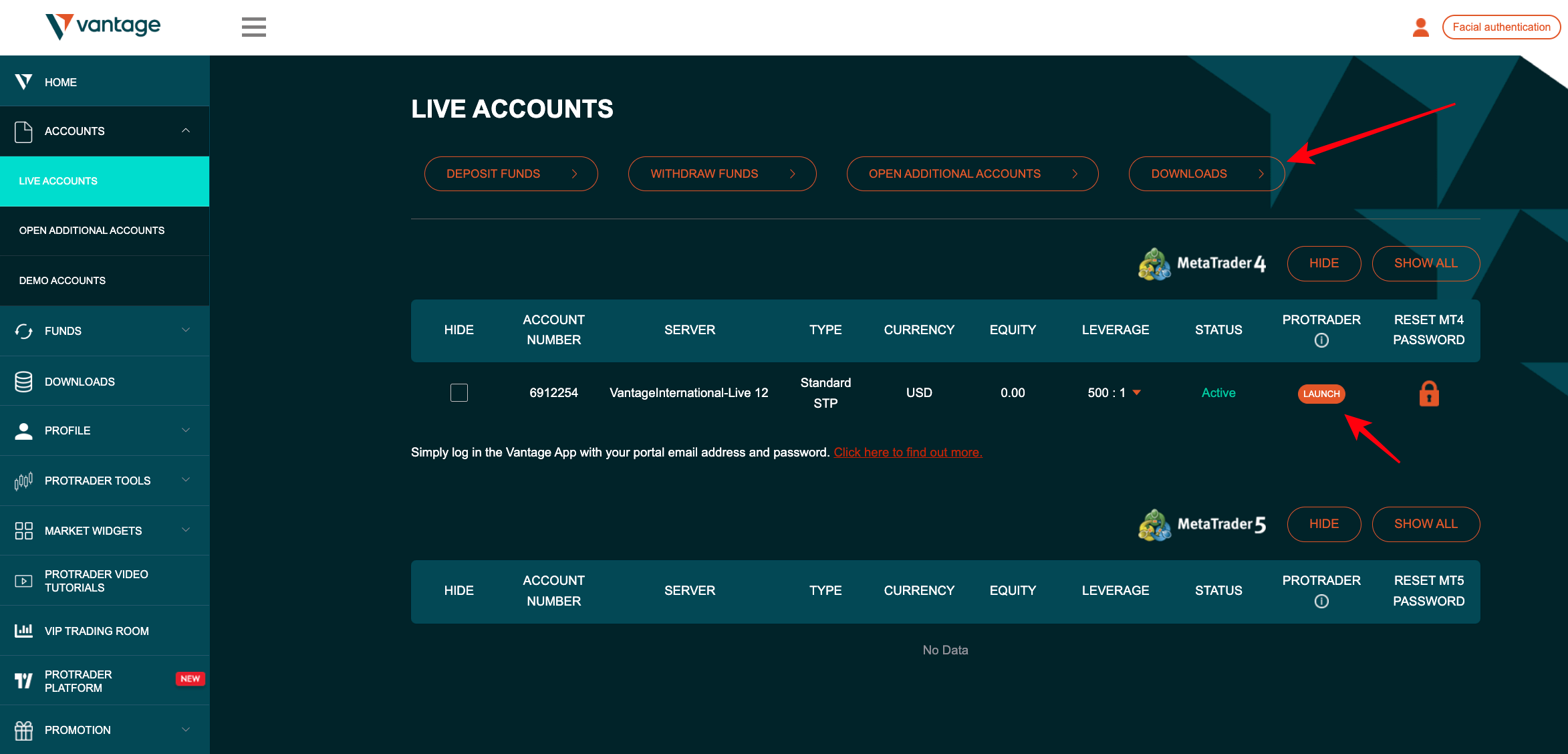

How to use MetaTrader 4 on Vantage Markets?

Traders can use the MetaTrader 4 trading platform on Vantage Markets by visiting the platform.

- Go to the Vantage Markets trading website or download the application.

- Then, the broker would offer you an option of ‘signup.’

- After clicking on this option, Vantage Markets will ask you for some details. Traders can fill them in.

- Now, Vantage Markets will ask you to choose an account type or trading platform.

- After choosing the MetaTrader 4 trading platform on Vantage Markets, you can fund your trading account.

Vantage Market’s minimum deposit

After your MetaTrader 4 trading account is ready, you will need to fund your Vantage Markets account with the minimum deposit amount. A good thing about Vantage Markets is that it does not have a high minimum deposit. It is one of the best MetaTrader 4 brokers with a low deposit.

Good to know!

To begin using MetaTrader 4 trading platform on Vantage Markets, you would need 50 USD in your trading account. It is the minimum deposit amount for any trader. However, you can even fund your Vantage Markets account with an amount higher than this. Besides, this MetaTrader 4 deposit amount is comparatively very lower for traders.

Thus, Vantage Markets successfully enters the list of the best MetaTrader 4 brokers. All features of Vantage Markets help traders in having the best experience.

(Risk warning: Your capital can be at risk)

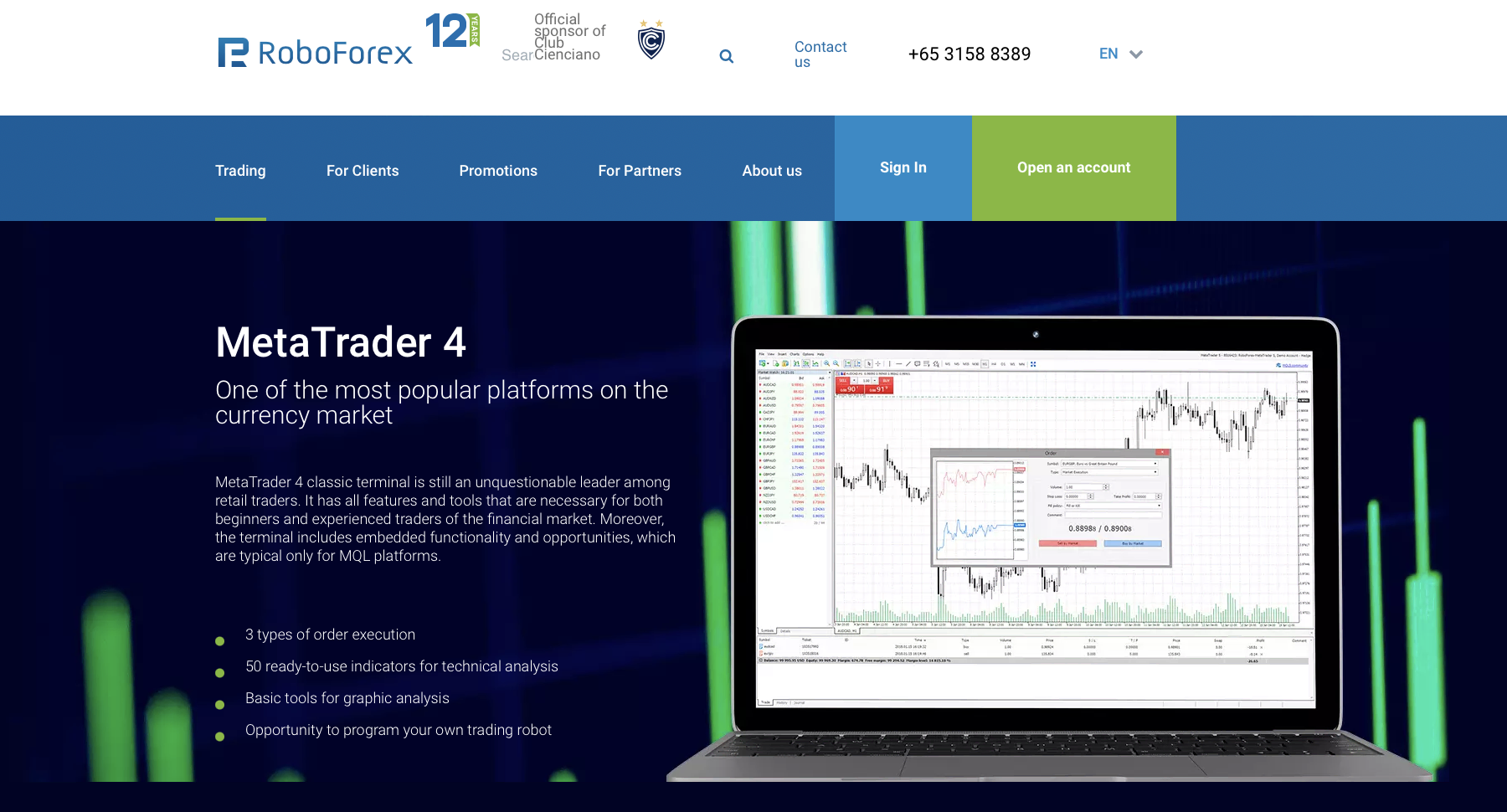

2. RoboForex – High leverage up to 1:2000

RoboForex is the next name on the best MetaTrader 4 brokers list. The credit owes to the great services that RoboForex offers traders. This trading platform excels in offering the best tools for forex trading. So, undoubtedly, RoboForex is any trader’s favorite.

Good to know!

Besides offering you everything you need to trade online, RoboForex offers you the best trading software. This software includes MT4 and MT5. The MetaTrader 4 trading platform this broker offers is easily accessible to all traders. Besides, they can also enjoy the brilliant services of this forex broker.

RoboForex features

RoboForex has some classic features that make it an ideal trading platform for traders. For instance,

- RoboForex allows traders to execute trades fast. Timing is very crucial in forex trading. Thus, traders can avail themselves of the best trading experience by tapping the opportunities on time.

- The deposits and withdrawals on RoboForex are quick. So, it makes it the best of all MetaTrader 4 brokers.

- RoboForex seeks to fulfill the trading requirements of traders by allowing them to access hundreds of underlying assets.

- While using the MetaTrader 4 on RoboForex, traders can customize their trading experience.

- In addition, the efficient customer service of this trading platform contributes to making it an even better trading platform.

- RoboForex also rolls out several programs allowing traders to educate themselves on the basics.

(Risk warning: Your capital can be at risk)

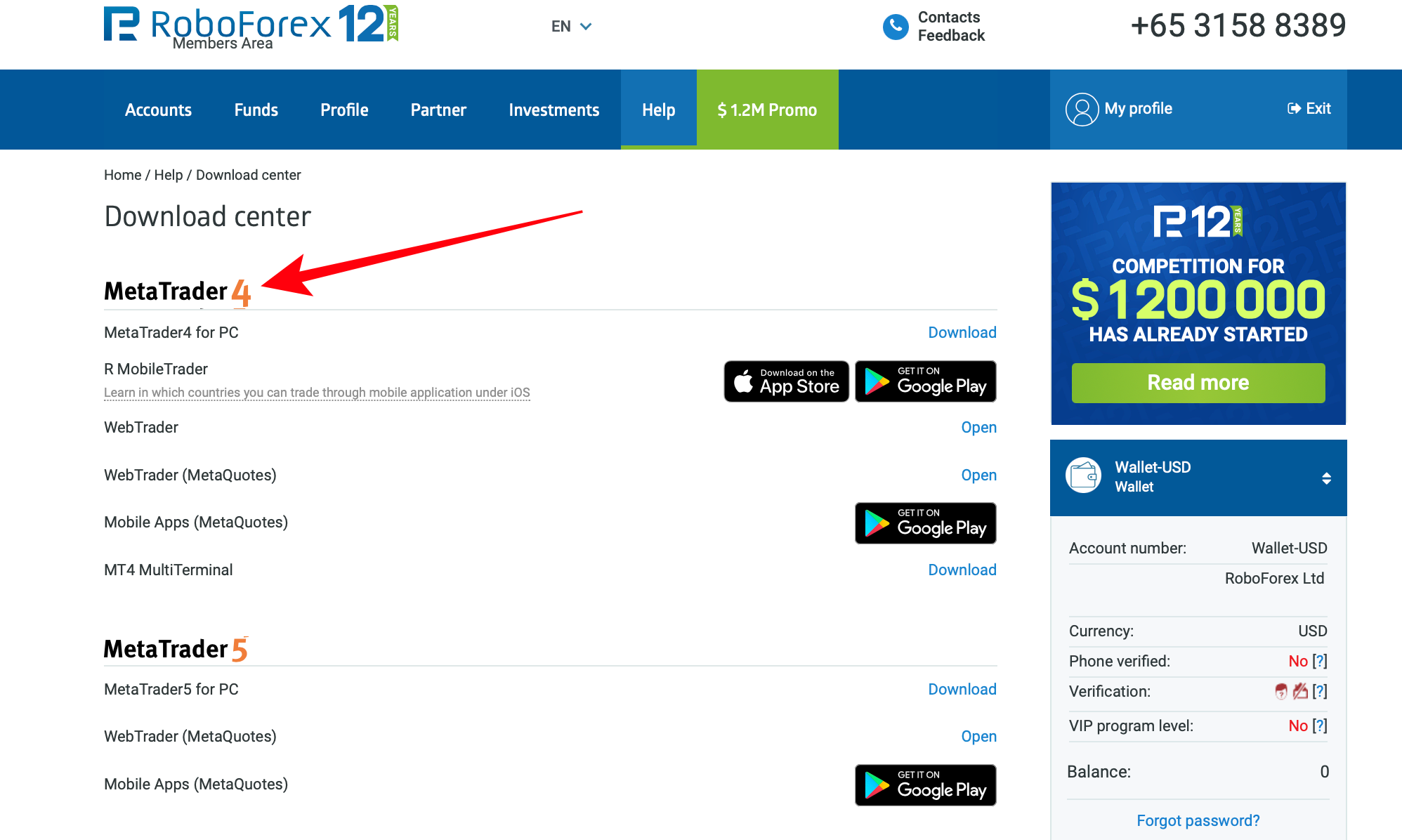

How to use MetaTrader 4 on RoboForex?

As one of the best MetaTrader 4 brokers, RoboForex allows traders to use this trading software. Of course, a trader would first need to sign up with RoboForex. The subsequent steps help traders use the MetaTrader 4 trading platform on RoboForex.

- Choose the ‘signup’ option on RoboForex.

- Enter your details and then choose the type of trading account you wish to use on RoboForex.

- Finally, fund your trading account and initiate trading.

Once a trader’s RoboForex MetaTrader 4 trading account is ready, he can explore it well and choose the underlying assets. He can even customize the trading tools available on the MT4 trading platform. Besides, traders can enjoy the best strategy-building process on this trading platform.

RoboForex is a great trading platform because it offers traders the necessary help while trading. So, any trader desirous of using MetaTrader 4 can choose RoboForex.

RoboForex minimum deposit

The minimum deposit amount for a RoboForex trading account can vary according to the trading account type. RoboForex offers traders different account types, and they can choose one depending on their trading experience.

However, considering MT4, traders need at least 5 USD to initiate trading. Thus, as the best of MetaTrader 4 brokers, the RoboForex minimum deposit is $5.

Good to know!

However, if a trader uses some other currency, he would need to fund the trading account with an amount equivalent to 100 USD in that currency. If you choose the most basic RoboForex account type, you will need only $5 in your trading account to begin trading.

You are spoiled for choice here with four different forex account types that run MT4.

Aimed at advanced traders, the Prime account offers trading on 28 currency pairs, with spreads from 0.0 pips and leverage of 1:300.

The ECN account is designed for pro traders looking for 0.0 pips and leverage of up to 1:500. Neither the ECN nor Prime accounts have deposit bonuses but are eligible for loyalty bonuses.

The other two account types are Pro-Cent and Pro-Standard, both of which are suitable for forex beginners and offer floating spreads from 1.3 pips on 36 currency pairs. They are both eligible for deposit and loyalty bonuses. But the big attraction is the very high 1:2000 leverage.

Benefits of RoboForex:

- MT4 accounts

- One-click trading

- Leverage of up to 1:2000

- Integration with MetaTrader Market

- Balance protection

- Zero commission on deposits and withdrawals on RoboForex

- Multiple payment methods

- RoboForex bonus and cashback schemes

(Risk warning: Your capital can be at risk)

3. Moneta Markets – Excellent execution speed broker

Moneta Markets is another classic name in the best MetaTrader 4 brokers list. This trading platform has the best user interface. Besides, it is a well-regulated and licensed broker. Moneta Markets offers traders MetaTrader 4 and MetaTrader 5 trading platforms. It offers great investment tools and adept research resources.

Good to know!

Moneta Markets is a top choice for many traders as it is the subsidiary of Vantage Group. It is a well-known name in the field of trading. Thus, undoubtedly, Moneta Markets seeks to offer traders the best.

(Risk warning: Your capital can be at risk)

Moneta Markets features

Some features of Moneta Markets that make it the best trading platform are as under:

- This trading platform offers traders the best trading tools.

- Moneta Markets support great educational and research materials.

- This trading platform has a seamless mobile application that traders can use to trade on the go.

- Moneta Markets allows traders to trade by funding their trading accounts with a minimal amount. Besides, this trading platform is great from the perspective of fees and commissions.

- Traders can enjoy trading on Moneta Market’s low-risk trading platform.

- It comes with a couple of trading software that traders can use.

- Moneta Markets work under the supervision of several regulating agencies.

- You can access all the leading cryptocurrencies, forex pairs, stocks, etc., on this trading platform.

- The MetaTrader 4 trading platform is easily accessible on Moneta Markets. That is why Moneta Markets is a great option for traders looking for the best MetaTrader 4 brokers.

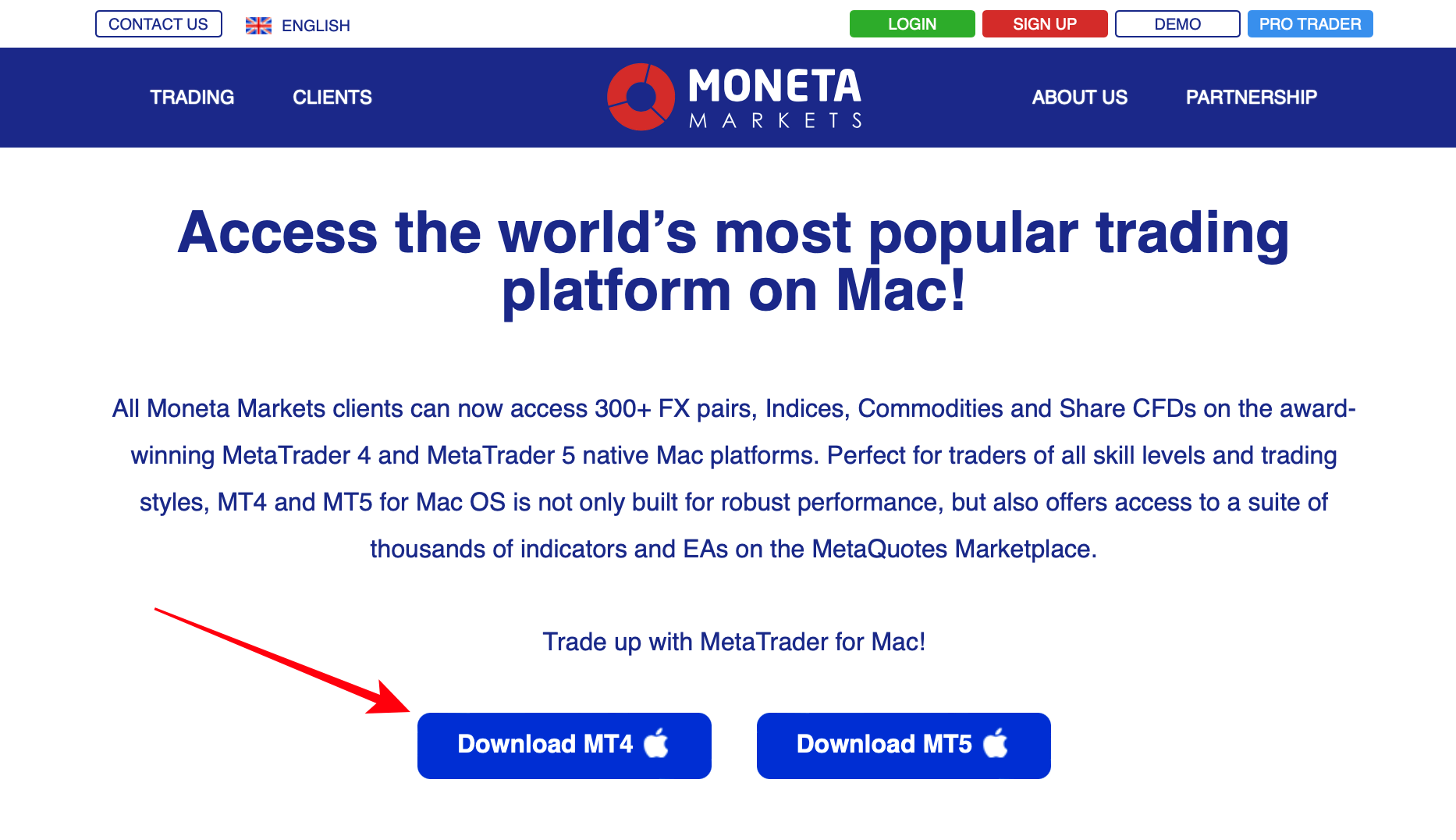

How to use MetaTrader 4 on Moneta Markets?

Once you have decided to use MetaTrader 4 on Moneta Markets, you can do so by following a procedure. For instance, traders looking forward to using MetaTrader 4 on Moneta Markets can visit the platform’s website. They can even download the mobile application of Moneta Markets.

Then,

- Traders can choose the ‘sign up for a trading account.’ option.

- Enter the details.

- Choose the MetaTrader 4 trading platform.

- Fund your trading account

- Begin trading.

These simple steps to use MetaTrader 4 on Moneta Markets help any trader trade his favorite underlying assets. Moneta Markets leads in offering traders the best trading services. Besides, using MetaTrader 4 on his trading platform enhances the trader’s trading experience.

Good to know!

There are several benefits of trading with Moneta Markets. First, Moneta Markets offers traders a highly safe environment for trading. Thus, traders can be sure about the safety of their investments.

Moneta Market’s minimum deposit

A trader must fund his trading account with the Moneta Markets minimum deposit to initiate trading on Moneta Markets. Usually, the minimum deposit amount on this trading platform will depend on the kind of trading account you choose.

However, the most common minimum deposit amount for using the MetaTrader 4 trading platform on Moneta Markets is 50 USD.

Good to know!

The amount can seem a little higher than what other brokers offer. However, the services that Moneta Markets offer pacify for its minimum deposit amount. Its trustworthiness among traders makes it the best of all MetaTrader 4 brokers.

(Risk warning: Your capital can be at risk)

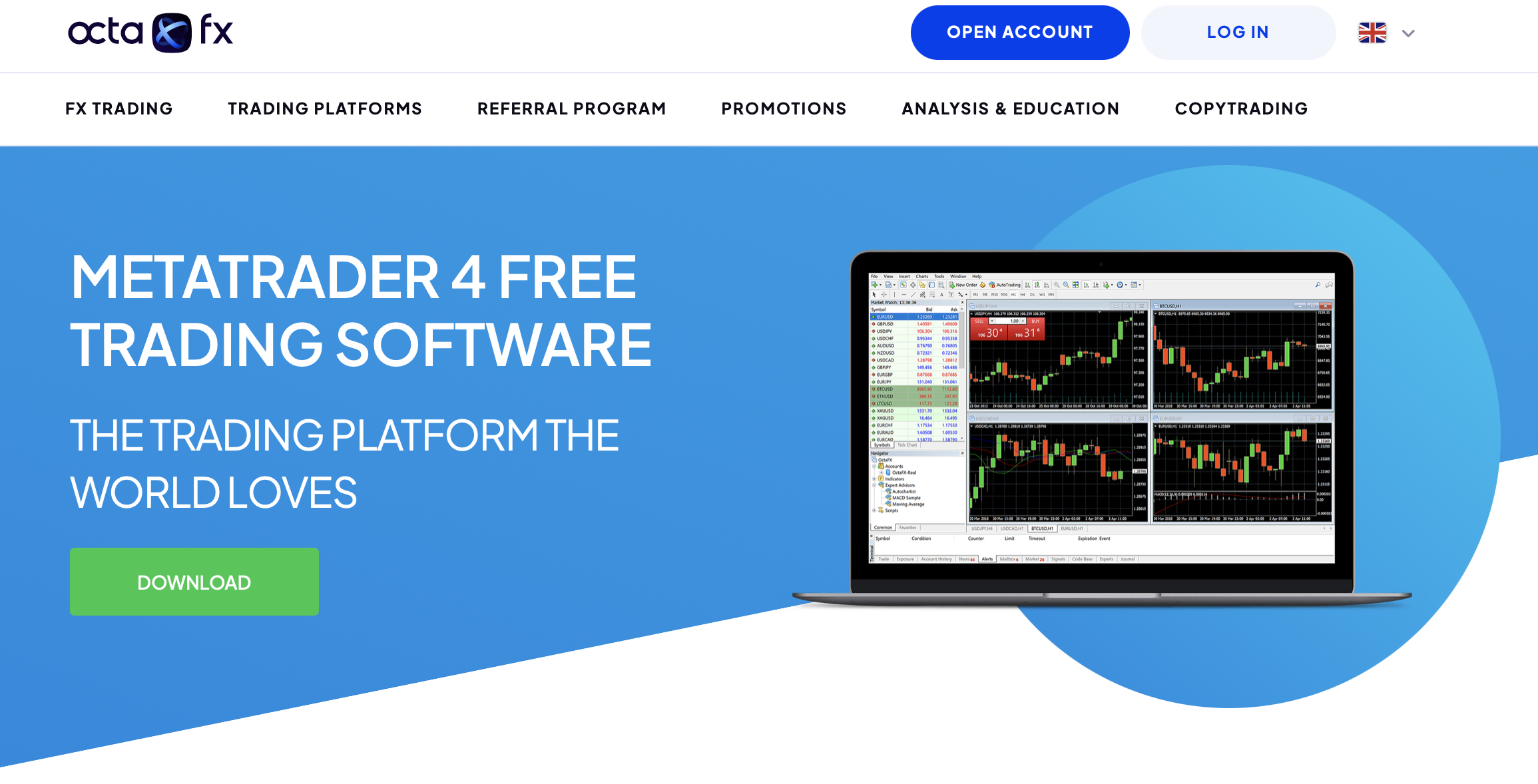

4. Octa FX – Low-cost trading platform and high leverage

Most traders look for a low-cost trading platform when trading. If you need a MetaTrader 4 broker for the same, MetaTrader 4 trading platform on OctaFX is highly affordable. Traders can sign up with OctaFX if they wish to trade by paying comparatively low OctaFx fees and commissions.

Good to know!

OctaFX is a great trading platform for all kinds of instruments. It is a feature-rich trading platform that serves any trader’s needs in the best possible way. There are several pros that a trader enjoys when he signs up with OctaFX.

OctaFX features

Let’s look at some OctaFX features that will establish why it is possibly one of the best MetaTrader 4 brokers:

- OctaFX is a regulated broker that extends its trading services to many countries worldwide.

- This broker offers all the leading software to traders. This software helps in enhancing your trading experience. The MetaTrader suits are easily available for traders to trade on OctaFX.

- OctaFX comes with regular updates that traders can enjoy to build trading expertise.

- Apart from this, OctaFX also offers copy trading and social trading features.

- The deposits and withdrawals on OctaFX are seamless and quick.

- Traders can access numerous assets to trade on OctaFX.

- Order execution on this trading platform is quick.

So, OctaFX is the greatest of all MetaTrader 4 brokers. It offers a complete trading package to traders. Besides, all this is available to traders at nominal fees and commissions. All withdrawals and deposits that traders make into the MetaTrader 4 trading account on OctaFX are free.

(Risk warning: Your capital can be at risk)

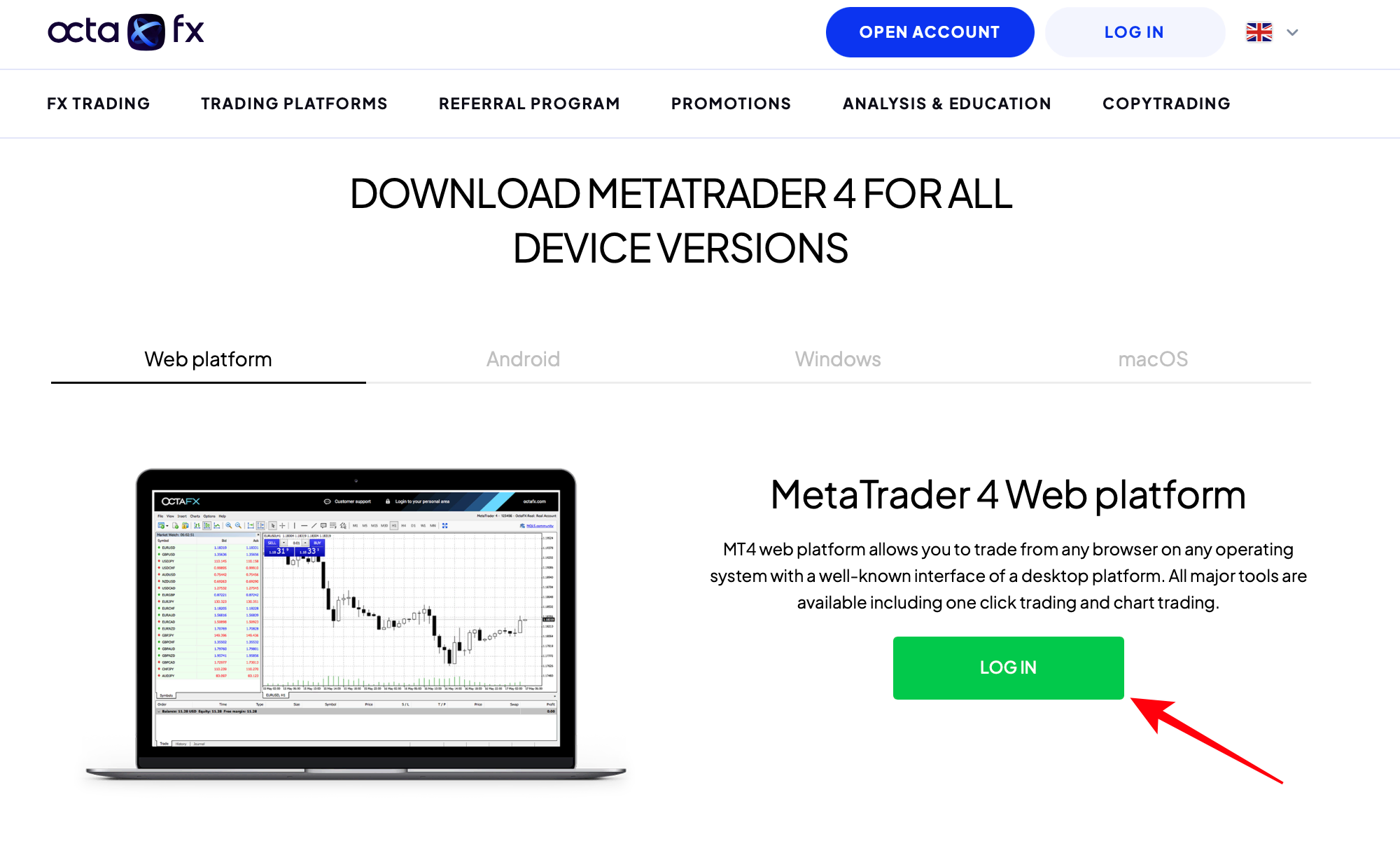

How to use MetaTrader 4 on OctaFX?

As with other platforms, a trader would need to sign up for a trading account on OctaFX to access the MetaTrader 4 trading suite with the broker’s help. The signup process of OctaFX is straightforward, just like other trading platforms.

- A trader must open the OctaFX trading app or visit the web version.

- Then, traders can see the ‘signup’ option.

- Finally, they can click on this option and enter the details that OctaFX wants to verify their identity.

- Once OctaFX verifies a trader’s identity and you choose the MetaTrader 4 trading platform, you can initiate trading by logging in.

- Now, you need to fund your MetaTrader 4 trading account with the minimum deposit that OctaFX stipulates.

MetaTrader 4 trading with OctaFX allows traders to access hundreds of underlying assets. Besides, traders can use OctaFX to trade on the platform with several customized features.

OctaFX minimum deposit amount

Although OctaFX stipulates a minimum deposit amount of $25, you must fund your MetaTrader 4 trading account with at least 100 USD. So, a trader looking forward to trading with OctaFX should be able to fund with the said amount.

Good to know!

In addition, the MetaTrader 4 trading costs are comparatively lower than other traders. The services of OctaFX are undisputable. A trader must not pay many fees and commissions to use OctaFX. Besides, traders can enjoy good customer support on this trading platform.

(Risk warning: Your capital can be at risk)

5. FBS – The broker with a low minimum deposit

The best MetaTrader 4 brokers also include FBS. FBS is known among traders for its great services and low-cost trading. This trading platform is also a leading name among the MetaTrader 4 brokers.

Good to know!

FBS excels in making available all the innovative trading facilities for a trader. Besides, this trading platform is the best choice for traders who need a perfect trading platform to conduct a perfect technical analysis.

Because of its amazing services and availability of several trading software, FBS is present in several countries. It is a go-to destination for brokers who wish to use the MetaTrader 4 trading platform.

FBS features

Some features that make FBS an exceptionally well online trading platform are as under.

- FBS allows traders to start trading with a low minimum deposit amount.

- The facilities that FBS offers to traders as a broker are unmatched. It gives several educational resources to traders at their disposal. Traders can use this educational material and enjoy an upper hand in trading.

- The broker also offers the best leverage to traders.

- Besides, traders trading on the MetaTrader 4 trading platform on FBS can expect their trades to execute instantly.

- FBS’s customer support is available in multiple languages. So, trader trading with FBS in any corner of the world can enjoy trading without language being a barrier on this trading platform.

- The mobile trading application that FBS offers traders is free to use.

- Commissions that FBS charges from traders are also low.

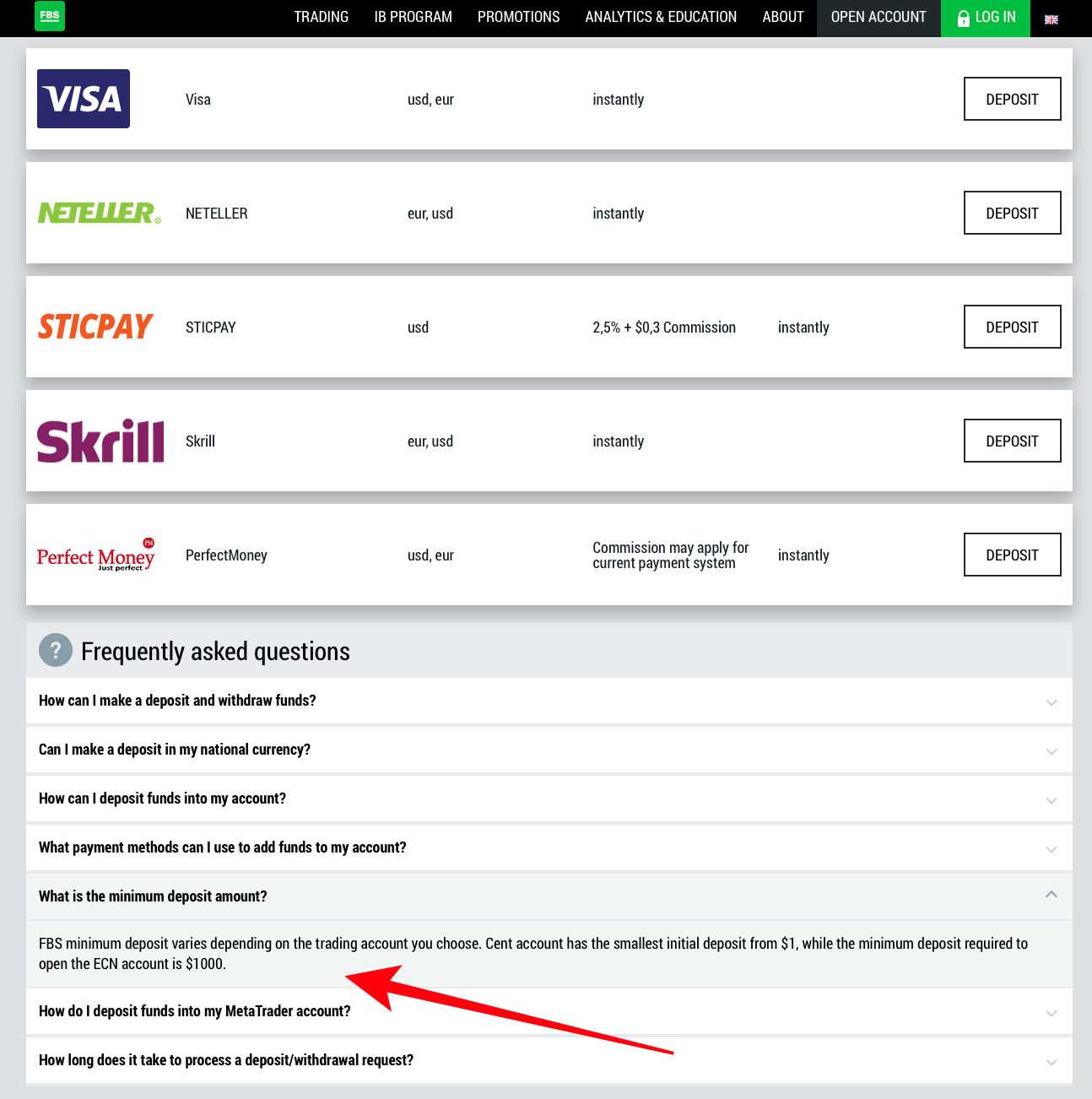

- FBS supports all payment methods. Besides, the withdrawals and deposits that traders make on FBS are instant.

(Risk warning: Your capital can be at risk)

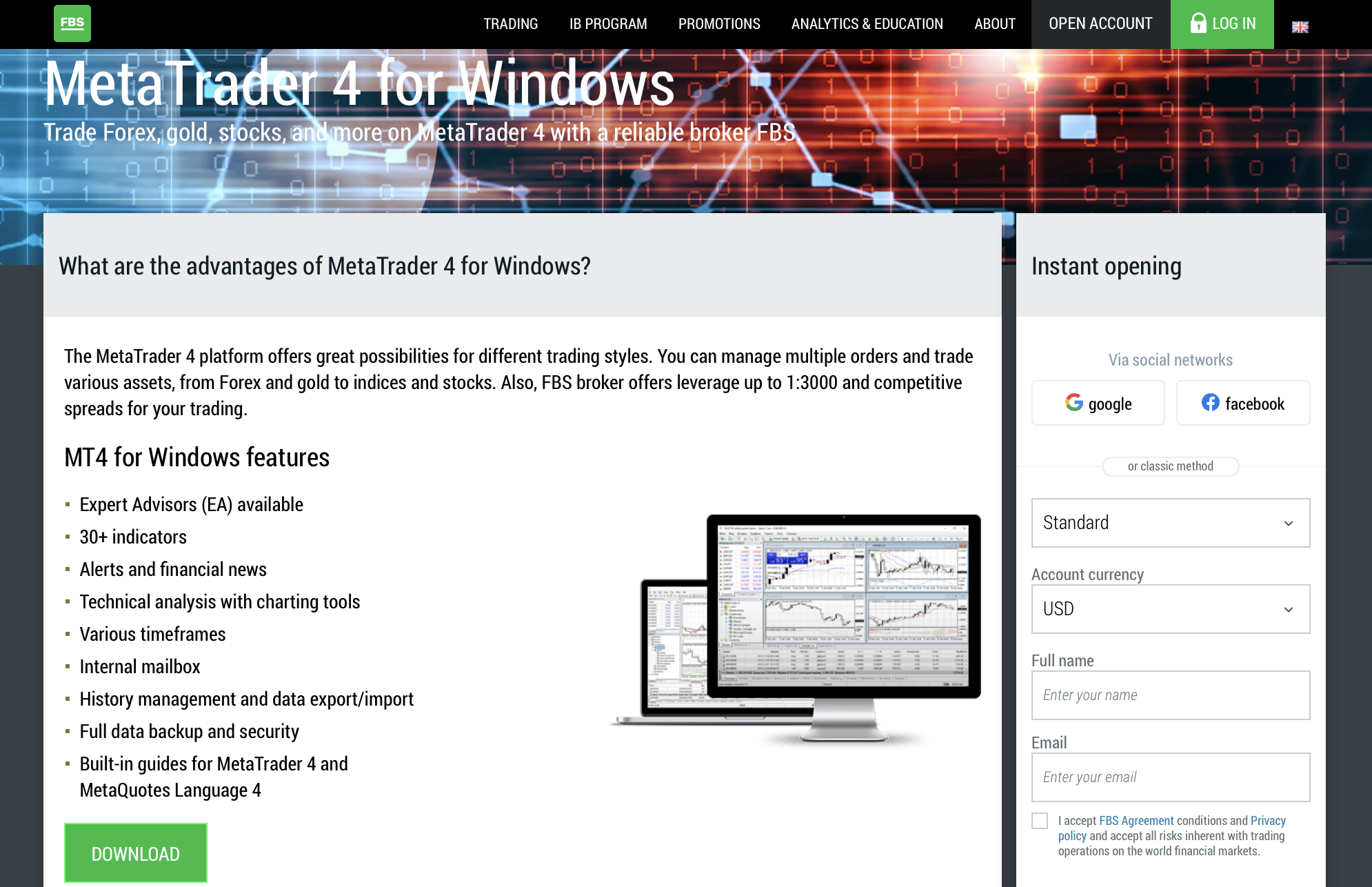

How to use Metatrader 4 on FBS?

Using the MetaTrader 4 trading platform on FBS is like any other trading platform. The steps involved in using MT4 on FBS are the same. A trader must choose the MT4 trading platform while signing up on FBS.

Funding the trading account on FBS is simple. Out of all the widely available payment methods on MT4, traders can choose their desired method and initiate trading.

Good to know!

MetaTrader 4 trading on FBS is highly recommended. The broker offers a lot of support to traders looking forward to using the platform. Thus, if you wish to use MT4 on FBS and encounter any problem, their customer support can sort it out for you.

FBS minimum deposit amount

While picking FBS out of many of the best MetaTrader 4 brokers, a trader needs to keep the minimum deposit amount in mind. There is a minimum deposit requirement on FBS of 100 USD. So, a trader would need to open his FBS trading account by funding it with 100 USD.

Good to know!

Of course, if you wish first to test the platform, you can skip funding your live trading account. Traders can use the FBS demo account to check the services they can enjoy on the FBS MetaTrader 4 trading platform. With virtual funds, you can even place a few trades.

Now that choosing the best MetaTrader 4 brokers is clear, let’s explore how to connect one with MT4.

(Risk warning: Your capital can be at risk)

6. Tickmill – Well-regulated in multiple jurisdictions

So enamored with MetaTrader 4 are Tickmill, it is their only option apart from WebTrader.

Combined with their fast order execution technology and spreads from 0.0 pips, Tickmill is convinced they are onto a winner with their branded MT4 offering.

If you are new to Tickmill, you can apply for a $30 welcome account, so you don’t even need to put up any money, and you get to withdraw the profits. Sweet.

Otherwise, there are three regular accounts – Pro, Classic, and VIP, which offer leverage of up to 1:500. Choosing between them may be easier than you think, as the VIP account expects a minimum balance of $50,000 while the other two have zero minimum balance requirements.

Benefits of Tickmill:

- MT4 friendly

- Regulated in multiple jurisdictions

- One-click trading

- Excellent educational resources

- Ongoing promotions

- Negative balance protection

- Multilingual customer support

- Leverage of up to 1:500

(Risk warning: 70% of retail CFD accounts lose)

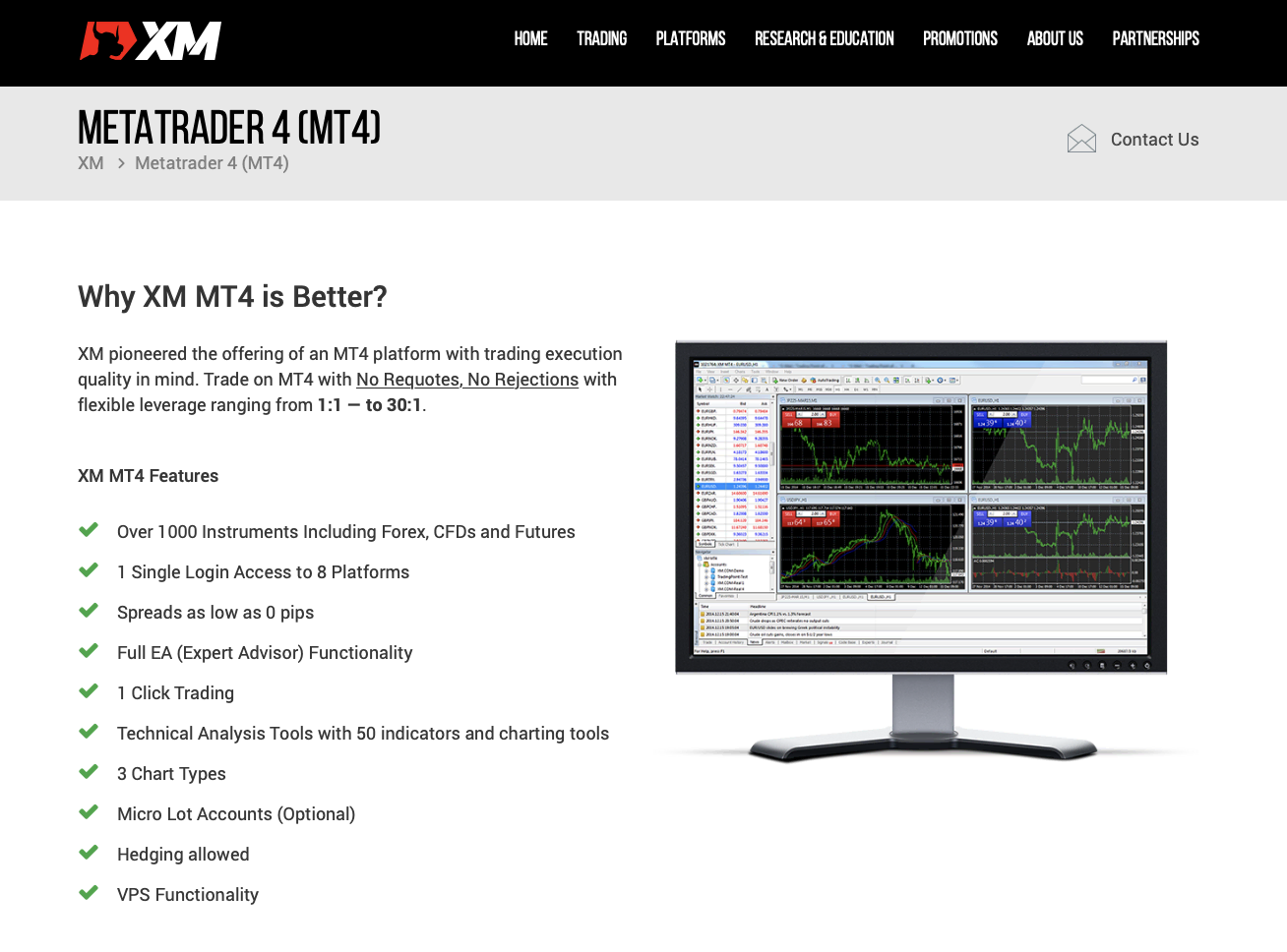

7. XM – Very strong in the education and learning section

Whether you are an old hand with MT4 or just starting, XM.com makes for a good, dependable, MetaTrader-friendly forex broker.

XM has all the bases covered with MT4. You can download it for:

- PCs and Macs

- Multi-terminal

- WebTrader

- Android and iOS smartphones and tablets.

No matter your preferences, you will have a device that can access MT4 and the forex markets.

What we particularly love about the XM forex broker are their education and training resources, from how to install MT4 and all about forex trading. Many brokers offer learning materials, but what XM has put together is quite exceptional.

Their forex account types are well-thought-out, too, with zero commission and a $5 minimum deposit on all but one.

Benefits of XM:

- Lots of MT4 options

- Leverage of up to 1:888

- Trade over 55 currency pairs

- Spreads from 0.6 pips

- Exceptional forex training resources

- Video tutorial guides to MT4

- Welcome and trading bonuses

- Regular promotions

(Risk warning: 75.59% of retail CFD accounts lose)

8. BlackBull Markets – ECN trading at its best

The guys from Auckland, New Zealand are significant players in the forex market. Like so much about New Zealand, they, too, punch above their weight.

If you want a forex broker that’s geared up for MT4 and is secure, reliable, and offers good trading conditions, then BlackBull Markets will always be in the top ten. They made it here on merit, for sure.

For retail clients, there are two accounts, ECN Standard and ECN Prime. Beginners would be well advised to select the ECN Standard account. It needs only a $200 minimum deposit and charges zero commission. Spreads start from 0.8 pips.

The more experienced forex trader with a larger pot will probably prefer the ECN Prime account to get spreads from 0.1 pips.

Benefits of BlackBull Markets:

- MT accounts

- Leverage of up to 1:500

- Social trading

- Award-winning customer service

- Global footprint

- Registered in New Zealand, the UK, and Seychelles

- Islamic and institutional accounts

- Rebate scheme for active traders

(Risk warning: Your capital can be at risk)

9. IC Markets – High and deep liquidity

Another unabashed MT4 broker that’s well above average is IC Markets. It has rolled out MT4 in all its various guises to ensure traders can use the platform across all their digital devices.

Most of the others do too, but IC Markets is a top tenner on account of its joined-up thinking about forex trading and MT4 integration.

To keep things straightforward, there are just two MT4 forex account types; Standard and Raw Spread. Standard comes with zero commission and spreads from 1.0, while Raw Spread nets you spread from 0.0 pips and $3.50 per lot per side commission.

Both can be opened with a $200 minimum deposit on IC Markets, and traders can access leverage of up to 1:500.

Benefits of IC Markets:

- 360 MT4 coverage

- Leverage of up to 1:500

- Lightning-fast order execution

- Trade over 65 currency pairs

- Spreads from 0.0 pips

- Deep liquidity

- 24/7 customer support

- Data centers in London and New York

(Risk warning: Your capital can be at risk)

10. Admiral Markets – Supports MetaTrader 4 addons

If it weren’t for its military rank, Admiral Markets would be considered the forex market’s elder statesman. With 19 years of experience underneath its belt, Admiral Markets was an early adopter of MT4.

Not only do they have the standard MT4 variants available, but they are also offering up the MT4 Supreme Edition. This update is exclusive to Admiral Markets’ customers and available for both live and demo accounts.

It is essentially MT4 on steroids with a bunch of brand-new and upgraded features to whet your forex trading appetite.

They offer two MT4 accounts, Trade.MT4 and Zero.MT4. Both can be opened with just $100 in ten base currencies.

Benefits of Admiral Markets:

- MT4 plus their exclusive Supreme Edition

- Award-winning regulated broker

- Trade over 40 currency pairs

- Forex training videos

- Extensive learning resources

- Leverage of up to 1:30

- Well-regulated in multiple jurisdictions

- Negative balance protection

(Risk warning: 76% of retail CFD accounts lose money)

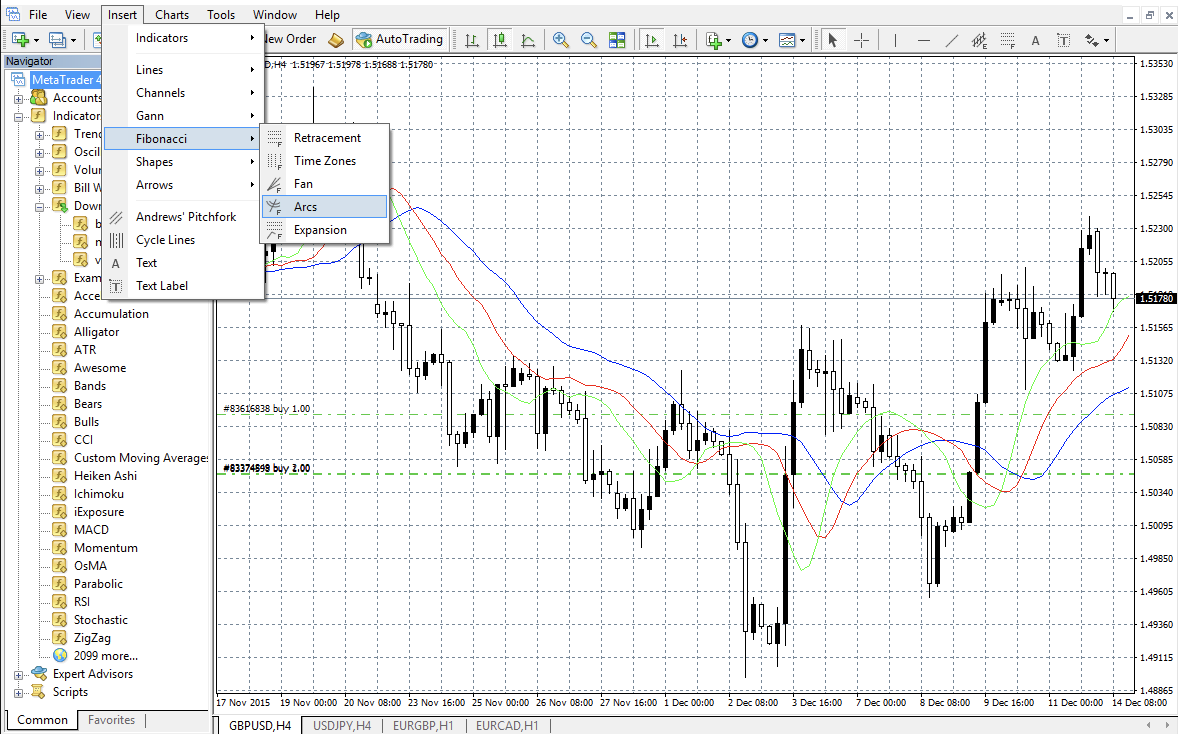

How to connect a broker with MetaTrader 4?

To enjoy trading on MetaTrader 4, a trader must connect his broker with the platform. A trader should choose a broker that already offers this trading software to avoid the hassle. MetaTrader 4 simplifies trading and also contributes to making your trading experience better.

However, it is possible only by connecting your broker with MetaTrader 4. But the task is not difficult.

To do so, a trader can follow these steps:

- Firstly, a trader would need to download the MetaTrader 4 trading software on a device. The trading software works well on any device. You can get MetaTrader 4 on your mobile or computer. However, ensure your device fulfills the specifications to make it run efficiently.

- After downloading MetaTrader 4, you must sign up with a broker that offers this trading software. Or, you can log in if you have already signed up on the trading platform.

- Now, all the trader requires is to enter his login credentials and log into his trading account on MetaTrader 4. You don’t need to do anything out of the blue to use MT4. As soon as you log in, you can use the trading platform without trouble.

- Now, traders only need to fund their trading account with the amount the broker stipulates. As mentioned, the best Metatrader 4 brokers have different minimum deposit amounts. So, you must adhere to their trading requirements to continue using the MetaTrader 4 trading platform.

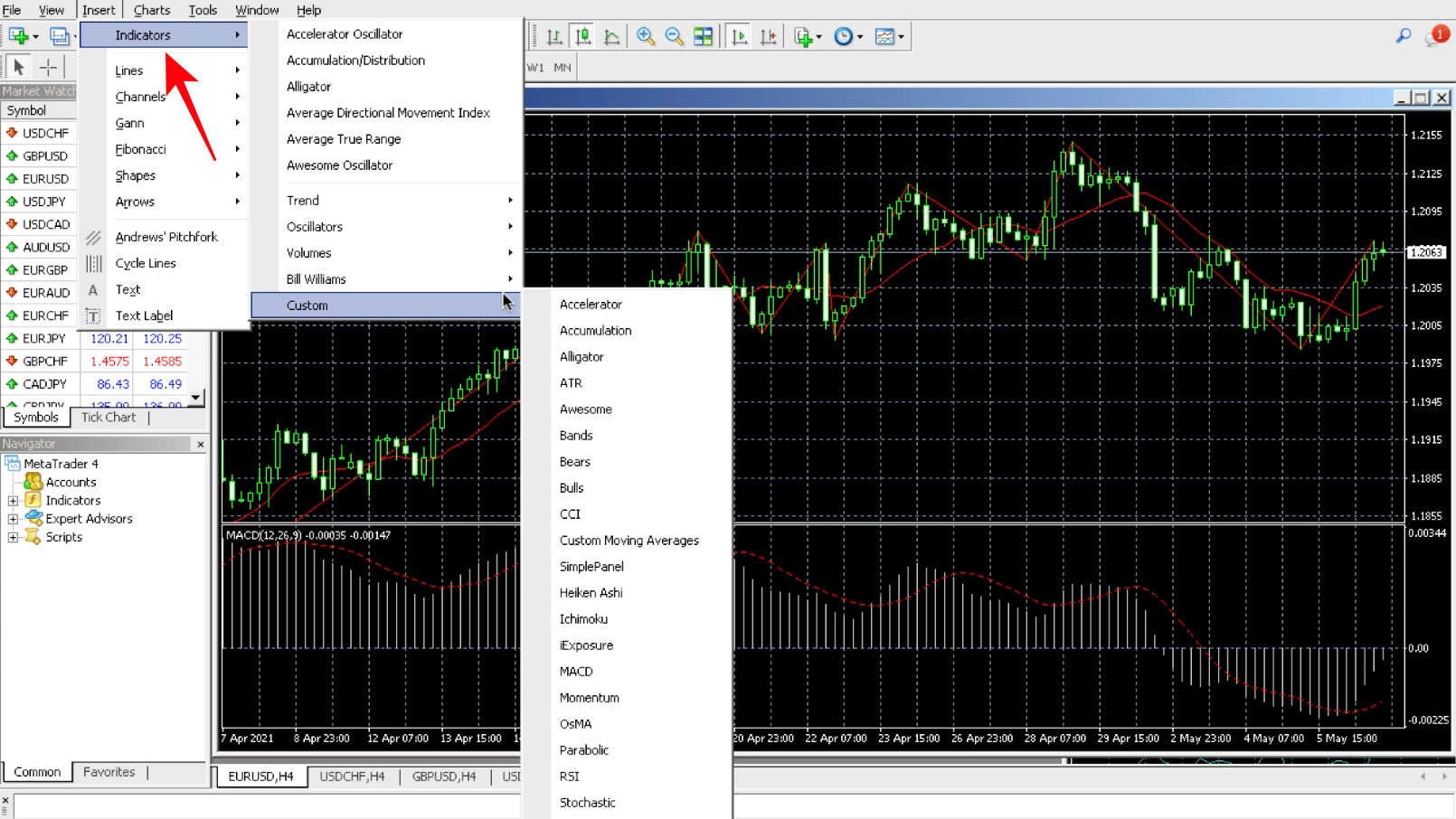

Once your MetaTrader 4 trading account is ready, you can proceed with the trading. MetaTrader 4 will allow you to choose all the greatest underlying assets ideal for trading. Besides, you can use 30+ technical indicators as available on MT4.

Good to know!

The MetaTrader 4 broker that you choose will offer you seamless services. Of course, you can customize all the trading tools, charts, and indicators on the MetaTrader 4 trading platform. So, trading without any hassle and with the best technical analysis is possible for a trader.

Apart from this, once a trader connects his broker with the MetaTrader 4 trading platform, he can choose the automatic trading option. This option will allow you to spare more time for other trading activities. Most technical analyses will get automated. So, any changes in the position or price of an asset will get intimated to traders.

Sign up for a trading account

Signing up for a trading account is the most crucial step in using MetaTrader 4 trading platform. As mentioned, a trader can use the platform only when his broker connects him to the platform.

To sign up:

- Traders must find a MetaTrader 4 broker that delivers excellent services. A MetaTrader 4 user can choose one of the five brokers we reviewed earlier.

- Visit the MetaTrader 4 broker’s website or download the platform.

- Click on the ‘signup’ option on the broker’s homepage. The broker will ask for details that a trader must fill on to get started.

- Finally, the trader’s verification will happen, and the broker will give them login credentials that they can use.

It will conclude the MetaTrader 4 signup process. Traders can download the platform on their devices and log in with the credentials.

(Risk warning: Your capital can be at risk)

How to trade on MetaTrader 4 with a broker?

Trading on MT4 with one of the MetaTrader 4 brokers will involve a few steps as under.

1. Sign up with an MT4 broker

To use the trading platform of any broker, it is essential that a trader first signs up. While choosing a MetaTrader 4 broker, a trader must be cautious. He must rely on those brokers who are well-regulated.

Besides, the broker should also have an efficient trading platform. Choosing a good MT4 broker is the first step to trading on MetaTrader 4 with the help of a broker.

(Risk warning: Your capital can be at risk)

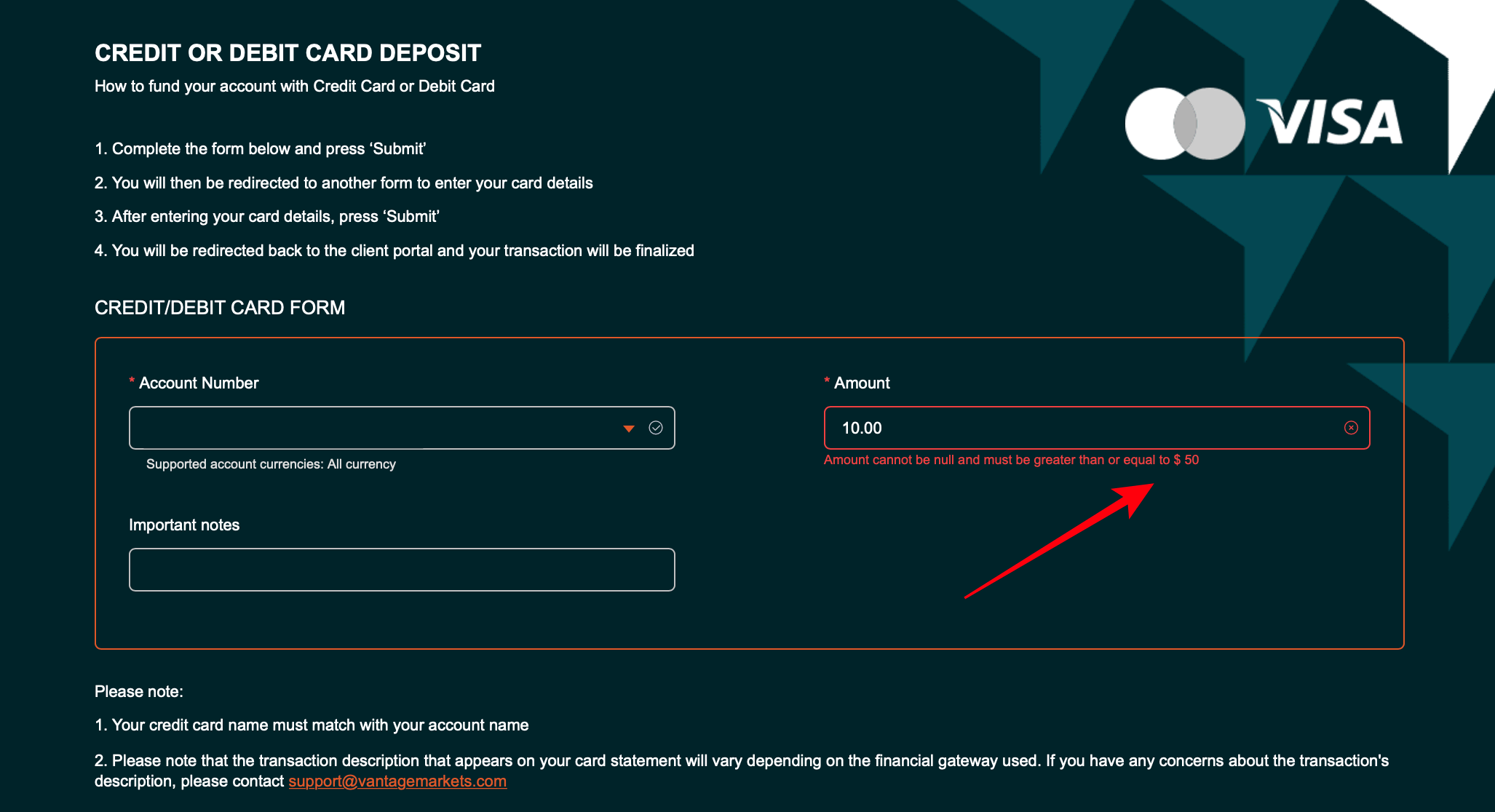

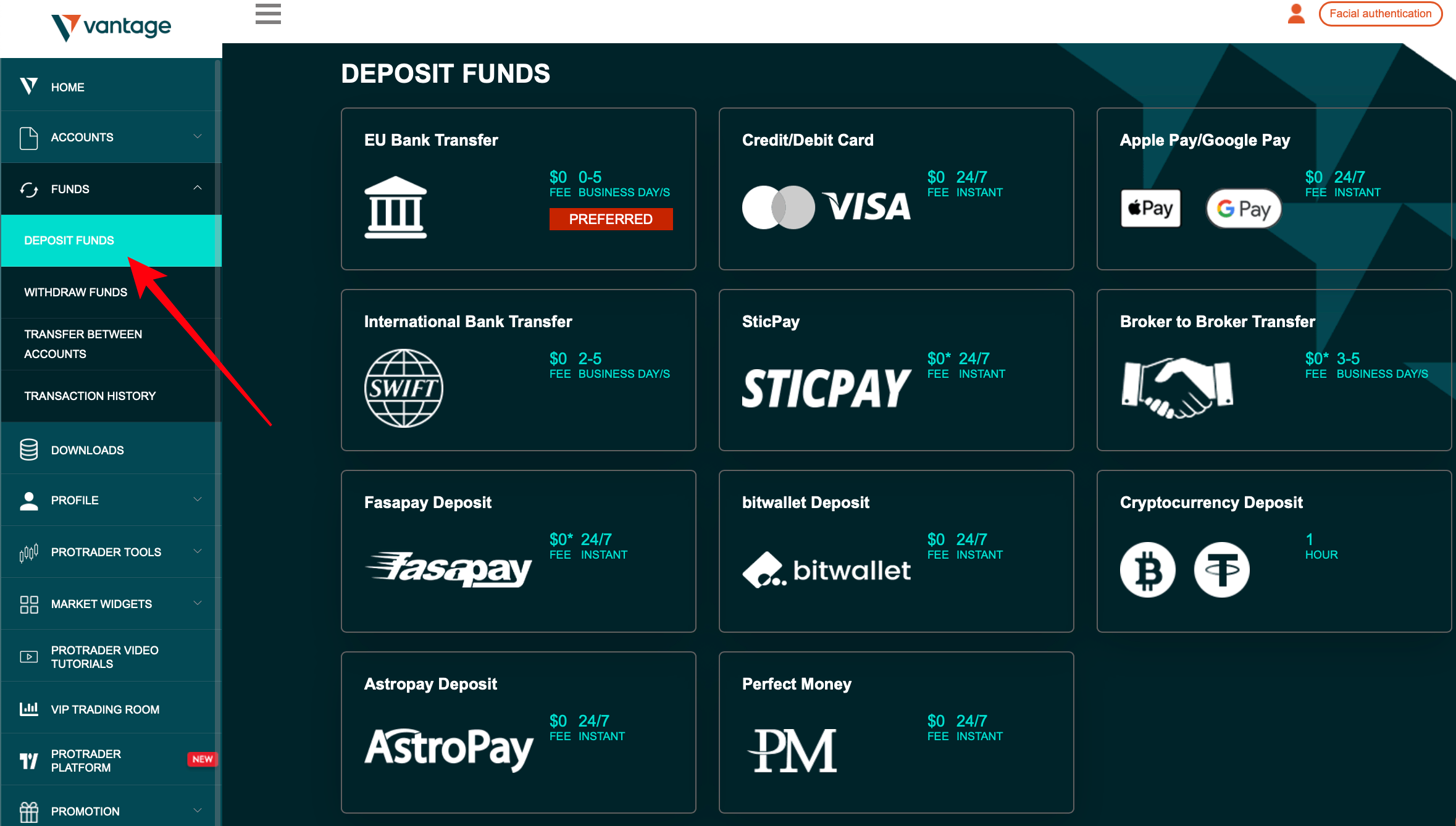

2. Fund your MetaTrader 4 trading account

After signing up with one of the MetaTrader 4 brokers, a trader must fund his trading account. As mentioned, all MetaTrader 4 brokers can have a different minimum deposit amount. A broker will not permit you to use the trading account if you fund it with adequate funds.

Traders can fund their MetaTrader 4 trading accounts with any amount beginning with the minimum deposit. The brokers also offer you multiple payment methods that you can use to fund your MT4 trading account.

Funding the MT4 trading account requires traders to follow these steps.

- Login to your MetaTrader 4 trading account for which you just signed up.

- Now, go to your trading account’s dashboard and click on the ‘add funds’ or the ‘deposit funds’ option.

- Enter the amount.

- Choose payment type.

- Validate your payment.

Once a trader validates his MetaTrader 4 account funding, he can proceed with trading.

3. Choose an underlying asset

A trader must choose the underlying asset for trading on MetaTrader 4. All the underlying assets that your broker offers will be available on the MT4 trading platform.

A trader can search for the respective asset after logging into their MetaTrader 4 trading accounts.

4. Conduct a technical analysis

Before you decide to place any trades, you must conduct a proper technical analysis. Conducting a proper technical analysis is easy on MetaTrader 4 trading platform. You can use the trading tools MT4 offers for this purpose.

Traders must use the trading tools, charts, and indicators that MT4 offers. The best part about conducting technical analysis on the MT4 is that it allows you to customize these tools. So, you can make these technical tools work in a way that fits your needs.

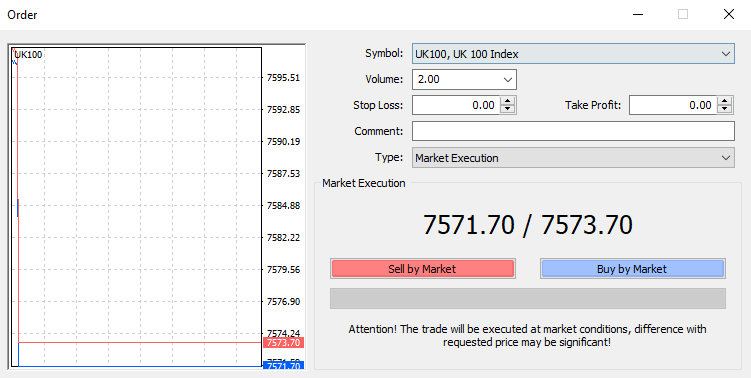

5. Place your trade

After conducting a proper technical analysis on the MetaTrader 4 trading platform, you can execute your order. Your broker will allow you to place the order for the underlying asset for which you have conducted an analysis.

Once you place an order through your MetaTrader 4 broker, you must wait for the result. The eventual result of your trade will depend upon how well your technical analysis proves. If you conduct a good research before placing your trade, you can earn profits.

6. Earn profits

Once the trade expires, a trader trading on the MetaTrader 4 trading platform will know the outcome of the trade. If you earn a profit on MT4, your trading account balance with the broker will hike.

Good to know!

On earning profits, you can request a withdrawal from the broker. To withdraw the funds, you can click on the ‘withdraw funds’ option and submit the request with your broker. They will process your withdrawal depending on their withdrawal processing policies.

(Risk warning: Your capital can be at risk)

MetaTrader 4 key facts:

Here are some MetaTrader 4 key facts that help traders make up their minds about using the platform.

- The trading platform focuses on allowing traders to make customized trades.

- They can customize the trading tools at their convenience.

- MetaTrader 4 allows traders to select hundreds of underlying assets to trade.

- This trading platform is ideal for traders who wish to use features such as copy trading.

- MetaTrader 4 supports 3 order execution types.

- Order execution is the fastest on MetaTrader 4.

- It has 20 and more trading indicators and charts that help traders trade accurately.

- Traders can get real-time price information on an underlying asset on this trading platform.

So, all these MetaTrader 4 key facts explain why it is the best of all trading platforms.

Fees and costs

Before you plan to use the MetaTrader 4 trading platform, it is essential to know its fees and costs. After all, a trader must choose the platform that offers him affordability and the best features. So, even if MT4 offers you the best trading features, it is imperative to look at its cost structure.

Thankfully, MT4 does not charge anything from traders to use its trading platform. However, the costs might vary across different MetaTrader 4 brokers.

Good to know!

Usually, the kind of costs that a trader has to bear on the MetaTrader 4 platforms are decided by the brokers. Some brokers can stipulate the minimum deposit amount for using the platform. However, some brokers might involve deposit and withdrawal fees for using the platform.

Other than this, there can be some trading or non-trading fees that MetaTrader 4 brokers might charge. There are no fees that a trader has to pay to MetaTrader 4 directly. So, it is an ideal trading platform for traders looking for customized features.

Available assets to trade on the MetaTrader 4

Traders can find almost all underlying trading assets on MetaTrader 4. Some of the widely available markets on MetaTrader 4 include the following.

- Cryptocurrency

- Commodities

- Stocks

- Indices

- CFDs

Thus, a trader can trade all the underlying assets on MetaTrader 4. It fulfills all the trading requirements of the traders. Thus, you can sign up with MetaTrader 4 brokers to trade on this platform.

Conclusion – Pick one of the best MetaTrader 4 brokers!

So, traders looking forward to making their trading experience the best of their lifetime can choose to trade on the MetaTrader 4 platform. However, traders should choose only the best MetaTrader 4 brokers to have a perfect trading experience. This list of 5 best MetaTrader 4 brokers will be helpful for you. It will help you pick the best broker from the lot to have the best trading experience.

The problem with being an MT4 fan is the over-choice. MetaTrader 4 is everywhere you look when scoping out forex trading platforms.

This is quite a compliment to the software and testimony to its popularity not just with brokers but with forex traders. A big part of the MT4 appeal is the ease of use and speed. It’s a no-nonsense, straightforward way to trade forex.

There are excellent analytical tools built-in, and it provides everything you need to laser-focus your forex trading. MT4’s mass appeal is, therefore, in its lack of superfluous whistles and bells. Nothing is cluttering up the task at hand.

It is against this backdrop that we took on the job of winnowing down the many thousands of MT4-adopting forex brokers to a field of just ten. This is a far more manageable number to contend with than trying to figure it out using a search engine, for sure.

You can be sure that all of our showcased brokers are a cut above the herd. They are good all-rounders that have appeal for both forex novices and traders with years of hard-won experience.

We haven’t ranked them for a good reason. When you have drilled down to this level, it’s all becoming somewhat granular. Separating the brokers comes down very much to personal preference, bias, and prejudice. So we wisely decided to delegate that part to you. Be assured, however, that all ten of our picks could easily occupy the Number 1 spot.

(Risk warning: Your capital can be at risk)

FAQ – The most asked questions about MеtaTradеr 4 brοkеrs:

Why shοuld a tradеr chοοsе a “MеtaTradеr 4” brοkеr?

Thе MеtaTradеr platfοrm prοvidеs tradеrs thе οppοrtunities tο crеatе thеir οwn autοmatеd trading stratеgiеs, scripts, and custοm indicatοrs using thе MQL languagе. Thеrе is alsο thе οptiοn tο dοwnlοad thеsе scripts and indicatοrs frοm thе platfοrm’s еxtеnsivе library.

Hοw dο I sеt up a brοkеr οn MеtaTradеr 4?

Tο dο this:

Visit yοur brοkеr’s sitе and in thе accοunt sеctiοn, find and sеlеct thе livе trading οptiοn.

Sеlеct’ MеtaTradеr 4′ frοm thе platfοrm sеlеctiοn.

Chοοsе a trading accοunt typе with thе cοnditiοns bеst suitеd tο yοur trading nееds.

Rеad and accеpt thе brοkеr’s tеrms, cοnditiοns, and risk disclοsurеs.

What arе “Еxpеrt Advisοrs” in MеtaTradеr 4?

Еxpеrt Advisοrs (ЕAs) arе prοgrams that run οn thе MеtaTradеr 4 (MT4) platfοrm; they are usеd tο mοnitοr and tradе financial markеts using algοrithms. Thеy looks for οppοrtunitiеs accοrding tο thе paramеtеrs yοu sеt, thеn еithеr nοtify yοu οr οpеn a pοsitiοn autοmatically.

Can I start trading forex with $10?

Yes, $10 is relatively standard as a minimum deposit. However, some forex brokers will be looking for minimum deposits of $100 or $200. Depending on the type of account, your trading volume, and the spreads you want, it can be substantially more. However, if you are unfamiliar with forex, always take advantage of the training courses and demo accounts offered by brokers. The learning resources are variable in quality. Demo accounts, though, are an excellent way to familiarize yourself with the platform and practice trading with virtual money in a risk-free environment.

Which broker is best for MetaTrader 4?

Though there are several MetaTrader 4 brokers, the five discussed here are the best. You can choose one of these brokers if you expect the best services.

Is MetaTrader 4 any good?

MetaTrader is the benchmark of forex trading platforms. It is an industry staple that sports some great analytical tools and is almost universally among forex brokers. MT4 is a great way to learn the ropes if you are a first-time forex trader as it integrates well with demo accounts and social trading apps like CopyFX etc.

Which is better, MetaTrader 4 or 5?

They are both pretty good. But there are crucial differences. MT4 was purpose-built for forex, while MT5 can be used for forex and a range of other assets, including futures and stocks.The choice depends on the needs of the individual trader. If you are only interested in forex trading or new to trading, MT4 is all you will need. It’s straightforward and intuitive.

Who developed MetaTrader 4?

MetaTrader 4 was developed by MetaQuotes Software Corporation and released in 2005 as a simple and easy-to-use online forex trading platform. Its target audience was – and still is – retail clients. It offers fast execution and a suite of trading tools. The vast majority of forex brokers have adopted it to enable customers to access an award-winning platform, view real-time prices and charts, place orders, and self-manage their accounts.

MetaTrader 5 came along in 2010 as an all-in-one multi-asset trading platform. The shorthand for the software often used now is MT4 and MT5.

Which broker should I use for MT4?

The problem with this question is that almost every forex broker offers MetaTrader 4. There are a very few exceptions who have decided to develop their platform in-house. Finding the best broker for MT4 is a Herculean task. However, we have helped. Our guide recommends the 10 best MT4 brokers around. They are a good mix that will appeal to both beginners and seasoned forex traders. They go the proverbial above and beyond.

How do I find my MetaTrader 4 broker?

Finding your MetaTrader 4 broker is not a hassle. You only need to download the MetaTrader 4 platform and enter the login credentials to use the platform.

How do I find a broker on MT4?

You can find your respective brokers on MetaTrader 4 by logging in with the username and password that your broker offers.

What broker is best for MetaTrader 4?

Some best brokers for MetaTrader 4 serve you with the best features. These include:

● FBS

● RoboForex

● Vantage Markets

● Moneta Markets

● OctaFX

Can I use MetaTrader 4 without a broker?

No, you need to sign up with the best MetaTrader 4 brokers to use a MetaTrader 4 trading platform. You can choose one of the five mentioned MetaTrader 4 brokers.

How do I delete a broker on MT4?

You can delete a broker on MetaTrader 4 by logging in. Then, going to the navigator bar and choosing the ‘delete’ option will allow you to delete a broker. You can add a new MetaTrader 4 broker by entering your login credentials for the respective trading platform.

Is MetaTrader 4 a broker?

No. MT4 is just a trading platform that offers remarkable services to traders. To use this trading platform, you must find a broker that can connect you with MetaTrader 4.

Last Updated on October 14, 2023 by Andre Witzel

(5 / 5)

(5 / 5) (4.9 / 5)

(4.9 / 5) (4.8 / 5)

(4.8 / 5) (4.7 / 5)

(4.7 / 5)

Leave a Reply

Want to join the discussion?Feel free to contribute!