Gemini cryptocurrency exchange: Is it a suitable trading platform?

Table of Contents

Review: | Type: | Available: | Currencies: |

|---|---|---|---|

(4.5 / 5) (4.5 / 5) | Cryptocurrency company | Mobile & Desk | 40+ |

Advanced encryption techniques have led to the creation of cryptocurrencies, the budding digital currencies. The academic concept was brought to virtual reality through the emergence of Bitcoin in 2009. However, Bitcoin grasped the attention of media and investors for the first time in April 2013. The value was recorded at a whopping $266 per Bitcoin. It magnified by ten times in the next two months. After that, it saw a dip by 50%, sparking a debate on its future existence.

With an increasing number of trading platforms, it is difficult to choose the right one. There are more than 200 platforms that support active trading. More and more users are finding their way into the world of cryptocurrency trading.

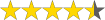

In this article, we bring you all the details about a trading and exchange platform called Gemini. It is accessible in all states of the United States, except Hawaii.

What is Gemini? – Introduction of the cryptocurrency exchange

Gemini is a US-based cryptocurrency platform. It was founded by the Winklevoss brothers and first went live in October 2015. It is expanding its presence in Asia and Europe too. Likewise, it is one of the best exchange platforms for people to start their cryptocurrency trading journey. You can sell, buy, and store digital assets on the platform. Gemini gives access to over 40 cryptocurrencies. The platform offers services for both major cryptocurrencies and smaller altcoins. The users can transfer their USD from their bank accounts. The currency exchange platform is operational in the United States, the United Kingdom, Canada, Hong Kong, Singapore, and South Korea.

The main currencies available for exchange are Bitcoin (BTC), Bitcoin Cash (BCH), Litecoin (LTC), Ethereum (ETH), and Zcash (ZEC).

Trade more than 100 different cryptocurrencies CFDs on professional platforms:

(Risk warning: 75% of retail CFD accounts lose money)

Security: How trustable is the crypto exchange?

Gemini takes the security of its infrastructure and the user’s Digital Assets as a top priority. It has three core principles:

- Protection against external threats

- Preventing misuse of insider access

- Protection against human error.

Gemini cold storage security

A major chunk of the users’ cryptocurrencies is in Gemini’s offline Cold Storage system. A small portion is held in the online hot wallet, which is protected by insurance. The Gemini Cold Storage uses HSM’s with FIPS 140-2 Level 3 rating or above. The private keys are managed and stored for a lifetime on Gemini’s HSM’s. The multi-signature scheme eliminates the probability of a single failure point. The HSM’s are distributed geographically in access-controlled facilities.

Gemini hot wallet security

Gemini uses HSM’s that have a rating of FIPS 140-2 Level 3 security rating or above. It follows the least-privilege principle by providing role-based access-control to the production environment. The protection is multi-tiered. Multi-factor authentication is required for administrative access.

Gemini account security

For account login and cryptocurrency withdrawal, you need to undergo a two-factor authentication (2FA). Gemini secures the hardware security keys through Web Authentication. The platform allows the user to create an “Approved Address” list. It ensures that your crypto withdrawals are done on the approved addresses only. In case of suspicious behavior, it disables the crypto withdrawals from a user’s account. For certain account operations, rate limits such as the number of login attempts are controlled to prevent external attacks. All the passwords are encrypted to protect your personal information during transit.

Good to know:

Gemini’s industry-leading protections insure your assets against Digital Asset theft. The capital is stored in reserve as a New York Trust Company. Gemini has strong and extensive controls over the storage and production environments. Gemini is a New York trust company regulated by the New York State Department of Financial Services (NYSDFS).

The best alternatives for crypto traders: Trade cryptocurrencies CFDs with the best conditions and a regulated broker

Crypto Broker: | Review: | Advantages: | account: |

|---|---|---|---|

1. Capital.com  | # More than 200 crypto CFD assets # No commissions # Best platform for beginners # No hidden fees # More than 3,000+ markets | Live account from $ 20 by card: (Risk warning: 75% of retail CFD accounts lose money) | |

2. Libertex  | # More than 50 crypto CFD assets # Trade with leverage 1:2 # Userfriendly # Fiat deposits & withdrawals # PayPal | Live account from $ 100: (Risk warning: 74.91% of retail investor accounts lose money when trading CFDs with this provider.) |

What does Gemini offer?

Gemini offers over 40 cryptocurrencies under its domain. It includes Gemini Dollars (GUSD), which is their very own coin. With Gemini, you get to store and trade cryptocurrencies. Gemini has a partnership with Samsung and leads the Samsung Blockchain. Users from Canada and the United States can link Gemini mobile app with their Samsung Blockchain wallet for trading coins.

The supported currencies are:

- Bitcoin (BTC)

- Bitcoin Cash (BCH)

- Ethereum (ETH)

- Litecoin (LTC)

- Zcash (ZEC)

- Chainlink (LINK)

- Dogecoin (DOG)

- and many more

Gemini Dollar (GUSD)

GUSD is Gemini’s personal cryptocurrency, curated for trading purposes. It is the first-ever regulated stablecoin. It went live in September 2018. The Gemini Trust Company is the sole issuer. In the modern digital world, GUSD’s purpose is to project the value of the US Dollar. The currency is built on Ethereum. You get to experience the seamless creation and redemption of the coin.

GUSD has a backing of USD held at State Street Bank and Trust Company. You can use Gemini Dollar for lending, spending, investing, and other practical cases.

Trade more than 100 different cryptocurrencies CFDs on professional platforms:

(Risk warning: 75% of retail CFD accounts lose money)

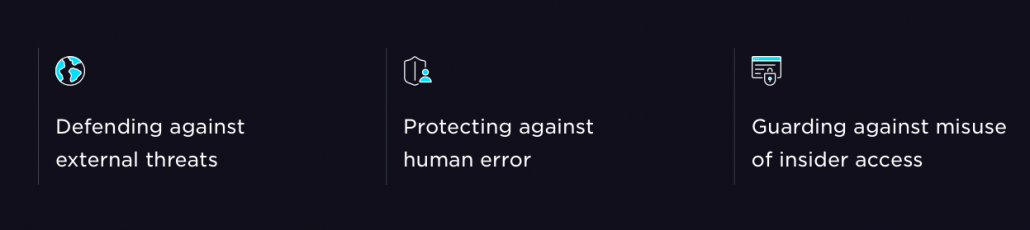

Gemini Active Trader

On the Gemini platform, you have the option of viewing your auctions, multiple order types, block trading, and advanced charting. These features are available to active users through the Gemini Active Trader interface. You get to keep track of the latest market rates. The Active Trader has a fee schedule when you place an order through the interface. The gross trading volume determines the fee rate over a 30-day trading period. The fee is applicable in notional USD through Gemini’s block trading, continuous order books, and auction order books.

The fee rate is reassessed at midnight (UTC) every day and applies to all orders henceforth. You can refer to the marketplace fee schedules section of their user agreement.

| 30 DAY TRADING VOLUME (USD) | MAKER FEE (%) | TAKER FEE (%) | AUCTION FEE (%) |

|---|---|---|---|

| 0 | 0.25 | 0.35 | 0.25 |

| >= $500,000 | 0.15 | 0.25 | 0.20 |

| >= $2,500,000 | 0.15 | 0.25 | 0.10 |

| >= $5,000,000 | 0.10 | 0.15 | 0.10 |

| >= $10,000,000 | 0.10 | 0.15 | 0.00 |

| >= $15,000,000 | 0.00 | 0.10 | 0.00 |

| >= $50,000,000 | 0.00 | 0.075 | 0.00 |

| >= $100,000,000 | 0.00 | 0.05 | 0.00 |

| >= $250,000,000 | 0.00 | 0.04 | 0.00 |

| >= $500,000,000 | 0.00 | 0.03 | 0.00 |

The Active Trader users are eligible for a taker fee reduction of 0.005% for achieving the following benchmarks:

- When you clear and settle more than $10,000,000 of the aggregate notional value

- in any calendar month.

- When you hold an equivalent or greater value of $10,000,000, the average notional value in any calendar month.

Please note:

Gemini offers discounts, rebates, and incentives to certain users from time to time, including affiliates. For Block trading, there is no maker/taker fee.

Trade more than 100 different cryptocurrencies CFDs on professional platforms:

(Risk warning: 75% of retail CFD accounts lose money)

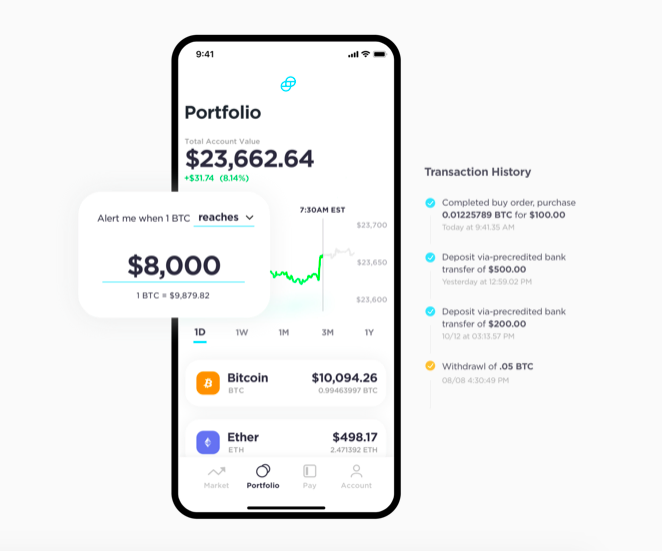

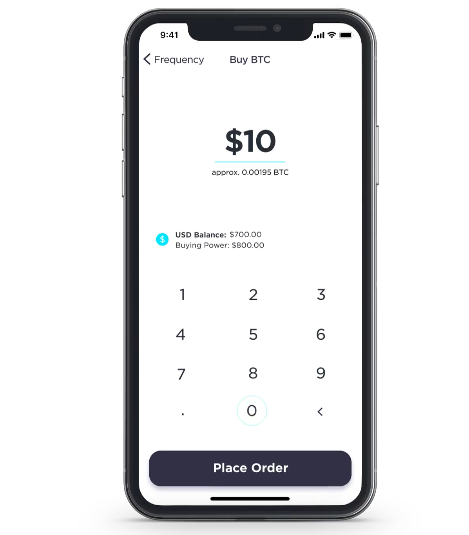

Gemini mobile app

You can find the Gemini mobile application on the Google Play Store, Galaxy store, and Apple app store. It is compatible with Android and Apple interfaces. The app is free to download. You can get started on the app within three minutes! It is an easy installation process and lets you get started instantaneously.

Gemini wallet

Gemini has It’s in-house hot wallet and cold storage system for safekeeping your cryptocurrencies. The wallet is safe and secure, and the infrastructure supports all the listed assets. There are a few notable features that we address below.

- Industry-leading Engineering: The up-gradation of the wallet infrastructure is a continuous process. It is done to accommodate new coins, optimize network usage and user experience. Gemini is the first exchange platform to launch SegWit full support. It offers native SegWit addresses.

- Expert Support: Gemini delivers an incredible storage experience. In case of any roadblocks, it provides 24/7 customer support to all its users. The team answers all your queries and provides the best solutions.

Trade more than 100 different cryptocurrencies CFDs on professional platforms:

(Risk warning: 75% of retail CFD accounts lose money)

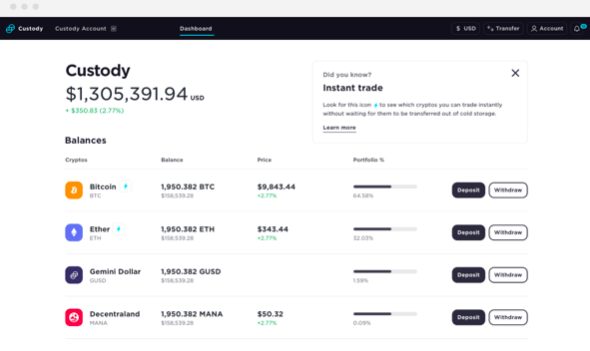

Gemini custody

Gemini Custody is an interface that provides secure and compliant custody solutions to manage and store your Digital Assets. It is regulated as a New York State Trust Company. You get to experience instant liquidity and same-day withdrawals for trading on Gemini Exchange. The platform provides free setups with no minimums criteria. The service pricing is flexible. Gemini Custody has witnessed 200 million USD worth of insurance coverage. It is the largest limit that a crypto custodian has ever purchased. There are dedicated account executives who provide round-the-clock customer support.

Gemini Custody is the compliance standards and capital reserve requirements of a traditional financial firm. The designated authorities regularly audit it. The customers have the liberty to purchase additional insurance for their assets.

Some notable features are:

- You can trade directly from Gemini Exchange with your assets reserved in the cold storage. The withdrawals to the exchange account get credited instantly. The funds’ movement is monitored with the best security and verification protocols.

- It provides multi-layered security architecture. There are several layers of biometric access controls, role-based governance protocols, and multi-signature technology to safeguard your assets.

- The platform has all the essential compliance in place, maintains transparency with all its customers.

- You cannot access the custody infrastructure without using proper credentials. These credentials are safeguarded through hardware security modules (HSM). It has attained the highest security ratings from the US government.

- Checking balance, accessing monthly statements, creating sub-accounts, transferring assets, and initiating withdrawals are very hassle-free processes. The Gemini Custody interface seamlessly integrates with the Gemini Exchange dashboard.

- There are different custody requirements of institutions and investors. It depends on the activity volume. Gemini works with every customer and chalks out an exclusive price plan for you.

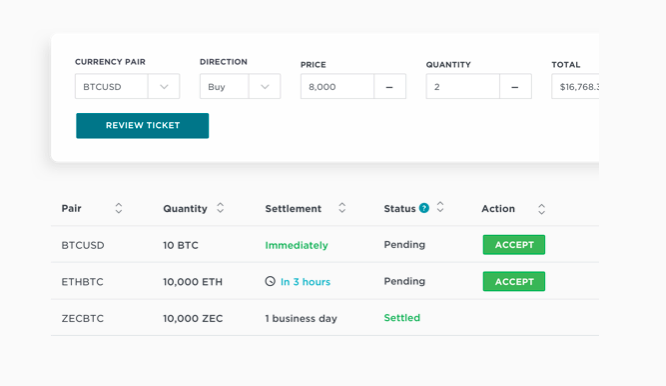

Gemini clearing

It allows two parties to settle a trade of the order book. In these pre-arranged transactions, Gemini acts as a confirming third party. It ensures that the settlement is attained timely while contemplating counterparty risks. Gemini Clearing has no trade size restrictions. Its price point is very competitive in the market. For customers seeking additional control services, it offers a white glove solution.

Gemini Clearing also ensures immediate trade facilitation of Bitcoin and other cryptocurrencies. Both parties need to be completely funded to clear asset movements. Both the parties have to undergo Gemini’s AML requirements and KYC onboarding. It helps to ensure security and validation on a transaction’s side. The transaction information is accessible only to the counterparties. Gemini does not publish the trade details on its market data feed.

Trade cryptocurrencies CFDs with the best conditions and a regulated broker:

Crypto Broker: | Review: | Advantages: | account: |

|---|---|---|---|

1. Capital.com  | # More than 200 crypto CFD assets # No commissions # Best platform for beginners # No hidden fees # More than 3,000 markets | Live account from $ 20: (Risk warning: 75% of retail CFD accounts lose money) | |

2. Libertex  | # More than 50 crypto CFD assets # Trade with leverage 1:2 # Userfriendly # Fiat deposits & withdrawals # PayPal | Live account from $ 100: (Risk warning: 74.91% of retail investor accounts lose money when trading CFDs with this provider.) |

Registration, funding and trading with Gemini

There is a registration link present on the top right side of the landing page. The platform is compliant with all the New York securities, regulations, and trading laws. You will have to provide a lot more personal details than you would expect. But Gemini is very safe to use.

Full legal name, phone number, email address, proof of residence, bank account details, and valid government ID are some of the things you need to provide in the personal details form.

You can fund your Gemini account only through a bank account. The maximum funding limit daily and monthly are $500 and $15,000, respectively. You get a daily withdrawal limit of $100,000. You can fund your Gemini account through a third-party wallet via crypto-to-crypto trading. However, you can do so in the case of only five coins – BTC, BCH, ETH, LTC, and ZEC.

Trading necessities on Gemini

It is imperative to have a bank account associated with the platform. You cannot do transactions via a credit/debit card. You cannot transfer stable coins from a different exchange. Furthermore, you can, however, trade crypto-to-crypto from another wallet. Gemini hosts five currencies – BTC, BCH, ETH, LTC, and ZEC.

Once you are set up with your account, you need to fund the account by buying crypto with cash. If you do not have an updated investor or institutional account, the maximum funding allotment you get daily is $500.

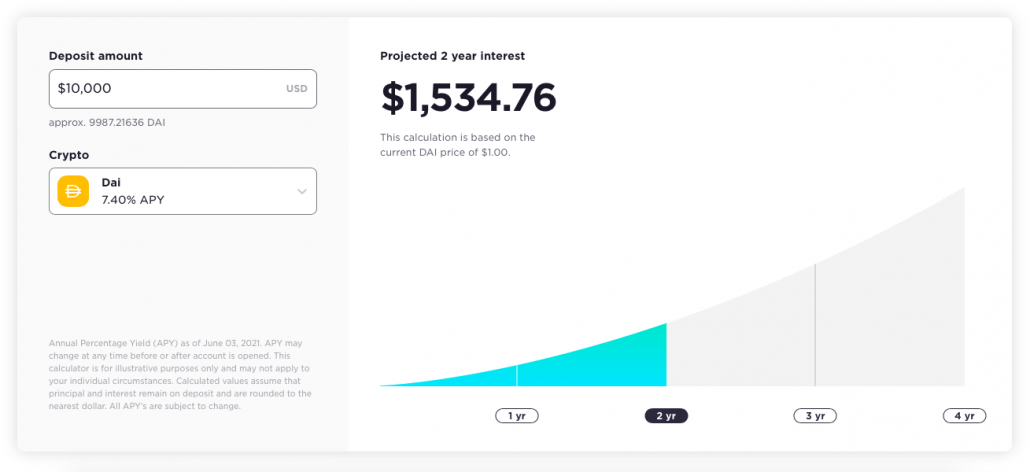

Crypto savings through Gemini earn

Recently, Gemini launched a lending platform called Gemini Earn. You can choose the coin you wish to lend to an institutional borrower. In return, you earn an interest amount on the coin you lent. Users can access their trading and earn balance on the platform along with the interest amount. The interest amount gets credited daily. It gets accrued at 4 pm (ET) on the following working day, once you move the funds to Gemini Earn.

Gemini partners with third-party borrowers, including Genesis. These borrowers undergo the risk management framework of Gemini, which reviews the entire process of lateralization process. The balance sheet, cash flow, and financial analysis of the partners are done periodically to check the risk ratios and financial health.

Risk warning:

Cryptocurrencies are volatile and subject to price variations. There is an investment risk present, and the traders need to judge their risk tolerance before investing in a coin. Gemini Earn has obligations towards returning funds. It is mentioned in the terms and conditions of their loan agreement.

Trade more than 100 different cryptocurrencies CFDs on professional platforms:

(Risk warning: 75% of retail CFD accounts lose money)

How to Redeem on Gemini earn?

For the mobile application:

- Press “Redeem” on the coin of your choice

- After entering the quantity of the coin, you wish to redeem, press “Continue”

- After the confirmation, swipe right at the screen’s bottom to “Confirm” the redemption

- The redeemed coin flashes in your Gemini trading account instantly. For a high-volume redemption request at the same time, it takes longer for the coins to reflect in your account. According to the rule, you receive the funds within five working days

For the Website:

- Choose the crypto you would like to claim and click “Redeem”

- Provide the details of the crypto quantity you wish to redeem and click “Continue”

- After reviewing the confirmation page, click “Confirm”. You stop earning interest amount on the coin the instant you click for redemption.

- The redeemed coin appears instantly in your Gemini trading account after the process. For a high-volume redemption request at the same time, it takes longer for the coins to reflect in your account. According to the rule, you receive the funds within five working days.

Gemini exchange features

Gemini has many excellent features. The platform is simple and user-friendly. It is a safe space for beginners to kick-start their trading journey. Some notable features are discussed below.

- Incredible user interface: The interface is neat and user-friendly. The tabs are strategically placed and within the periphery of your vision. They have all the information available in tabs that contain answers to all the questions/queries you can have. All the products and their partners are listed on the landing page in the form of links. You can access all the information by clicking on each link. The information is written in an easy-to-follow language.

- Easy crypto payments: Now you can use your cryptocurrency to pay at certain retail outlets. Gemini’s partnership with Flexa has made this possible for customers. The users can spend directly from their Gemini wallet to pay for their physical products.

- Flexa: On Gemini, you can spend your cryptocurrency straight from the wallet. Gemini has a partnership with Flexa. It allows you to buy physical goods from retail outlets using cryptocurrencies. Some of the notable retailers that accept the crypto mode of payment are Whole Foods, Home Depot, Nordstrom, and GameStop. You can spend Bitcoin, Bitcoin Cash, Gemini Dollars, and Ether. Gemini has launched the Nifty marketplace. It is a platform where you can sell or buy digital art.

Gemini fee calculation

The fee is calculated as a fraction of the trade value (price x quantity of coin). The fee is either charged to the account or deducted from the trade execution’s gross proceeds based on the type of order. The fee is applied during order placement. For partial orders, the executed bit is deemed for trading fees. Gemini charges the fee in quote currency or the second currency in the pair. For example, for a BTC/USD trade, the fee is charged in USD. For an ETH/BTC trade, a fee is charged in BTC.

Gemini charges a convenience fee that is 0.50% above the market rate. If you multiply 0.50% (1.005) by the quantity of the coin, you get the convenience fee. Additionally, a flat transaction fee is applicable when you place your order through the web or mobile application. Gemini charges 0.40% to users who have assets greater than one million USD and want to place their coins in cold storage. There is an administrative withdrawal fee of $125 too.

Trade more than 100 different cryptocurrencies CFDs on professional platforms:

(Risk warning: 75% of retail CFD accounts lose money)

Exceptional customer service

Gemini has dedicated a section to blogs on the platform. It uploads the latest movements in the market. There are frequently asked questions highlighted that capture every possible query a user can possess. For additional doubts, you can write to them at [email protected].

There is a “Help Desk” tab on the bottom of the landing page for registration-related help. You get directed to a page that features a chatbot. You can type your question, and a support executive will be at your disposal at the earliest. Not only that, but you can also choose the problem statement from one of the options listed in the dropdown menu.

Final thoughts: Gemini has a big offering

Since its inception, Gemini has never faced any thefts or hacks or any sort of security compromises. The strong network and infrastructure security. Gemini’s cold storage security has been recognized to be of the US government security level. Gemini is the best platform to buy Bitcoin, Litecoin, Bitcoin Cash, Ethereum, and Zcash. For digital asset offering, Gemini has an incredible user interface and amazing liquid order books. It is not advisable to leave your funds on an exchange platform. But Gemini is the safest space because of its multi-layer security features.

The fee schedules are competitive, and you save money on large order volumes. The timely discounts and rebates provided by the platform ensure the engagement of the customers on the platform.

Trade more than 100 different cryptocurrencies CFDs on professional platforms:

(Risk warning: 75% of retail CFD accounts lose money)

FAQ – The most asked questions about Gemini cryptocurrency exchange :

Is Gemini Cryptocurrency real?

Gemini is the best option for beginners as it provides user-friendly services. Likewise, it is also a very good option for experienced traders. It has provided the best services to many of its subscribers, so it is a real cryptocurrency. It is one of the best cryptocurrency trading platforms to try, with industry-leading security measures, its hot wallet, and a full help center.

Is Coinbase better than Gemini?

Both Coinbase and Gemini are best at their functions. While Gemini focuses on supporting industrial investors, Coinbase can help you learn crypto while trading. However, both platforms are suitable for beginners. The only advantage you get with Coinbase is it is available in most countries as compared to Gemini.

Is Gemini as safe as Coinbase?

Both Gemini and Coinbase are best known for their security. Both of them have the best security features that enable excellent account protection and safe storage methods. So, if you are in a dilemma about finding the best site for buying, selling, and storing crypto, both of them are equally good.

How does Gemini make money?

Transaction fees, exchange fees, processing fees, holding fees, and interests on money stored in Gemini’s Earn accounts are the company’s primary source of revenue. Gemini is valued at $7.1 billion just within eight years of its foundation.

More articles about cryptocurrencies:

Last Updated on January 27, 2023 by Arkady Müller

(5 / 5)

(5 / 5)