What is an online broker account statement?

You have a brokerage account, but do you know how to read a brokerage statement? While it’s not the most exciting thing, it’s important for smart money management.

Now knowing how to read broker account statements can make it difficult for you to spot mistakes or find fraud in plain sight.

So, thoroughly read the brokerage statement and if you find anything confusing, consult your financial professional for an explanation. Or you can reach out to regulators that oversee the brokerage industry.

Table of Contents

What’s included under the broker account statement?

A broker account statement is an official document that contains all the information about your trading account. While account statement of different firm looks different, they all have some common information, including:

- Account information

- Contact information

- Clearing firm

- Account Summary

- Income Summary

- Fees

- Account activity

- Margin

- Portfolio details

- Disclosures and definitions

As a trading broker account holder, you need to provide quarterly statements. But an active trading account will receive monthly statements. You can either get your account statement digitally or via mail.

Trade more than 3,000+ markets from 0.0 pips spread without commissions and professional platforms:

(Risk warning: 67% of retail CFD accounts lose money)

Here’s a detailed look at all the information contained in the brokerage statement:

1. Statement period

The statement period contains the end date, which shows you the value of your investment. You can measure your investment’s performance over a certain period by knowing the end date.

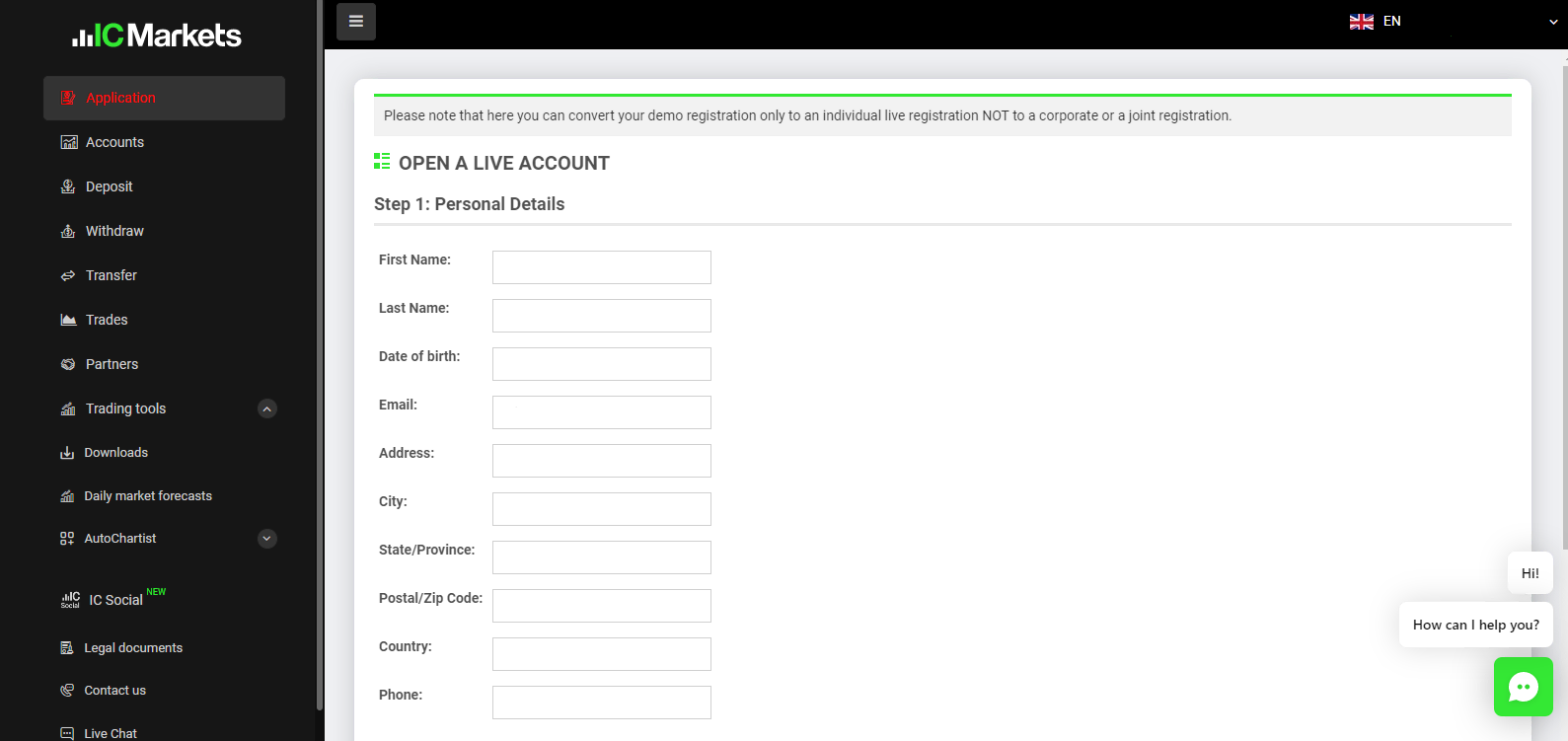

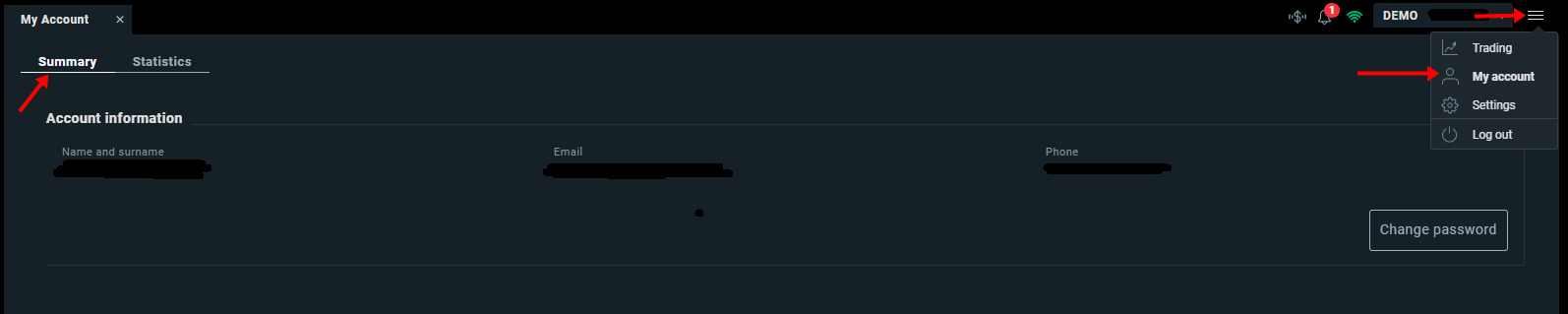

2. Account information

Account information in the broker statement identifies the owner of the account. It also tells the type of account (personal, business, and more), account number(s), and mailing address.

The account number provided on the broker summary should match your previous statements.

3. Contact information

Contact information and the financial professional’s name are present at the top of the broker statement.

But statements with no investment advice do not include certain finance professionals. However, they should offer a phone number for contact.

4. Clearing firm

The clearing firm is a brokerage firm that monitors securities and cash in your account. The account statements should provide clear contact information.

A clearing firm can be a subsidiary of a brokerage firm with a name similar to yours. Or your broker, for example XTB or Capital.com can hire another broker-dealer to be its clearing firm.

Any inaccuracy on your account statement should be immediately reported in writing. The issue should be raised with your primary brokerage firm and clearing firm.

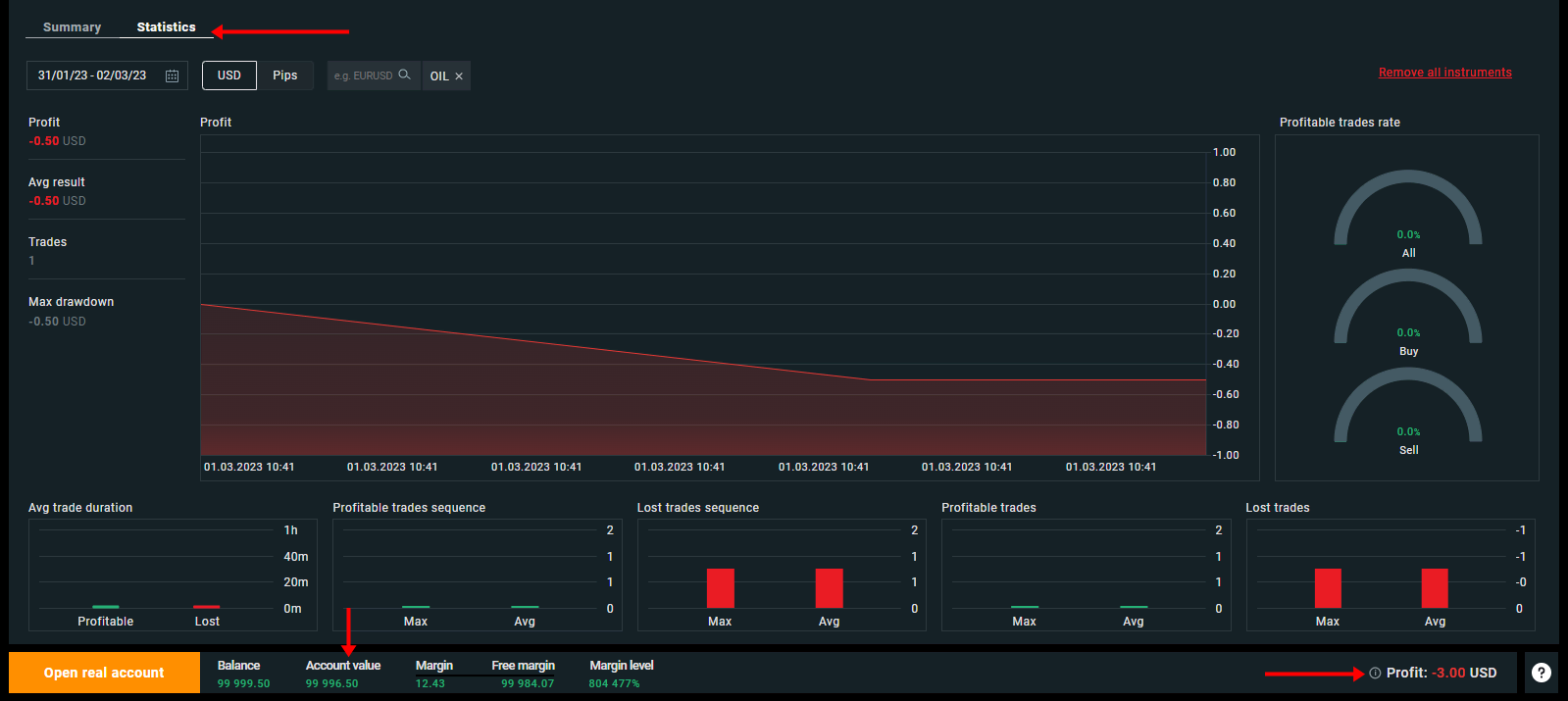

5. Account summary

The account summary on the trading brokerage account shows a big picture of your performance. It mainly includes your performance and the account’s total value.

An account summary can be used to understand how successful your strategy is. Also, you get an idea of whether you should use the same strategy.

It’s important to regularly check your account summary. Lastly, you need to be wary of positive returns that appear unrealistic.

6. Income summary

The income summary keeps you updated with the income earned. It can consolidate your withdrawals, deposits, bond maturity dates, and account summary.

It’s important to remember that your total investment can differ from the estimated yield and estimated actual income.

You should always raise concerns regarding unknown sources of dividends and interest income. Also, if you see an income that you have not deposited in your account, report it.

Trade more than 3,000+ markets from 0.0 pips spread without commissions and professional platforms:

(Risk warning: 67% of retail CFD accounts lose money)

7. Fees

This section discusses the fees linked to your account. Reviewing this section is important to understand your investment results without knowing the fees.

Always ask about fees, which include commission and seem excessive or unusual. Also, if you notice any uninformed charges and costs, discuss them.

8. Account activity

Account activity includes information during the period, i.e., any trades made and money going out or in. Don’t forget to check for accuracy to make sure it matches the trade you have made in the past.

9. Margin

Margin refers to the loan from your brokerage firm. Your brokerage account statement helps you get an idea of which securities you have purchased. If you notice any margin costs that increase the disclosed interest rate without your permission, report it.

10. Portfolio details

This section shows the individual assets present in your trading account and the investment breakdown by asset class. It helps you understand your holdings and how diversified your portfolio is.

The details given in this section help you evaluate whether or not your investments are in line. The portfolio section also includes bond insurance, unrealized gains, income from investments, and losses.

11. Disclosure and definitions

The disclosure and definitions section is designed to give an explanation of fees to key definitions. You can also find details about key legal information. Plus, the details present in this section need to match what you have been charged.

Conclusion about online broker account statement

As a trading broker account holder, it’s your responsibility to check for errors and inaccuracies. If you notice any mistake, immediately contact your broker or advisor.

Trade more than 3,000+ markets from 0.0 pips spread without commissions and professional platforms:

(Risk warning: 67% of retail CFD accounts lose money)

Last Updated on May 30, 2023 by Yuriy Kunets