Currency Futures explained: A complete trading guide

Table of Contents

The forex market is the largest in the world, facilitating trades worth $6.6 Trillion every day. The market is fast-paced, and the right trade can make you a lot of money. However, you need to be in the loop all the time and must be an expert at managing risk to succeed with forex trading. Fortunately, participating in the foreign exchange market directly isn’t the only way to make money. Currency futures can give you access to the same market and also offer some noteworthy benefits.

The most notable benefit of using currency futures is that an investor can create a long or short position as the circumstance demands. Furthermore, managing risk is also a lot easier with currency futures. Research by the FIA indicates that the futures trading volume increased by 32% in the first half of 2020.

With all that’s happening in the world, traders realize that impeccable risk management is the need of the hour.

But few critical questions remain:

- What exactly are currency futures? How do they work?

- And how can one start trading them?

We outline everything you need to know about the financial derivative in this guide.

What are Currency Futures?

Every country has a currency that facilitates buying and selling of goods for its residents. The value of this currency continually keeps changing with respect to other currencies. A currency’s value may change due to several factors. Some of the key factors that dictate the price of a currency include the supply and demand of goods in the country, the central bank’s policies, foreign exchange reserves, and the state of the economy.

Currency futures, which are sometimes referred to as forex futures, enable a trader to buy or sell a stipulated amount of a specific currency at a fixed time in the future. These trading instruments are contracts that are traded on exchanges, with the contract’s underlying asset being the currency’s exchange rate. Examples of exchange rates include the GBP to US Dollar exchange rate and the US Dollar to Canadian Dollar exchange rate.

Note:

Currency futures aren’t different from futures in other markets, meaning they are traded in the same way that commodities and indices are traded in futures markets.

History of the Futures Markets

In the 1840s, Chicago became the country’s commercial center, since it connected to the rest of the country via railroad and telegraph lines. The launch of the venerable McCormick reaper led to a surge in wheat production around the same time. It became conventional for many farmers from the Midwest to travel to Chicago and sell their wheat.

Chicago did not have any set procedures for weighing and grading wheat at the time. There was also a shortage of storage facilities. Farmers were at the mercy of dealers in the city to make money selling their wheat. All this changed in 1848 when a central spot in the city became famous for making deals in “spot” grain. Farmers could get their cash right as when they delivered wheat.

A little later, farmers and dealers began committing to future wheat exchanges for cash, which is how futures contracts were devised. A farmer would agree on the price and quantity to be delivered to the dealer. The two parties would also agree on a delivery time. These deals were favorable for both parties, since the dealer knew the expenses beforehand, and the farmer knew how much they would be paid. Both parties would sign a written commitment, and a portion of the purchase amount would be paid in advance as a “guarantee.”

- It didn’t take long for contracts like these to become universal, and there came the point when banks began accepting the contracts as collateral for loans. Eventually, the sellers even started to deliver the goods before time.

- If a dealer decided they didn’t want to trade wheat anymore, they would sell the contract to someone who wanted to. Similarly, if a farmer couldn’t or didn’t want to deliver grain to a dealer, they would sell their contract to another farmer.

- If the weather were bad, the farmers would stand to make more money since the price of the wheat in the market would rise. On the other hand, if the year’s harvest were bigger, the price of wheat would fall, making the contract less valuable.

As time went by, people who had no intention to buy or sell the wheat began to trade the contracts. These are who we now call “speculators” – they aim to buy low and sell high or sell high first before buying commodities for a lower price. A few decades later, in 1972, the CME (now part of the CME Group) introduced currency futures. They applied the same trading technique but for foreign currencies.

How Futures Contracts are settled

Currency futures contracts can be settled in one of two ways. The first and most popular way is to offset a position a day before the contract’s execution by buying an opposite position. When the trade is closed in this way, the profit or the loss is credited to/debited from the connected trading account.

The second way of settling a contract is to hold it till the maturity date. Then, the trader can either take a cash settlement or opt to get their hands on the goods physically. The trader must specify that they want the goods physically when the terms of the contract are being discussed. Physical deliveries of goods typically take place four times a year at specific times. It is typically on the third Wednesday of March, June, September, and December. Bear in mind that only a tiny fraction of futures contracts traded online are settled physically. Physical settlement is even rarer when trading currency futures.

Currency Futures trading with the CME Group

Besides establishing banking facilities in the US, The CME Group also establishes them in countries worldwide. These banks that the company partners up with are called “agent banks.” Agent banks act on behalf of the company and maintain US Dollar accounts in the country. A foreign currency account is also maintained to facilitate physical deliveries of contracts.

The International Monetary Market is a division of the CME, where both buyers and sellers have an account (either directly or via an agent bank). The delivering bank will transfer the seller’s currency to an IMM delivery account, and the CME will then transfer the funds from the IMM account to the buyer’s account.

Contract Specifications and terminology you need to know

At a minimum, every futures contract, including a currency futures contract, specifies:

- The size of the contract

- Minimum price increment

- Corresponding tick value

The size of the contract is typically the amount of the goods that need to be delivered – for instance – 37,500 pounds of coffee. In currency futures contracts, the size of the contract comprises details like the exchange rate of the currency and the volume to be traded. Contracts involving major currencies typically have a size of 125,000 units. The minimum price increment defines the smallest price by which a contract’s value will rise or fall. Each of these incremental (or detrimental) movements is called a tick.

Let’s say you buy a EUR/USD contract, and the minimum price increment in the contract is defined as €0.0001. In this scenario, if the price of EUR appreciates from $1.2000 to $1.2010, the price will have moved up by ten ticks. These parameters are used by currency futures traders to determine position sizing and to ensure they meet the minimum balance requirements.

Besides these technicalities, you should also learn about margins before you start trading currency futures.

Futures Margins

“Margins” in the stock market are loans that a broker gives a trader based on the trader’s portfolio. However, a “margin” has a different meaning in the futures market. A margin in futures markets refers to a relatively small sum of money given to the exchange, so the trader can meet a minimum requirement. The clearing households these funds, and there is no borrowing involved.

The sum of money is paid to represent good faith between the two parties involved in the trade. It is an excellent way to ensure that both the buyer and the seller fulfill their obligation. The value of a futures contracts’ margin is typically less than 10% of the value of the contract.

Traders need to remember that futures can lose value every day since, in futures markets, accounts are balanced every day. For this reason, every futures trader must carry a “maintenance margin” in their account. If the future rises in value, funds are added to the trader’s account. On the other hand, if the contract loses value, funds will be deducted from the trader’s account accordingly. Also, if the maintained margin amount in a trading account drops to zero, a trader is requested to add funds (via a margin call) to the account, so the account can be balanced. If the trader does not add the required funds, the clearinghouse is entitled to liquidate the position.

Role of Exchanges in Currency Futures trading

In forex markets, trades buy and sell contracts to one another directly. But that’s not how currency futures work. The contracts in currency futures markets are traded via a regulated exchange. The pricing of the contracts is centralized, ensuring a fair deal. Exchanges make sure that the price of currency futures contracts remains the same regardless of the broker selling them.

If you only want to trade currency futures with the best exchange, sign up with The CME Group. The company gives you access to dozens of currency futures contracts and has daily liquidity of over 100 billion dollars. However, there are other exchanges you can trade currency futures over, like the Tokyo Financial Exchange and NYSE Euronext. One of the advantages of trading currency futures contracts is that the functioning of markets is overseen a lot more keenly than spot forex markets. Forex markets are criticized because there is no centralized pricing, and brokers often trade against clients.

Types of Futures Contracts

Besides the popular contract types like the EUR/USD pair, you can get your hands on E-Micro futures contracts. Those contracts trade for a tenth of the price of a regular currency futures contract. You could also buy currency pairs like PLN/USD or get the Russian Ruble/US Dollar pair contract for lesser if you’re short on capital.

What’s vital for you to remember is that contracts have different liquidity levels. They may be hundreds of thousands of contracts available for the EUR/USD pair, but an emerging market may have under a hundred contracts to trade.

Note:

If you decide to get your hands on a lower-priced futures contract, you risk having no one to sell the contract to/ buy the contract from when the time is right.

Most popular Contracts

Futures contract traders are most attracted to markets that offer high liquidity because it allows them a better opportunity to make profits. By the same token, low-volume markets offer low liquidity and leave a trader high and dry when they need to cash out or get out of a losing trade. Emerging markets are considered risky and avoided for this reason. G10, E-mini, and E-micro contracts are seasoned traders’ go-to contracts since they offer the most liquidity of all contracts.

Currency Futures trading account requirements

As mentioned earlier, currency futures are traded on exchanges. You will need to create an account with a broker that can direct your orders to exchanges worldwide. Most traders typically open a margin account with a broker, so they can buy and sell currencies. Margin accounts give traders access to more funds, which are lent to the trader by the broker.

What you need to know is that different brokers establish different requirements for the traders that can join them. However, most currency futures brokers in the industry allow conservative degrees of leverage. Expecting leverage of 400:1 like you get with forex brokers is unrealistic. You will be able to make decent profits with the relatively liberal margin you get, but remember that using leverage also puts you at risk of substantial loss.

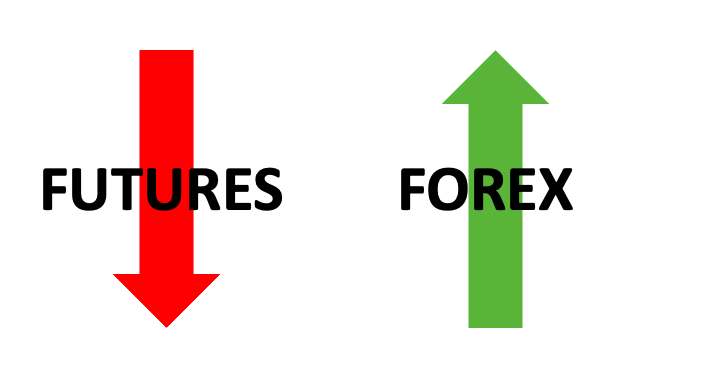

Reasons for trading Futures over Forex

Both forex and currency futures contracts use foreign exchange rates as the underlying determining factor. However, there are some key differences between trading the two. Here are four reasons why you must consider choosing to trade futures over forex.

#1 Diversification of Portfolio

If you trade in a forex market, you will essentially be trading one currency for another. In contrast, if you trade futures contracts, you can get your hands on a contract that gives you access to any asset and commodity you feel will make you money.

Currency futures are only the beginning. You can also choose to bet on the price of gold, coffee, bonds, indices, and more. Diversifying your portfolio in this way will enable you to put your eggs into different baskets and protect your capital from considerable risk.

#2 Predetermined Costs

One of the biggest advantages of trading futures is that you know exactly how much you need to make a trade happen. The transaction costs are fixed, and you know about them upfront. Furthermore, traders never have to worry about needing to pay extra, so they can hold a position overnight for potentially increased profits.

On the other hand, spot forex trading entails variable spreads, which makes the price uncertain. Additionally, the transaction cost varies from trade to trade. Traders must pay extra to hold a position overnight, and these increased and variable costs make the capital requirements for trading forex ambiguous.

#3 Availability of Precise Volume Data

One of the most significant indicators that help traders determine if the conditions for making a trade are right is the volume data. It aids in technical analysis and helps figure out the right time to exit a position. Futures markets are regulated by exchanges, meaning they are centralized, and all the traders get access to the same volume data consistently.

On the other hand, there is no volume data available to forex traders since those markets are not centralized. Traders can sometimes access volume data from one exchange, but another exchange may have different volume data. Knowing what data is accurate is not possible.

#4 High Market Transparency

All futures trade is cleared via an exchange – meaning details of trades are available publicly in real-time. Furthermore, futures markets operate by the FIFO rule, leveling the playing field for traders and ensure that they have an equal chance of winning and losing trades.

In contrast, individual traders and institutional traders may be treated differently by brokers trading forex. Since there is always a middleman (or “dealing desk”) involved between buyers and sellers on forex markets, the marketplace is never fair to every participant.

Reasons for trading Forex over Futures

While there are many reasons why one would consider trading currency futures the right way to go, forex trading also offers some advantages that may suit your trading style.

#1 Better risk management

Capital is at lower risk in a forex market since all forex brokers require traders to set position limits to manage risk. The value of the position limit is fixed according to the capital available in the trader’s account. If market conditions are normal, if a trade goes against you, open positions will be closed immediately. If the market is moving sporadically, the position may close beyond the stop loss you set, but you will never be at risk of losing a lot of capital.

In contrast, with futures contracts, your position could be liquidated at a value larger than what was in your account if a trade moves against you. You will be required to pay the deficit in your account.

#2 Higher liquidity

As mentioned earlier in this post, the forex market has a daily trading volume of $6.6 trillion. On the other hand, futures markets only facilitate trades worth billions. The contrast is stunning, and traders have exponentially less liquidity.

#3 Significantly lower commissions

Competition between forex brokers is fierce, and the companies keep reducing commissions to attract traders. You can expect to pay much lower fees trading forex.

#4 Markets are always open

There is always some market open for you to trade forex with. If you only get the time to trade on the weekends, trading futures may not be the best option for you. While some futures brokers allow after-hours trading, there is very little liquidity in the market at this time, and the chances of you making a profit after-hours are lower.

Our conclusion on Currency Futures

If you’re interested in getting involved in forex markets, you have two ways to participate. Forex trading and currency futures trading offer different advantages to traders that want to hedge or speculate. However, with futures, you get the option to diversify your portfolio and make smarter trades by looking at accurate volume data. The playing field is level – you don’t have to pay brokers more because you’re an individual trader, and you get access to the same tools as everyone else, making your skills the only variable for success. Trading currency futures is the right way to go for new and conservative traders looking to dip their toes into trading foreign currencies.

FAQ – The most asked questions about Currency Futures :

What exactly are currency futures?

Currency futures, to put in simple words, are future contracts on a particular asset or currency, which denotes the price of exchanging one asset for another on a fixed future date. Currency futures contracts are priced using spot rates for the currency pair. They are used to protect against the possibility of receiving foreign currency payments.

Is it possible to buy currency futures?

Yes, you can buy or sell currency futures on any currency exchange platform. If you are a buyer, just lock in a price your seller agrees to at a future date. Through this, you can avoid the risk associated with the exchange rate.

What are the features of currency future?

Some of the main features of currency futures include the underlying asset, which is the fixed currency exchange rate decided beforehand, and the final settlement for cash-settled futures, which is the expiration date. All the contracts are of the same size, and an initial margin is always important to enter into a future currency contract.

What are currency futures and options?

The right to buy a particular asset on a specific date and at a specific rate is called a currency option. At the same time, a currency future option is a contract that provides a trader the right to sell or buy a foreign currency at any time for a given time.

See similar articles about trading:

Last Updated on January 27, 2023 by Arkady Müller

pixabay.com/Futures trading tipps

pixabay.com/Futures trading tipps